Region:Europe

Author(s):Rebecca

Product Code:KRAB5255

Pages:88

Published On:October 2025

By Type:

The market is segmented into Mobile Banking Apps, Payment Processing Apps, Investment Management Apps, Personal Finance Management Apps, Lending Apps, Insurance Apps, Cryptocurrency & Blockchain Apps, Buy Now Pay Later (BNPL) Apps, and Others. Mobile Banking Apps hold the largest share, driven by their convenience and the increasing number of users managing finances via smartphones. The surge in digital banking adoption has resulted in a notable increase in mobile app downloads, positioning this segment as the market leader .

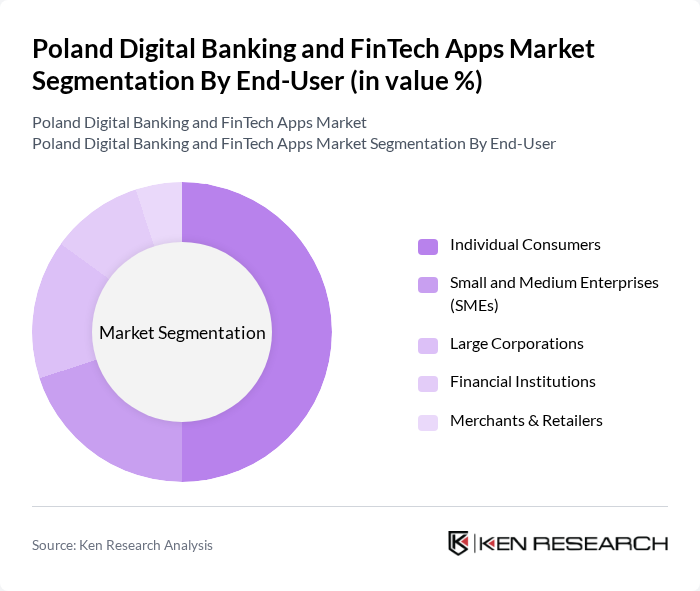

By End-User:

The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Financial Institutions, and Merchants & Retailers. Individual Consumers account for the largest segment, propelled by rising smartphone penetration and the mainstreaming of online banking. The accessibility and ease of digital banking solutions have led to high adoption rates among individuals, while SMEs and merchants benefit from integrated payment and financial management tools .

The Poland Digital Banking and FinTech Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as mBank S.A., ING Bank ?l?ski S.A., PKO Bank Polski S.A., Santander Bank Polska S.A., Alior Bank S.A., Bank Pekao S.A., Revolut Ltd., PayU S.A., Przelewy24 (PayPro S.A.), BLIK (Polski Standard P?atno?ci Sp. z o.o.), Twisto Payments a.s., N26 GmbH, Klarna Bank AB, Billon Group S.A., and Kanga Exchange contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland digital banking and FinTech apps market appears promising, driven by technological advancements and evolving consumer preferences. As mobile-first banking solutions gain traction, financial institutions are expected to invest in user-friendly interfaces and enhanced functionalities. Additionally, the integration of AI and machine learning will likely revolutionize customer service and risk management, providing personalized experiences. The focus on sustainability will also shape product offerings, aligning with global trends towards responsible finance and ethical banking practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Banking Apps Payment Processing Apps Investment Management Apps Personal Finance Management Apps Lending Apps Insurance Apps Cryptocurrency & Blockchain Apps Buy Now Pay Later (BNPL) Apps Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Financial Institutions Merchants & Retailers |

| By Distribution Channel | Direct Downloads App Stores Partnerships with Banks Online Marketplaces Embedded Finance Platforms |

| By User Demographics | Age Group (18-24, 25-34, 35-44, 45+) Income Level (Low, Middle, High) Urban vs Rural Users Digital Literacy Level |

| By Payment Method | Credit/Debit Cards Bank Transfers E-wallets (including BLIK, Google Pay, Apple Pay) Cryptocurrencies Buy Now Pay Later (BNPL) |

| By Security Features | Biometric Authentication Two-Factor Authentication Encryption Technologies Fraud Detection & Monitoring |

| By Customer Support | In-app Support Chatbots Phone Support Email Support Social Media Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Users | 120 | Retail Banking Customers, Digital Product Users |

| FinTech App Users | 90 | FinTech App Users, Tech-Savvy Consumers |

| Small Business Owners | 60 | SME Owners, Financial Decision Makers |

| Regulatory Stakeholders | 40 | Regulatory Officials, Compliance Officers |

| Industry Experts | 50 | Financial Analysts, Market Researchers |

The Poland Digital Banking and FinTech Apps Market is valued at approximately USD 5.7 billion, reflecting significant growth driven by the adoption of digital payment solutions and mobile banking services.