Saudi Arabia Digital Lending Platforms Market Overview

- The Saudi Arabia Digital Lending Platforms Market is valued at approximately USD 42 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital financial services, rapid expansion of fintech companies, rising internet penetration, and a young, tech-savvy population. The market has seen a significant shift towards online lending platforms, which offer convenience, efficiency, and accessibility to both consumers and businesses. The integration of AI and machine learning is further enhancing credit scoring, risk assessment, and fraud detection, supporting scalable and secure lending operations .

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their economic significance, high population density, and advanced digital infrastructure. Riyadh, as the capital, serves as a financial and fintech hub, attracting numerous startups and established banks. Jeddah and Dammam also contribute significantly, leveraging their strategic locations and dynamic business environments to foster a competitive landscape for digital lending services .

- In 2023, the Saudi Arabian government implemented regulations to enhance the digital lending landscape, including the issuance of the "Fintech Activity Regulations" by the Saudi Central Bank (SAMA). These regulations set operational standards for fintech companies, require licensing, and mandate consumer protection measures such as transparency in lending terms, data privacy, and fair lending practices. The framework aims to promote responsible lending, ensure market stability, and foster trust among consumers and businesses .

Saudi Arabia Digital Lending Platforms Market Segmentation

By Type:The digital lending market is segmented into Personal Loans, Business Loans, SME Loans, Microloans, Islamic/Shariah-compliant Loans, Peer-to-Peer Loans, Auto Loans, and Others. Personal Loans and Business Loans are particularly prominent, driven by high demand for individual financing and enterprise capital. SME Loans are rapidly growing, supported by government initiatives and fintech innovation targeting small and medium-sized enterprises. Microloans and Peer-to-Peer Loans are expanding access to underserved segments, while Islamic/Shariah-compliant Loans cater to religious preferences and compliance requirements .

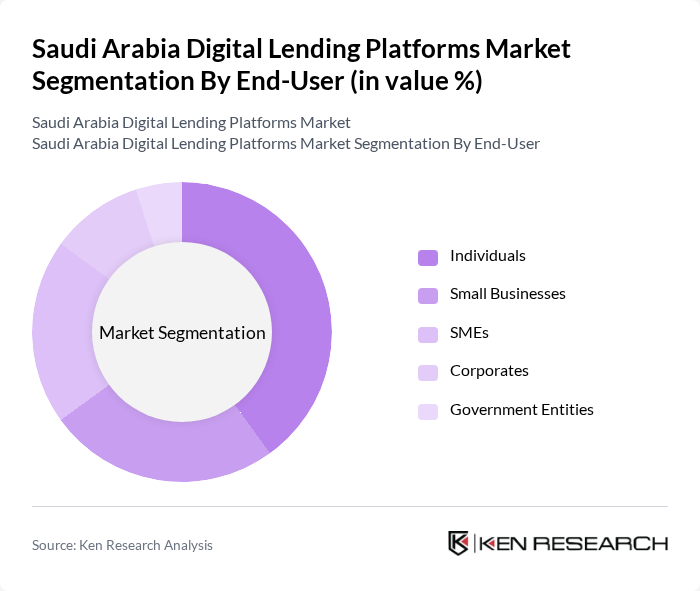

By End-User:The end-user segmentation includes Individuals, Small Businesses, SMEs, Corporates, and Government Entities. Individuals represent the largest segment, reflecting strong demand for personal financing solutions. Small Businesses and SMEs are increasingly utilizing digital lending for operational funding and expansion, supported by government-backed financial inclusion initiatives and fintech platforms. Corporates and Government Entities also leverage digital lending for specialized financing needs, contributing to market diversity .

Saudi Arabia Digital Lending Platforms Market Competitive Landscape

The Saudi Arabia Digital Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lendo, Tamam, Sulfah, Raqamyah, Emkan, Nayla Finance, Tasheel Finance, Tamweel Aloula, Alinma Bank, Riyad Bank, STC Pay, Hala, Al Rajhi Bank, National Commercial Bank (NCB), Bidaya Home Finance contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Digital Lending Platforms Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration:As of future, Saudi Arabia boasts a smartphone penetration rate of approximately97%, with over30 million smartphone users. This widespread access facilitates the adoption of digital lending platforms, allowing consumers to apply for loans conveniently. The World Bank reports that mobile internet subscriptions have increased by15%annually, indicating a growing reliance on mobile technology for financial services, which is crucial for the digital lending sector's expansion.

- Rising Demand for Quick Loan Approvals:In future, the average time for loan approval in Saudi Arabia has decreased to justminutes to a few hours, driven by consumer demand for rapid financial solutions. The Central Bank of Saudi Arabia reported asubstantialincrease in online loan applications over the past year, reflecting a shift towards instant credit solutions. This trend is further supported by the growing number of fintech startups that prioritize speed and efficiency in their lending processes, catering to a tech-savvy population.

- Expansion of Digital Payment Systems:The digital payment landscape in Saudi Arabia is evolving rapidly, with a40%increase in digital transactions reported in future. The Saudi Payments Company has facilitated over7.2 billion transactionsin the past year, enhancing the infrastructure for digital lending. This growth in digital payment systems not only streamlines the loan disbursement process but also encourages more users to engage with digital lending platforms, thereby driving market growth.

Market Challenges

- Regulatory Compliance Complexities:The regulatory landscape for digital lending in Saudi Arabia is intricate, with over50specific compliance requirements outlined by the Saudi Arabian Monetary Authority (SAMA). In future, many digital lenders face challenges in navigating these regulations, which can lead to delays in market entry and increased operational costs. This complexity can deter new entrants and stifle innovation within the sector, impacting overall market growth.

- Consumer Trust Issues:Despite the growth of digital lending platforms, consumer trust remains a significant challenge. A survey conducted in early future indicated that60%of potential borrowers express concerns about data security and the legitimacy of online lenders. This skepticism can hinder user adoption and limit the market's potential. Building trust through transparency and robust customer service is essential for platforms to overcome this barrier and attract more users.

Saudi Arabia Digital Lending Platforms Market Future Outlook

The future of digital lending platforms in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. As fintech innovation continues to thrive, platforms are likely to enhance their offerings through personalized services and improved user experiences. Additionally, the integration of artificial intelligence for credit scoring will streamline the lending process, making it more efficient. The collaboration between digital lenders and traditional banks is expected to foster a more inclusive financial ecosystem, further propelling market growth.

Market Opportunities

- Untapped Rural Markets:Approximately16%of Saudi Arabia's population resides in rural areas, where access to traditional banking services is limited. Digital lending platforms have the opportunity to penetrate these markets by offering tailored financial products that cater to the unique needs of rural consumers, potentially increasing their customer base significantly.

- Collaboration with Traditional Banks:Partnerships between digital lending platforms and established banks can enhance service offerings and expand market reach. In future, over40%of banks in Saudi Arabia are exploring collaborations with fintech companies, which can lead to innovative lending solutions and improved customer experiences, ultimately benefiting both sectors.