Region:Europe

Author(s):Geetanshi

Product Code:KRAA4776

Pages:97

Published On:September 2025

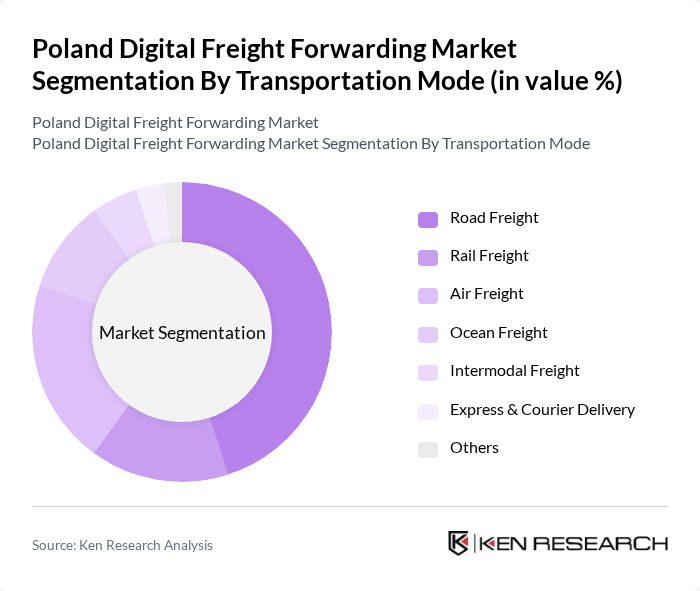

By Transportation Mode:The transportation mode segmentation covers road freight, rail freight, air freight, ocean freight, intermodal freight, express & courier delivery, and others. Road freight remains the largest segment due to its flexibility, extensive network, and suitability for both domestic and cross-border shipments. Air freight is increasingly preferred for time-sensitive and high-value shipments, particularly in e-commerce and pharmaceuticals. Rail and ocean freight support bulk and long-haul logistics, while intermodal solutions are gaining traction for their efficiency and sustainability. Express & courier delivery is driven by the surge in e-commerce and demand for fast last-mile solutions.

By End-User Industry:The end-user industry segmentation includes retail & e-commerce, manufacturing, automotive, pharmaceuticals & healthcare, consumer electronics, food & beverage, construction & building materials, agriculture, and others. Retail & e-commerce is the leading segment, driven by rising online shopping and consumer expectations for rapid delivery. Manufacturing and automotive sectors rely on freight forwarding for supply chain efficiency and export logistics. Pharmaceuticals & healthcare require specialized, time-sensitive logistics solutions, while food & beverage and consumer electronics benefit from robust distribution networks. Construction, agriculture, and other sectors contribute to overall market diversity.

The Poland Digital Freight Forwarding Market is characterized by a dynamic mix of regional and international players. Leading participants such as DB Schenker, DPDgroup, Kuehne + Nagel, DHL Supply Chain, XPO Logistics, Geodis, DSV, CEVA Logistics, Raben Group, Hellmann Worldwide Logistics, UPS Supply Chain Solutions, FedEx Logistics, Ziegler Group, Agility Logistics, PKP Cargo, Poczta Polska, Lotos Kolej, Rohlig SUUS Logistics, Omida Group, No Limit Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland digital freight forwarding market appears promising, driven by technological advancements and evolving consumer expectations. As companies increasingly adopt automation and AI technologies, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainability will likely shape logistics strategies, with businesses seeking eco-friendly solutions. The integration of blockchain technology is anticipated to enhance transparency and security in supply chains, further propelling market growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Transportation Mode | Road Freight Rail Freight Air Freight Ocean Freight Intermodal Freight Express & Courier Delivery Others |

| By End-User Industry | Retail & E-commerce Manufacturing Automotive Pharmaceuticals & Healthcare Consumer Electronics Food & Beverage Construction & Building Materials Agriculture Others |

| By Service Type | Digital Freight Brokerage Freight Forwarding Customs Brokerage Warehousing & Distribution Supply Chain Management Value-Added Services Others |

| By Delivery Speed | Standard Delivery Expedited Delivery Same-Day Delivery Scheduled Delivery Others |

| By Geographic Coverage | Domestic International Cross-Border (EU) Regional Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government & Public Sector Others |

| By Pricing Model | Fixed Pricing Dynamic Pricing Subscription-Based Pricing Pay-Per-Use Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Freight Forwarding Adoption | 70 | Logistics Managers, IT Directors |

| Impact of E-commerce on Freight Forwarding | 60 | eCommerce Managers, Supply Chain Analysts |

| Technology Integration in Logistics | 50 | Operations Managers, Digital Transformation Leads |

| Regulatory Challenges in Freight Forwarding | 40 | Compliance Officers, Legal Advisors |

| Customer Experience in Digital Freight Solutions | 45 | Customer Service Managers, Business Development Executives |

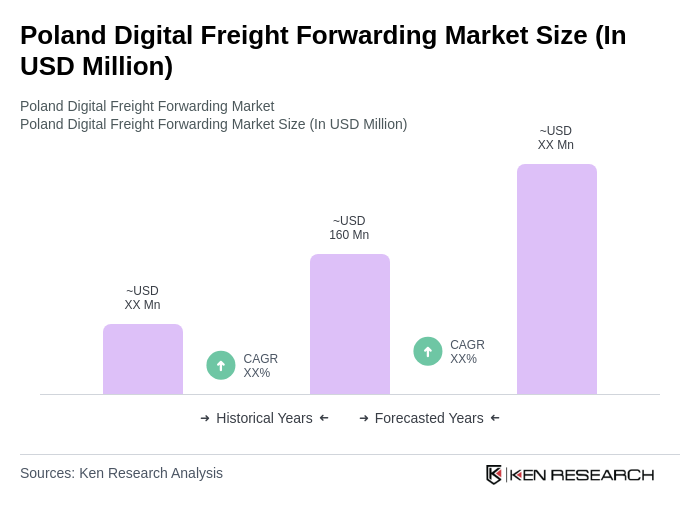

The Poland Digital Freight Forwarding Market is valued at approximately USD 160 million, reflecting significant growth driven by the expanding e-commerce sector and the adoption of digital technologies in logistics and supply chain management.