Region:Europe

Author(s):Geetanshi

Product Code:KRAB1598

Pages:94

Published On:October 2025

By Type:The market is segmented into various types, including Telemedicine Platforms, E-Pharmacy Services (Prescription & OTC), Remote Patient Monitoring Solutions, Mobile Health Applications, Digital Therapeutics, Integrated Health Management Systems, and Others. Among these, Telemedicine Platforms are leading due to the increasing demand for remote consultations and virtual care, especially following the pandemic. E-Pharmacy Services are also gaining traction as consumers increasingly value the convenience and accessibility of online medication purchases. Remote Patient Monitoring Solutions and Mobile Health Applications are witnessing rising adoption, driven by chronic disease management needs and the proliferation of health-focused mobile apps .

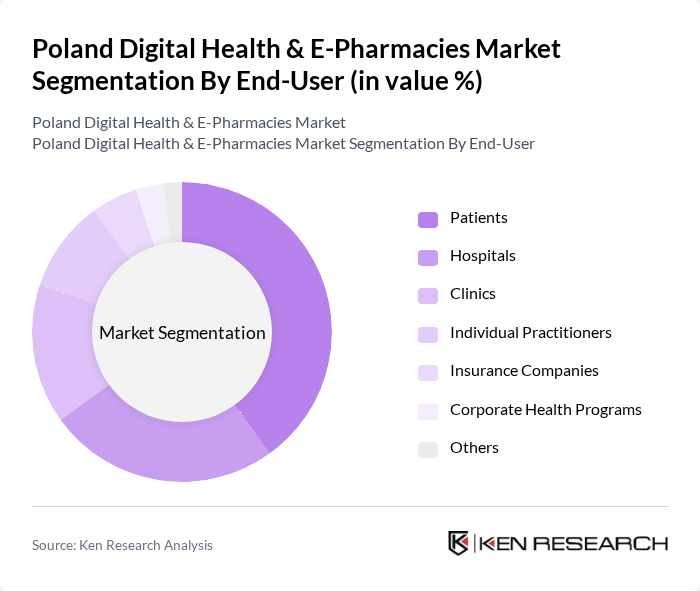

By End-User:The end-user segmentation includes Patients, Hospitals, Clinics, Individual Practitioners, Insurance Companies, Corporate Health Programs, and Others. Patients are the largest segment, driven by the increasing acceptance and trust in digital health solutions for personal healthcare management and chronic disease monitoring. Hospitals and Clinics are also significant users, leveraging digital health technologies to enhance patient care, streamline workflows, and improve operational efficiency. Insurance Companies and Corporate Health Programs are expanding their digital health offerings to improve service delivery and employee wellness .

The Poland Digital Health & E-Pharmacies Market is characterized by a dynamic mix of regional and international players. Leading participants such as DocPlanner, Telemedico, Medicover, Lux Med, Apteka Gemini, MedApp, Ziko Apteka, Polpharma, eZiko, eZdrowie, HealthUp, MyDoctor, Apteka DOZ, Apteka S?oneczna, Medico contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital health and e-pharmacies market in Poland appears promising, driven by technological advancements and increasing consumer acceptance. The integration of artificial intelligence in healthcare is expected to enhance patient care and streamline operations. Additionally, the expansion of telemedicine services into rural areas will address healthcare disparities, ensuring broader access to essential health services. As the market evolves, collaboration between technology firms and healthcare providers will be crucial for fostering innovation and improving patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Telemedicine Platforms E-Pharmacy Services (Prescription & OTC) Remote Patient Monitoring Solutions Mobile Health Applications Digital Therapeutics Integrated Health Management Systems Others |

| By End-User | Patients Hospitals Clinics Individual Practitioners Insurance Companies Corporate Health Programs Others |

| By Sales Channel | Direct-to-Consumer (D2C) B2B Partnerships Online Marketplaces Mobile Applications Telehealth Networks Others |

| By Distribution Mode | Home Delivery Click-and-Collect In-Store Pickup Subscription Services Others |

| By Customer Demographics | Age Group (Children, Adults, Seniors) Gender Socioeconomic Status Geographic Distribution Others |

| By Product Category | Chronic Disease Management Wellness and Prevention Mental Health Solutions Fitness and Nutrition Emergency Consultations Others |

| By Pricing Model | Subscription-Based Pay-Per-Consultation Freemium Models Bundled Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 100 | Doctors, Nurses, Pharmacists |

| Patients Using E-Pharmacies | 120 | Regular Users, Occasional Users |

| Digital Health Technology Developers | 60 | Product Managers, Software Engineers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Market Analysts and Researchers | 50 | Market Analysts, Industry Experts |

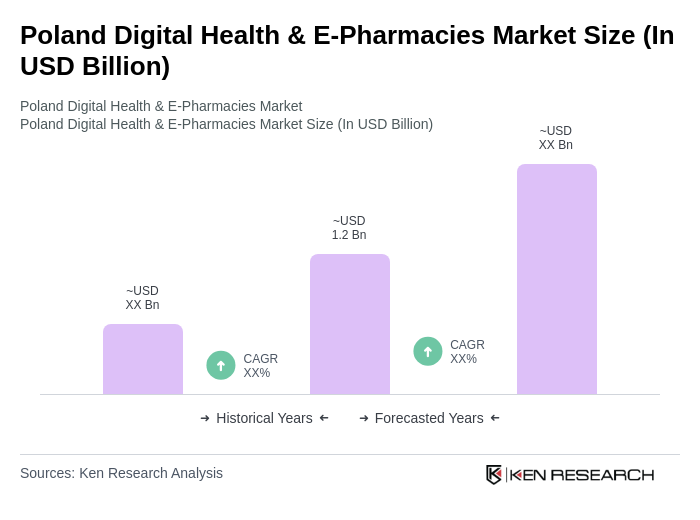

The Poland Digital Health & E-Pharmacies Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by telemedicine adoption, e-pharmacy services, and remote patient monitoring solutions, particularly accelerated by the COVID-19 pandemic.