Region:Europe

Author(s):Geetanshi

Product Code:KRAB5775

Pages:86

Published On:October 2025

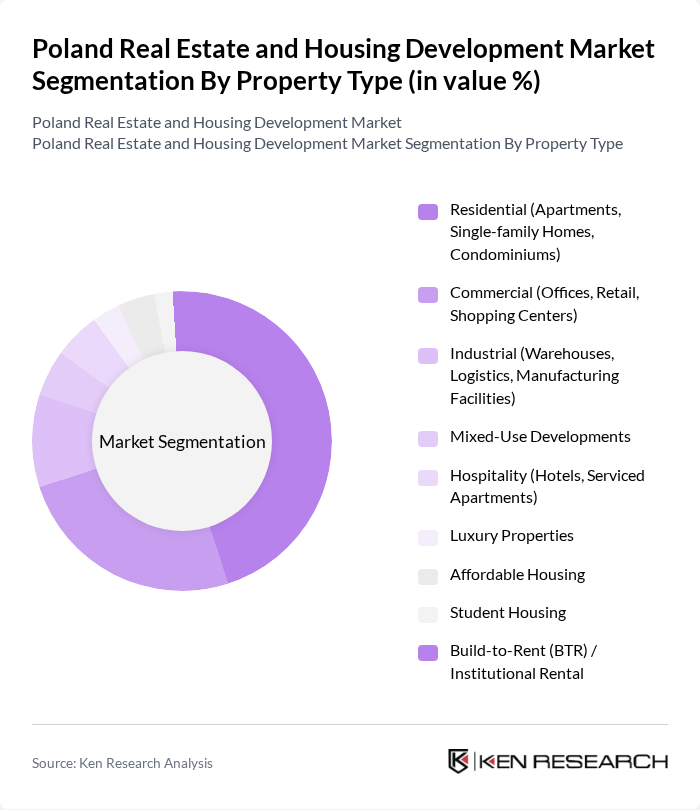

By Property Type:The property type segmentation includes residential, commercial, industrial, mixed-use developments, hospitality, luxury properties, affordable housing, student housing, and build-to-rent (BTR) / institutional rental. Residential properties—especially apartments and single-family homes—lead the market, fueled by urban migration, a persistent housing deficit, and evolving consumer preferences for energy-efficient, modern dwellings. The rise of remote work and demand for flexible living arrangements have further diversified residential offerings. Commercial and logistics assets remain highly attractive to investors, while student housing and BTR are emerging as high-growth segments .

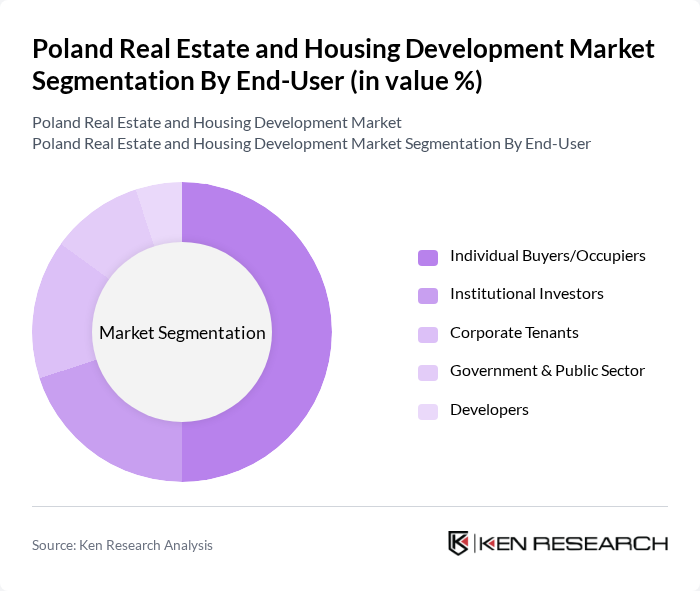

By End-User:The end-user segmentation encompasses individual buyers/occupiers, institutional investors, corporate tenants, government & public sector, and developers. Individual buyers and occupiers remain the largest segment, driven by population growth, urban migration, and the high demand for homeownership among young professionals. Institutional investors are increasingly active, particularly in the residential rental and logistics sectors, while corporate tenants and the public sector maintain steady demand for commercial and mixed-use properties .

The Poland Real Estate and Housing Development Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dom Development S.A., Echo Investment S.A., Atal S.A., Robyg S.A., Budimex S.A., Polnord S.A., Ghelamco Poland, Skanska Residential Development Poland, J.W. Construction Holding S.A., Marvipol S.A., Grupa Inwestycyjna Hossa S.A., Mota-Engil Central Europe S.A., Unibep S.A., Mostostal Warszawa S.A., Develia S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Poland's real estate market appears promising, driven by ongoing urbanization and a strong demand for housing. As the government continues to invest in infrastructure, cities will become more attractive to residents and businesses alike. Additionally, the integration of smart technologies and sustainable practices in new developments is expected to enhance property values. However, addressing regulatory challenges and construction costs will be crucial for maintaining momentum in the sector, ensuring that it remains resilient and competitive in the European market.

| Segment | Sub-Segments |

|---|---|

| By Property Type | Residential (Apartments, Single-family Homes, Condominiums) Commercial (Offices, Retail, Shopping Centers) Industrial (Warehouses, Logistics, Manufacturing Facilities) Mixed-Use Developments Hospitality (Hotels, Serviced Apartments) Luxury Properties Affordable Housing Student Housing Build-to-Rent (BTR) / Institutional Rental |

| By End-User | Individual Buyers/Occupiers Institutional Investors Corporate Tenants Government & Public Sector Developers |

| By Financing Type | Mortgages Cash Purchases Real Estate Investment Trusts (REITs) & Funds Government Grants/Subsidies Crowdfunding/Alternative Finance |

| By Location | Major Cities (Warsaw, Kraków, Wroc?aw, ?ód?, Pozna?, Tri-City, Katowice) Secondary Cities Suburban Areas Rural Areas Tourist Destinations |

| By Property Size | Small (up to 50 m²) Medium (51–150 m²) Large (above 150 m²) |

| By Development Stage | Pre-Construction Under Construction Completed |

| By Policy Support | Subsidized Housing Programs Tax Incentives Urban Development Grants Green Building Certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Development | 100 | Real Estate Developers, Project Managers |

| Commercial Property Management | 60 | Property Managers, Asset Managers |

| Housing Market Trends | 80 | Real Estate Agents, Market Analysts |

| Urban Planning and Development | 50 | Urban Planners, Local Government Officials |

| Homebuyer Preferences and Behavior | 40 | Potential Homebuyers, Mortgage Advisors |

The Poland Real Estate and Housing Development Market is valued at approximately USD 54 billion, reflecting significant growth driven by urbanization, housing demand, and government initiatives aimed at expanding housing supply.