Region:Asia

Author(s):Rebecca

Product Code:KRAB5884

Pages:96

Published On:October 2025

By Type:The market is segmented into various types, including residential, commercial, industrial, mixed-use developments, luxury properties, affordable housing, and land. Among these, theresidential segment, particularly apartments and villas, dominates the market due to high demand for urban housing. The trend toward urban living, increasing single-person households, and a focus on smart and sustainable building solutions are driving the need for diverse residential options .

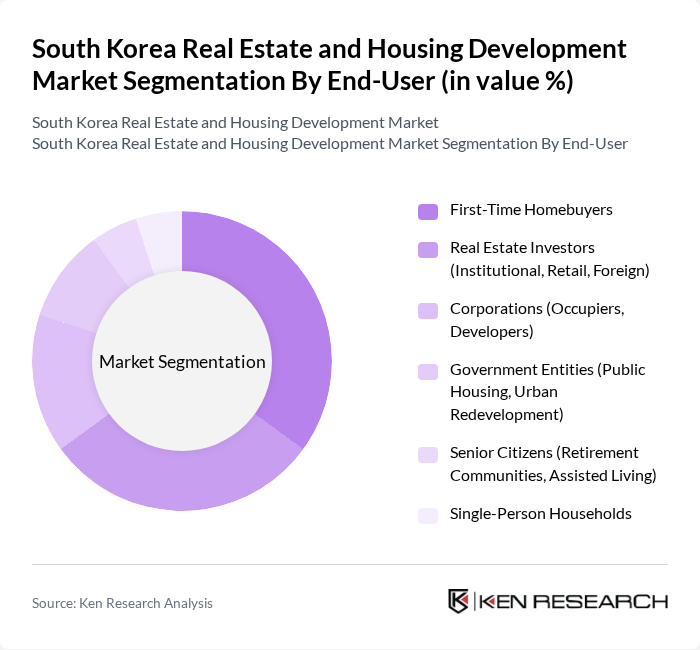

By End-User:The end-user segmentation includes first-time homebuyers, real estate investors, corporations, government entities, senior citizens, and single-person households. Thefirst-time homebuyerssegment is particularly significant, driven by favorable mortgage rates, government incentives, and policies supporting younger demographics in home ownership. The rise in single-person and elderly households is also influencing demand for new residential formats and community-oriented developments .

The South Korea Real Estate and Housing Development Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung C&T Corporation, Hyundai Engineering & Construction Co., Ltd., Daewoo Engineering & Construction Co., Ltd., GS Engineering & Construction Corp., SK ecoplant Co., Ltd., POSCO E&C (POSCO Engineering & Construction Co., Ltd.), Hanwha E&C (Hanwha Engineering & Construction Corp.), Lotte Engineering & Construction Co., Ltd., HDC Hyundai Development Company, Hoban Construction Co., Ltd., DL E&C Co., Ltd. (formerly Daelim Industrial Co., Ltd.), Dongbu Corporation, Shinsegae Property, Mirae Asset Global Investments Co., Ltd., Korea Land and Housing Corporation (LH) contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean real estate market is poised for transformative changes driven by urbanization and technological advancements. As cities evolve, the demand for innovative housing solutions, such as smart homes and eco-friendly developments, will increase. Additionally, the government's commitment to affordable housing initiatives will likely address the challenges of high property prices. Overall, the market is expected to adapt to these trends, fostering a more sustainable and inclusive housing environment in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential (Apartments, Villas, Detached Homes, Senior Living, Co-Living) Commercial (Office, Retail, Mixed-Use, Hospitality) Industrial (Warehousing, Logistics, Manufacturing Facilities, Data Centers) Mixed-Use Developments Luxury Properties Affordable Housing Land (Development Land, Redevelopment Sites, Greenfield/Brownfield) |

| By End-User | First-Time Homebuyers Real Estate Investors (Institutional, Retail, Foreign) Corporations (Occupiers, Developers) Government Entities (Public Housing, Urban Redevelopment) Senior Citizens (Retirement Communities, Assisted Living) Single-Person Households |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Property Size | Small Units (Studio, 1-Bedroom) Medium Units (2-3 Bedroom) Large Units (4+ Bedroom, Villas, Commercial Complexes) |

| By Financing Type | Mortgages Cash Purchases Lease Options REITs (Real Estate Investment Trusts) |

| By Development Stage | Pre-Construction Under Construction Completed |

| By Policy Support | Subsidies Tax Exemptions Grants Rent Control & Price Caps Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 100 | First-time Homebuyers, Investors |

| Commercial Real Estate Developers | 80 | Project Managers, Business Development Executives |

| Real Estate Agents and Brokers | 100 | Licensed Real Estate Agents, Market Analysts |

| Construction Firms | 70 | Construction Managers, Estimators |

| Urban Planning Experts | 40 | Urban Planners, Policy Makers |

The South Korea Real Estate and Housing Development Market is valued at approximately USD 145 billion, driven by urbanization, demographic changes, and government policies that promote housing and infrastructure development.