Region:Europe

Author(s):Geetanshi

Product Code:KRAB5213

Pages:97

Published On:October 2025

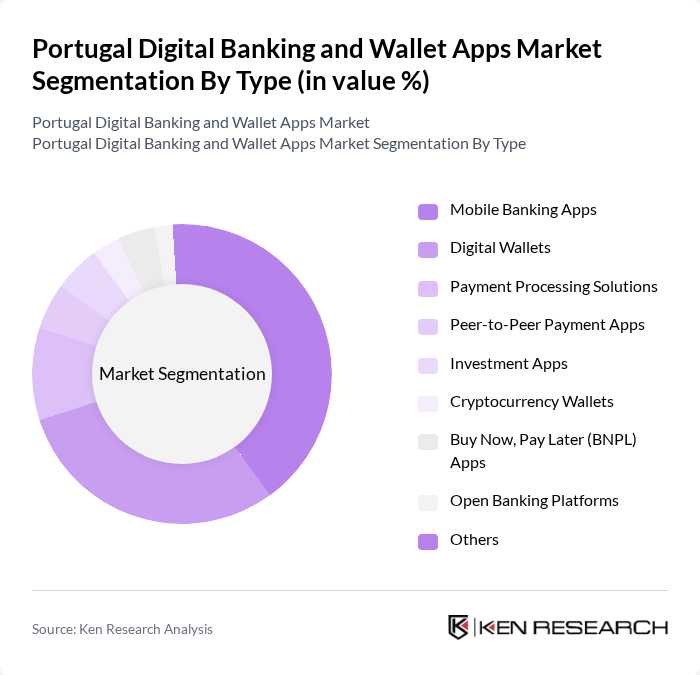

By Type:The market is segmented into various types, including Mobile Banking Apps, Digital Wallets, Payment Processing Solutions, Peer-to-Peer Payment Apps, Investment Apps, Cryptocurrency Wallets, Buy Now, Pay Later (BNPL) Apps, Open Banking Platforms, and Others. Among these,Mobile Banking AppsandDigital Walletsare the most prominent, driven by consumer demand for convenience, security, and the increasing trend of cashless and contactless transactions. The adoption of instant payment systems and integration with e-commerce platforms further accelerates growth in these segments .

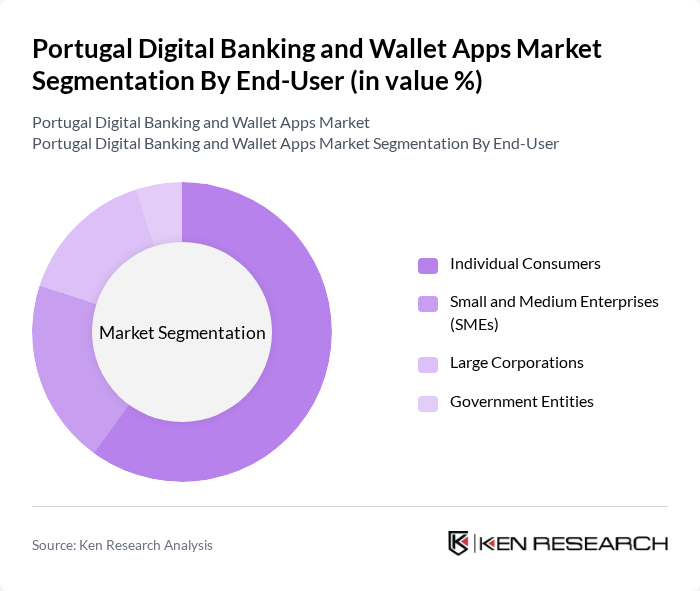

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities.Individual Consumersdominate the market due to the increasing number of users opting for digital banking solutions for personal finance management and transactions. The rapid uptake among younger demographics and urban populations is particularly notable, reflecting a broader shift towards digital-first financial services .

The Portugal Digital Banking and Wallet Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banco BPI, Millennium BCP, Caixa Geral de Depósitos, Revolut Ltd., N26 GmbH, Wise (TransferWise), MB WAY, SIBS, Unibanco, Banco Santander Totta, PayPal Holdings, Inc., Stripe, Inc., Adyen N.V., Monzo Bank Ltd., Moey!, ActivoBank, Openbank, CaixaBank Payments & Consumer contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital banking and wallet apps market in Portugal appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance customer experiences, providing personalized services. Additionally, the adoption of open banking frameworks will facilitate greater competition and innovation, allowing consumers to access a wider range of financial products. As these trends continue to unfold, the market is likely to witness significant transformation and growth opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Banking Apps Digital Wallets Payment Processing Solutions Peer-to-Peer Payment Apps Investment Apps Cryptocurrency Wallets Buy Now, Pay Later (BNPL) Apps Open Banking Platforms Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments Contactless Payments Instant Payments (SCT Inst) |

| By User Demographics | Age Groups Income Levels Geographic Distribution |

| By Security Features | Biometric Authentication Two-Factor Authentication Encryption Technologies Fraud Detection & Prevention Tools |

| By Customer Engagement | Loyalty Programs Customer Support Services User Experience Enhancements |

| By Integration Capabilities | API Integrations Third-Party Service Integrations Cross-Platform Compatibility Integration with E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Banking Users | 120 | Retail Banking Customers, Mobile Banking Users |

| Wallet App Users | 80 | Frequent Users, Occasional Users |

| Fintech Industry Experts | 40 | Product Developers, Market Analysts |

| Regulatory Stakeholders | 40 | Policy Makers, Compliance Officers |

| Small Business Owners | 60 | Entrepreneurs, Financial Decision Makers |

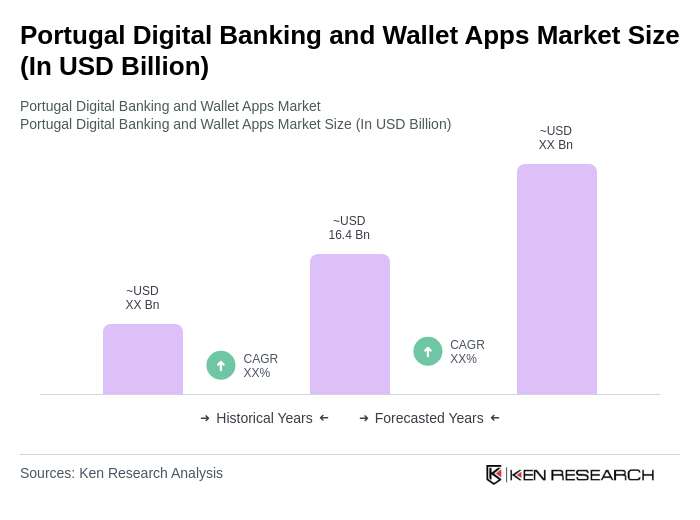

The Portugal Digital Banking and Wallet Apps Market is valued at approximately USD 16.4 billion, reflecting significant growth driven by smartphone adoption, e-commerce expansion, and a shift towards cashless transactions among consumers.