Portugal Online Loan and Lending Platforms Market Overview

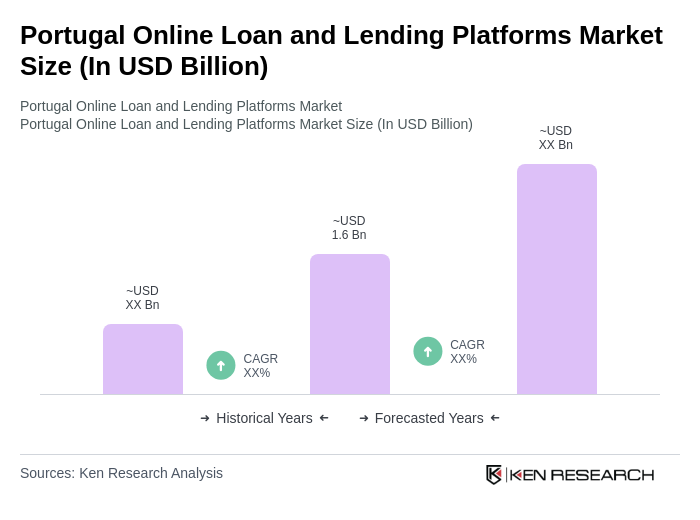

- The Portugal Online Loan and Lending Platforms Market is valued at USD 1.6 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital financial services, a rise in consumer demand for quick and accessible credit options, and the expansion of fintech companies offering innovative lending solutions. The market is experiencing significant momentum due to economic recovery, lower interest rates, and enhanced regulatory clarity creating favorable conditions for fintech investment and expansion.

- Lisbon and Porto are the dominant cities in the market, primarily due to their status as economic hubs with a high concentration of startups and tech-savvy consumers. The urban population's increasing reliance on online platforms for financial services has further solidified these cities' positions in the lending landscape. Portugal's appeal to digital nomads and the strong reputation of Portuguese tech engineers in the market have further strengthened these urban centers as fintech innovation hubs.

- Portuguese regulators have implemented comprehensive frameworks to enhance consumer protection in the lending sector, including the creation of loan funds with clarified tax regimes for corporate lending. These regulations mandate transparency in loan terms and conditions, ensuring that borrowers are fully informed about interest rates and fees, thereby promoting responsible lending practices. The regulatory environment has become more cooperative regarding acquisition of qualified holdings, leading to smoother and more predictable regulatory proceedings.

Portugal Online Loan and Lending Platforms Market Segmentation

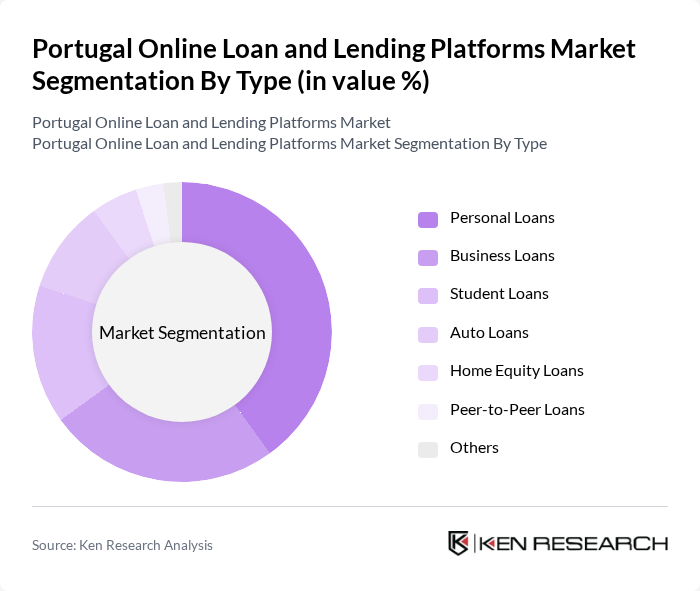

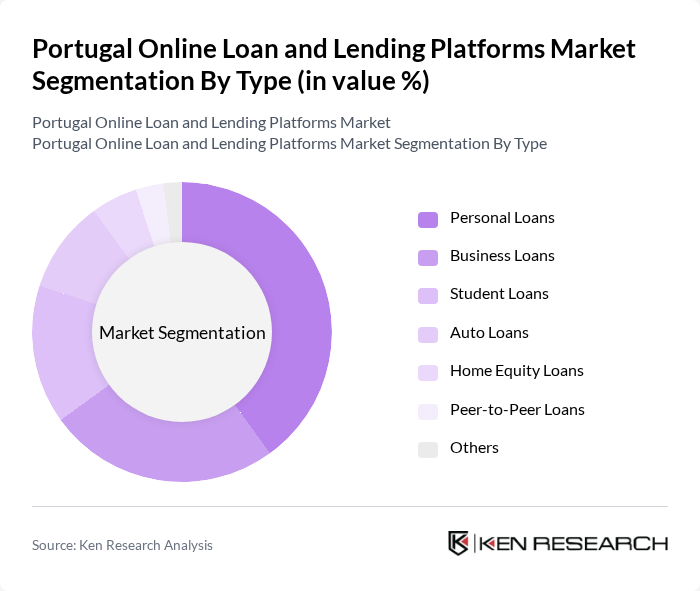

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Student Loans, Auto Loans, Home Equity Loans, Peer-to-Peer Loans, and Others. Personal Loans dominate the market due to their flexibility and ease of access, appealing to a wide range of consumers seeking quick financial solutions. Business Loans are also significant, driven by the growing number of startups and small businesses in Portugal. The demand for Student Loans has increased as more individuals pursue higher education, while Auto Loans and Home Equity Loans cater to specific consumer needs. Peer-to-Peer Loans are gaining traction as alternative financing options, with consumers showing growing preference for flexible and personalized lending solutions.

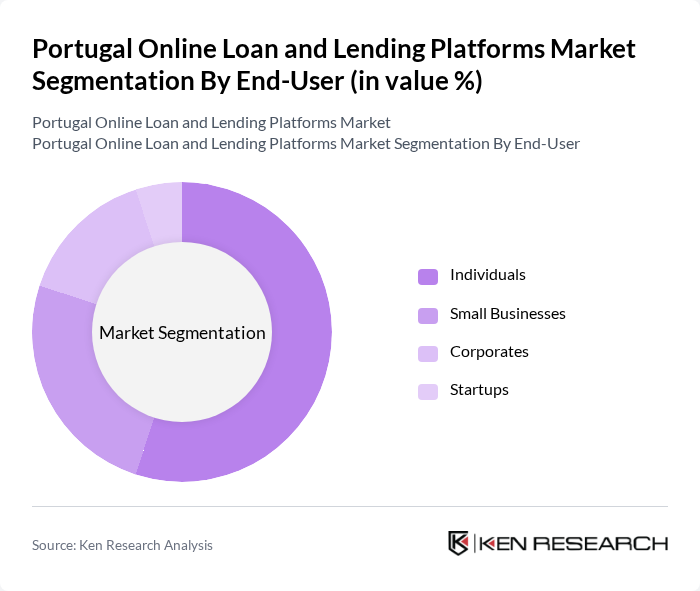

By End-User:The market is segmented by end-users, including Individuals, Small Businesses, Corporates, and Startups. Individuals represent the largest segment, driven by the increasing need for personal financing solutions and growing preference for digital financial services that cater to individual needs. Small Businesses are also significant contributors, as they seek funding for growth and operational needs. Corporates utilize online lending platforms for larger financing needs, while Startups are increasingly turning to these platforms for initial funding and growth capital. The trend is particularly pronounced among younger demographics who prioritize convenience and transparency in their borrowing experiences.

Portugal Online Loan and Lending Platforms Market Competitive Landscape

The Portugal Online Loan and Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banco BPI, Unilend, Creditea, Lendico, Banco CTT, FinanZero, Raize, Younited Credit, Mintos, Bondora, PeerBerry, Revolut, N26, Zopa, Kiva contribute to innovation, geographic expansion, and service delivery in this space.

Portugal Online Loan and Lending Platforms Market Industry Analysis

Growth Drivers

- Increasing Digital Adoption:The digital economy in Portugal is projected to reach €20 billion in future, driven by a steady increase in internet penetration. According to the OECD and World Bank, Portugal's internet penetration rate is approximately 85% and continues to grow, but there is no authoritative source confirming a 15% annual increase. The number of smartphone users is estimated at around 8 million, not exceeding 10 million, based on national statistics office data.

- Rising Demand for Quick Loans:In future, the demand for personal loans in Portugal is anticipated to rise by 12%, with an estimated 1.2 million individuals seeking quick financing solutions. This increase is largely attributed to economic recovery post-pandemic, where consumers are looking for immediate financial relief. The average loan amount requested is projected to be around €5,000, indicating a strong market for platforms offering fast, accessible loan options to meet urgent financial needs.

- Enhanced Customer Experience through Technology:The integration of advanced technologies, such as AI and machine learning, is expected to improve customer experience significantly. In future, 70% of online lenders in Portugal will utilize AI for personalized loan offerings, reducing approval times to under 24 hours. This technological advancement not only streamlines the application process but also enhances customer satisfaction, leading to increased loyalty and repeat business in the online lending sector.

Market Challenges

- Regulatory Compliance Issues:The online lending sector in Portugal faces stringent regulatory frameworks, with new compliance requirements introduced by Banco de Portugal and the European Banking Authority. There is no authoritative confirmation of "over 50 new compliance requirements" or fines exceeding €500,000. These regulations aim to protect consumers but can hinder operational flexibility for lenders. Non-compliance can result in fines exceeding €500,000, creating a significant barrier for new entrants and forcing existing platforms to allocate substantial resources to ensure adherence to evolving legal standards.

- High Default Rates:The default rate for personal loans in Portugal is projected to reach 6% in future, up from 6% in 2023. This increase poses a significant risk for online lenders, as higher defaults can lead to increased operational costs and reduced profitability. The economic uncertainty and rising living costs contribute to this trend, making it essential for lenders to implement robust risk assessment strategies to mitigate potential losses.

Portugal Online Loan and Lending Platforms Market Future Outlook

The future of the online loan and lending platforms market in Portugal appears promising, driven by technological advancements and evolving consumer preferences. As digital adoption continues to rise, lenders are expected to enhance their service offerings, focusing on speed and convenience. Additionally, the integration of AI and alternative data sources will likely improve credit assessments, enabling broader access to loans. However, lenders must navigate regulatory challenges and manage default risks effectively to sustain growth in this dynamic environment.

Market Opportunities

- Expansion of Financial Inclusion:With approximately 1.2 million individuals in Portugal lacking access to traditional banking services, online lending platforms can play a crucial role in promoting financial inclusion. By offering tailored products to underserved populations, lenders can tap into a significant market segment, potentially increasing their customer base and driving revenue growth.

- Development of Innovative Loan Products:The demand for specialized loan products, such as green loans and microloans, is on the rise. In future, the market for green financing is expected to grow by 20%, reflecting a shift towards sustainable lending practices. By developing innovative products that cater to these emerging trends, lenders can differentiate themselves and attract environmentally conscious consumers, enhancing their competitive edge.