Italy Online Loan and Lending Platforms Market Overview

- The Italy Online Loan and Lending Platforms Market is valued at USD 15 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital financial services, a rise in consumer demand for quick and accessible loan options, and the expansion of fintech companies offering innovative lending solutions.

- Key cities such as Milan, Rome, and Turin dominate the market due to their economic significance, high population density, and the presence of numerous financial institutions and fintech startups. These urban centers serve as hubs for technological innovation and financial services, attracting both consumers and investors.

- In 2023, the Italian government implemented regulations to enhance consumer protection in the online lending sector. This includes mandatory transparency in loan terms and conditions, ensuring that borrowers are fully informed about interest rates and fees, thereby promoting responsible lending practices.

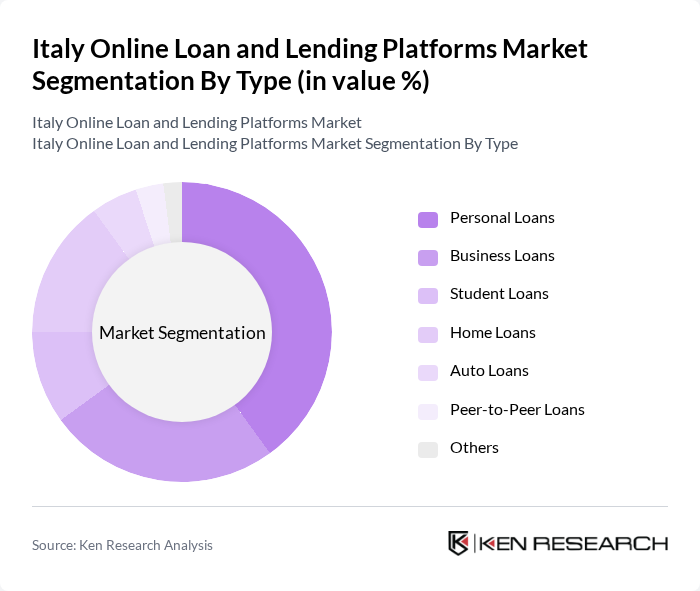

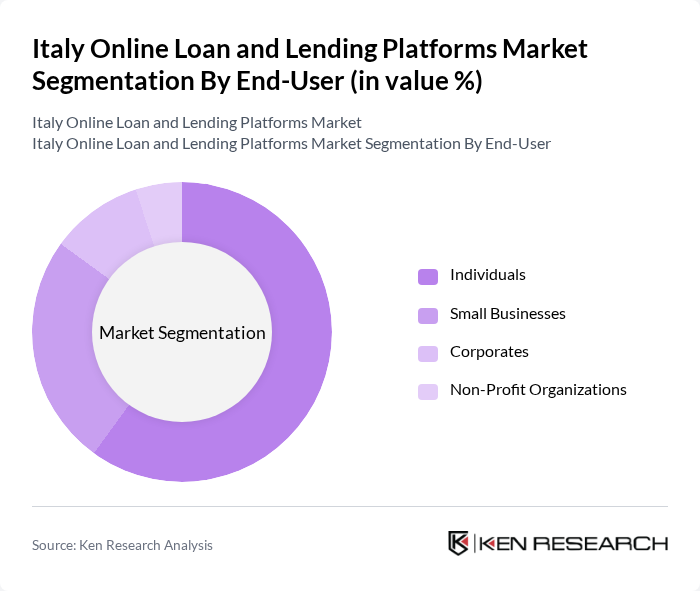

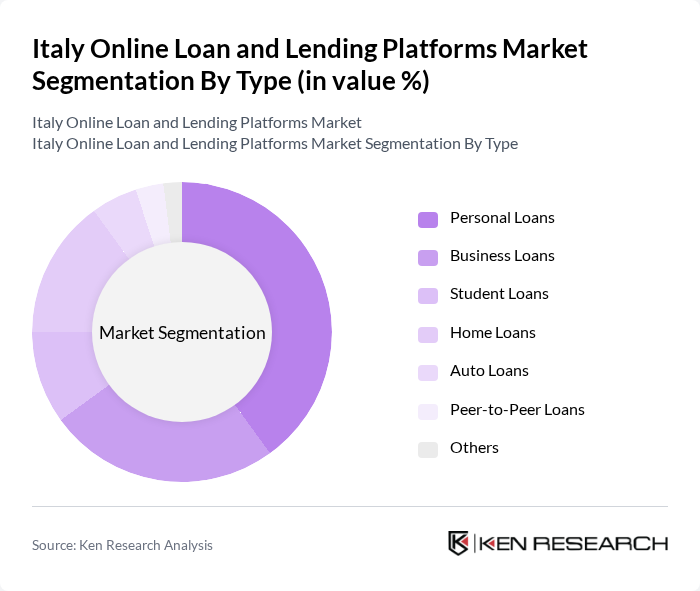

Italy Online Loan and Lending Platforms Market Segmentation

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Student Loans, Home Loans, Auto Loans, Peer-to-Peer Loans, and Others. Among these, Personal Loans are the most popular, driven by consumer demand for flexible financing options for personal expenses. Business Loans are also significant, as small and medium enterprises seek funding for growth and operational needs. The increasing trend of online lending platforms has made it easier for consumers to access these loans, contributing to their popularity.

By End-User:The end-user segmentation includes Individuals, Small Businesses, Corporates, and Non-Profit Organizations. Individuals represent the largest segment, as they frequently seek loans for personal needs such as home improvements, debt consolidation, and education financing. Small Businesses also form a significant portion of the market, as they require funding for operational expenses and growth initiatives. The increasing digitalization of financial services has made it easier for these end-users to access loans online.

Italy Online Loan and Lending Platforms Market Competitive Landscape

The Italy Online Loan and Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Credimi S.p.A., Younited Credit, Soisy S.p.A., PrestitiOnline, Findomestic Banca S.p.A., Banca IFIS, Hype, Lendico, Banca Sella, MoneyFarm, Sella Personal Credit, Banca Nazionale del Lavoro, Credito Fondiario, TAEG, Banca Popolare di Milano contribute to innovation, geographic expansion, and service delivery in this space.

Italy Online Loan and Lending Platforms Market Industry Analysis

Growth Drivers

- Increasing Digital Adoption:The digital landscape in Italy is rapidly evolving, with internet penetration reaching 85% in the future, according to the Italian National Institute of Statistics. This surge in digital connectivity has led to a significant increase in online loan applications, with over 5 million users engaging with lending platforms. The convenience of online services is driving consumer preference, as 70% of borrowers now prefer digital channels for loan processing, reflecting a shift towards a more tech-savvy financial ecosystem.

- Demand for Quick Loan Processing:The average loan processing time in Italy has decreased to just 24 hours, driven by advancements in technology and streamlined operations. This rapid turnaround is crucial, as 60% of consumers report needing funds within a week for personal or emergency expenses. The ability to access funds quickly is reshaping consumer expectations, with many platforms now offering instant approval features, catering to the growing demand for immediate financial solutions in a fast-paced economy.

- Rise of Alternative Lending Solutions:Alternative lending solutions, such as peer-to-peer lending, have gained traction, with the market witnessing a 30% increase in participation from 2022 to the future. This growth is attributed to the increasing number of platforms, which now exceeds 50, providing diverse options for borrowers. Additionally, the total volume of loans disbursed through these platforms reached €1.2 billion in the future, highlighting a shift away from traditional banking methods and a growing acceptance of innovative financial services.

Market Challenges

- Regulatory Compliance Issues:The online lending sector in Italy faces stringent regulatory frameworks, including the Consumer Credit Directive, which mandates transparency and consumer protection. Compliance costs have risen, with platforms spending an average of €200,000 annually to meet these regulations. This financial burden can hinder smaller players from entering the market, limiting competition and innovation, as they struggle to navigate the complex legal landscape while ensuring adherence to evolving regulations.

- Consumer Trust and Security Concerns:Despite the growth of online lending, consumer trust remains a significant challenge. A survey by the Bank of Italy revealed that 45% of potential borrowers express concerns about data security and fraud. The increasing number of cyberattacks on financial institutions, with reported incidents rising by 25% in the future, exacerbates these fears. Building consumer confidence through robust security measures and transparent practices is essential for platforms to thrive in this competitive environment.

Italy Online Loan and Lending Platforms Market Future Outlook

The future of the online loan and lending platforms market in Italy appears promising, driven by technological advancements and evolving consumer preferences. As fintech innovations continue to reshape the landscape, platforms are expected to enhance their offerings, focusing on personalized services and improved user experiences. Additionally, the integration of artificial intelligence in loan processing will streamline operations, making lending more efficient. However, addressing regulatory challenges and building consumer trust will be crucial for sustained growth in this dynamic market.

Market Opportunities

- Expansion of Fintech Innovations:The fintech sector in Italy is projected to attract €1 billion in investments by the future, creating opportunities for online lending platforms to leverage new technologies. Innovations such as blockchain and machine learning can enhance risk assessment and improve customer service, positioning platforms to capture a larger market share and meet the evolving needs of tech-savvy consumers.

- Partnerships with Traditional Banks:Collaborations between online lending platforms and traditional banks are on the rise, with over 30 partnerships established in the future. These alliances enable platforms to access a broader customer base and enhance credibility. By combining the agility of fintech with the stability of established banks, these partnerships can drive growth and foster innovation in the lending landscape, benefiting both parties and consumers alike.