Region:Africa

Author(s):Geetanshi

Product Code:KRAB5741

Pages:82

Published On:October 2025

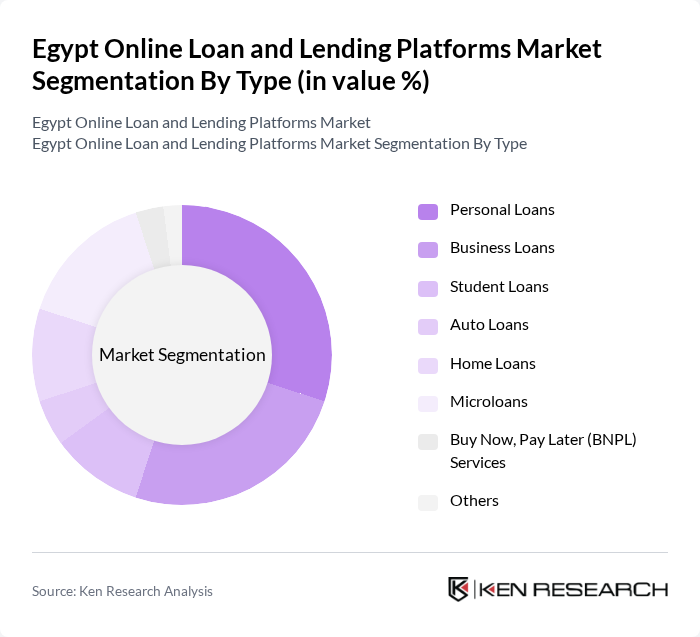

By Type:The market is segmented into various types of loans, includingPersonal Loans, Business Loans, Student Loans, Auto Loans, Home Loans, Microloans, Buy Now, Pay Later (BNPL) Services, and Others. Each type caters to different consumer needs and preferences, with Personal Loans and Microloans being particularly popular due to their accessibility and flexibility. BNPL services are rapidly growing, especially in e-commerce and retail, as consumers seek flexible payment options .

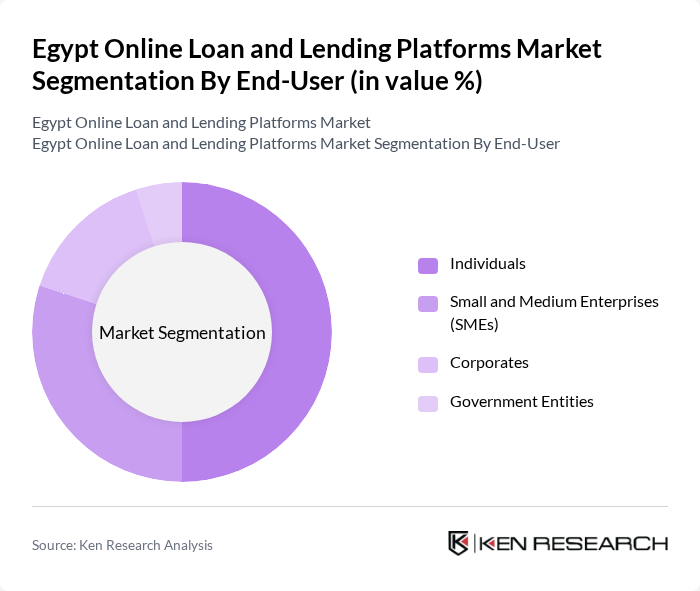

By End-User:The market is segmented by end-users, includingIndividuals, Small and Medium Enterprises (SMEs), Corporates, and Government Entities. Individuals represent the largest segment, driven by the increasing need for personal financing solutions, while SMEs are also significant contributors due to their demand for business capital. The adoption of digital lending among SMEs is supported by streamlined application processes and faster disbursement compared to traditional banking .

The Egypt Online Loan and Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fawry for Banking and Payment Technology Services, Tamweely, YAPILI, CashBasha, EFG Hermes, National Bank of Egypt (NBE), Banque Misr, Commercial International Bank (CIB), QNB Al Ahli, Amlak Finance, Al Baraka Bank, Arab African International Bank, Egyptian Gulf Bank, Abu Dhabi Islamic Bank, Bank of Alexandria, Paymob, Qard Hasad, MNT-Halan, Ameen Finance, Kiva Egypt, and B2B Pay contribute to innovation, geographic expansion, and service delivery in this space .

The future of Egypt's online loan and lending platforms is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital literacy improves, more consumers will engage with online lending services, particularly in underserved areas. Additionally, the integration of artificial intelligence in credit scoring will enhance risk assessment, allowing lenders to offer more personalized loan products. This evolution will likely lead to increased competition and innovation within the sector, fostering a more inclusive financial ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Auto Loans Home Loans Microloans Buy Now, Pay Later (BNPL) Services Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Government Entities |

| By Loan Amount | Small Loans (up to EGP 10,000) Medium Loans (EGP 10,001 – EGP 50,000) Large Loans (above EGP 50,000) |

| By Loan Duration | Short-term Loans (up to 1 year) Medium-term Loans (1–3 years) Long-term Loans (above 3 years) |

| By Interest Rate Type | Fixed Interest Rate Variable Interest Rate Hybrid Interest Rate |

| By Application Method | Online Platforms Mobile Applications Partnered Retailers Traditional Banks |

| By Policy Support | Government-backed Loans Subsidized Interest Rates Tax Incentives for Lenders Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Borrowers | 150 | Individuals aged 25-45, employed, with varying income levels |

| Small Business Owners | 100 | Entrepreneurs seeking financing for business expansion |

| Microloan Recipients | 80 | Low-income individuals and small-scale entrepreneurs |

| Financial Advisors | 60 | Professionals providing financial guidance to clients |

| Online Lending Platform Executives | 50 | CEOs, CFOs, and Product Managers from leading platforms |

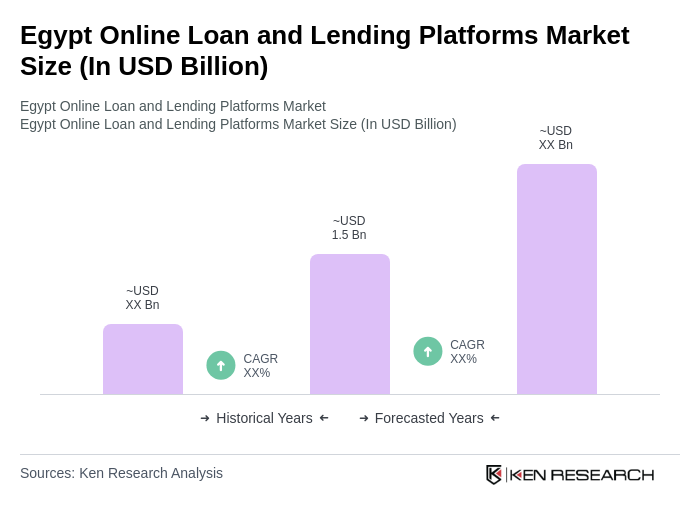

The Egypt Online Loan and Lending Platforms Market is valued at approximately USD 1.5 billion, driven by the increasing adoption of digital financial services and the demand for quick credit solutions among consumers and businesses.