Region:Europe

Author(s):Geetanshi

Product Code:KRAB5838

Pages:99

Published On:October 2025

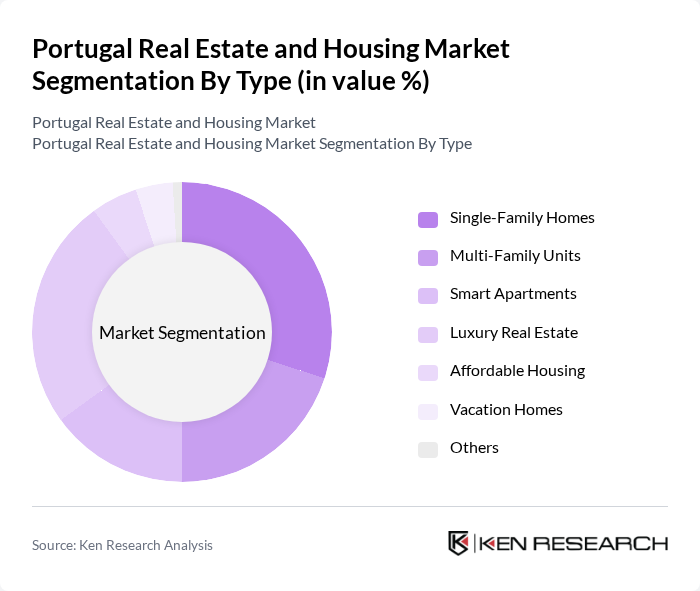

By Type:The market is segmented into various types, including Single-Family Homes, Multi-Family Units, Smart Apartments, Luxury Real Estate, Affordable Housing, Vacation Homes, and Others. Among these, Single-Family Homes and Luxury Real Estate are particularly popular due to the increasing demand for spacious living and high-end amenities. The trend towards Smart Apartments is also gaining traction as technology integration becomes a priority for modern buyers. Urban and coastal areas are seeing the fastest uptake of smart and luxury properties, while affordable housing remains a focus in government-backed projects .

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Investors, Corporations, and Government Entities. Individual Buyers and Real Estate Investors dominate the market, driven by the desire for home ownership and investment opportunities. The trend of purchasing properties for rental income has also surged, particularly in tourist-heavy areas, making this segment a key player in the market. Short-term rental demand and buy-to-let investments are especially strong in Lisbon, Porto, and the Algarve .

The Portugal Real Estate and Housing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Remax Portugal, Century 21 Portugal, ERA Portugal, Sotheby's International Realty Portugal, Engel & Völkers Portugal, Predibisa, JLL Portugal, CBRE Portugal, Savills Portugal, Grupo Casais, Sonae Sierra, Mota-Engil Real Estate, Teixeira Duarte, Vanguard Properties, Habitat Invest, LUXIMO'S Christie's International Real Estate, Idealista, BPI Expresso Imobiliário, Cushman & Wakefield Portugal, Lx Living contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Portugal real estate market appears promising, driven by ongoing economic recovery and sustained foreign investment. As urbanization continues, demand for housing in metropolitan areas is expected to rise, particularly for affordable and sustainable options. However, addressing regulatory challenges and rising property prices will be crucial for maintaining market stability. The integration of technology in real estate transactions is likely to enhance efficiency, making the market more accessible to a broader range of buyers and investors.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Family Homes Multi-Family Units Smart Apartments Luxury Real Estate Affordable Housing Vacation Homes Others |

| By End-User | Individual Buyers Real Estate Investors Corporations Government Entities |

| By Price Range | Low-End Properties Mid-Range Properties High-End Properties |

| By Location | Lisbon Metropolitan Area Porto and Northern Portugal Algarve Cascais and Portuguese Riviera Silver Coast and Comporta Braga and Inland Regions |

| By Property Size | Small Properties Medium Properties Large Properties |

| By Investment Type | Direct Purchases Real Estate Investment Trusts (REITs) Crowdfunding |

| By Development Stage | Pre-Construction Under Construction Completed |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Residential Market | 120 | Real Estate Agents, Homebuyers |

| Commercial Real Estate Sector | 60 | Property Developers, Investors |

| Rental Market Dynamics | 50 | Landlords, Property Managers |

| Foreign Investment Trends | 40 | International Investors, Real Estate Consultants |

| First-time Homebuyers Insights | 70 | Potential Homebuyers, Financial Advisors |

The Portugal real estate and housing market is valued at approximately EUR 34 billion, driven by increasing foreign investment, a booming tourism sector, and a growing demand for residential properties, particularly in urban areas.