Region:Asia

Author(s):Geetanshi

Product Code:KRAB5759

Pages:98

Published On:October 2025

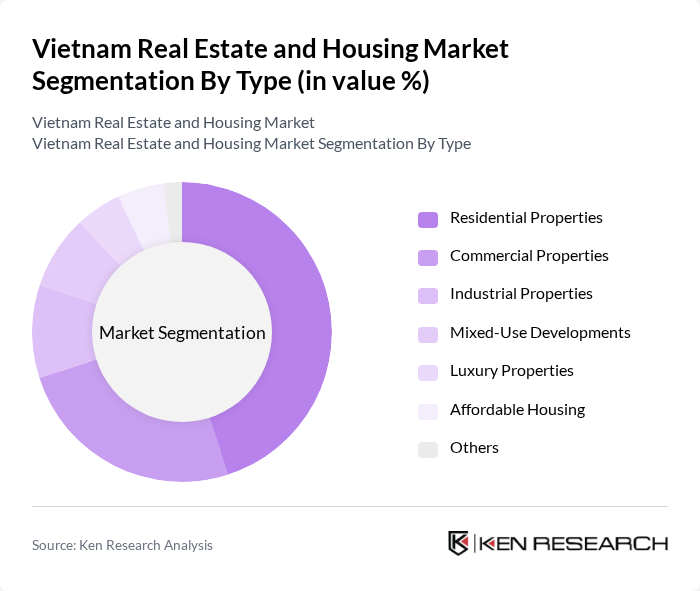

By Type:The market is segmented into Residential Properties, Commercial Properties, Industrial Properties, Mixed-Use Developments, Luxury Properties, Affordable Housing, and Others.Residential Propertiesdominate the market, driven by ongoing urban migration, population growth, and rising demand for diverse housing options. The trend toward urban living, the emergence of nuclear families, and the influx of foreign investment have further fueled demand for new residential developments and premium apartment projects.

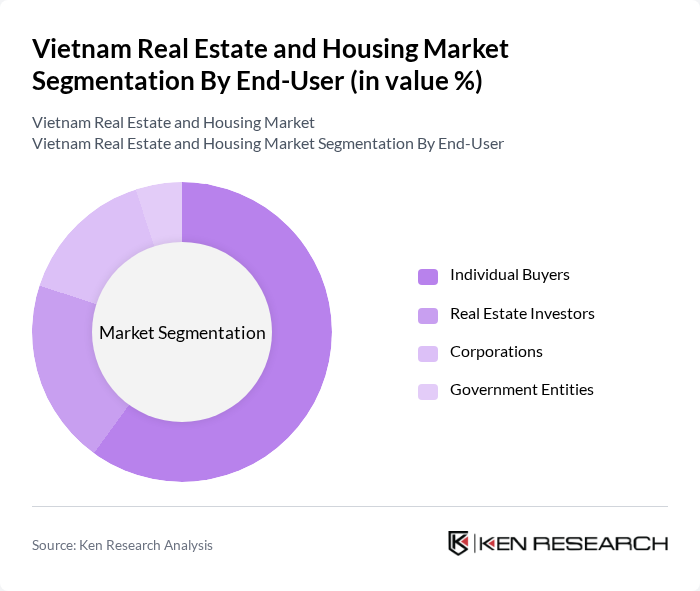

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Investors, Corporations, and Government Entities.Individual Buyersrepresent the largest segment, supported by the increasing number of first-time homebuyers, a growing middle class, and favorable lending conditions. Real estate investment as a means of wealth accumulation continues to rise, with Real Estate Investors actively participating in both residential and commercial segments.

The Vietnam Real Estate and Housing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vingroup JSC, Novaland Investment Group, FLC Group, Phu My Hung Development Corporation, Dat Xanh Group, Nam Long Investment Corporation, Kinh Bac City Development Holding Corporation, Becamex IDC Corporation, Saigon Newport Corporation, Him Lam Land, An Phu Investment and Trading Company, Tan Hoang Minh Group, Sun Group, Hòa Bình Construction Group, C.T Group contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam real estate market is poised for significant transformation in the future, driven by urbanization, rising incomes, and technological advancements. As the government continues to invest in infrastructure and smart city initiatives, the demand for sustainable and affordable housing will increase. Additionally, the integration of digital technologies in property management will enhance operational efficiency, attracting more investors. Overall, the market is expected to adapt to evolving consumer preferences, creating a dynamic environment for growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Mixed-Use Developments Luxury Properties Affordable Housing Others |

| By End-User | Individual Buyers Real Estate Investors Corporations Government Entities |

| By Price Range | Low-End Properties Mid-Range Properties High-End Properties |

| By Location | Urban Areas Suburban Areas Rural Areas |

| By Property Size | Small Properties Medium Properties Large Properties |

| By Development Stage | Pre-Construction Under Construction Completed |

| By Investment Source | Domestic Investment Foreign Direct Investment Public-Private Partnerships Government Funding |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 120 | First-time homebuyers, Investors, Young professionals |

| Commercial Real Estate Investors | 80 | Real estate investment managers, Corporate real estate executives |

| Real Estate Developers | 60 | Project managers, Business development leads |

| Property Management Firms | 50 | Property managers, Operations directors |

| Urban Planning Authorities | 40 | Urban planners, Policy advisors |

The Vietnam Real Estate and Housing Market is valued at approximately USD 22 billion, driven by rapid urbanization, foreign direct investment, and a growing middle class seeking home ownership. This growth reflects the country's strong economic fundamentals and improved regulatory environment.