Region:Middle East

Author(s):Rebecca

Product Code:KRAB5876

Pages:100

Published On:October 2025

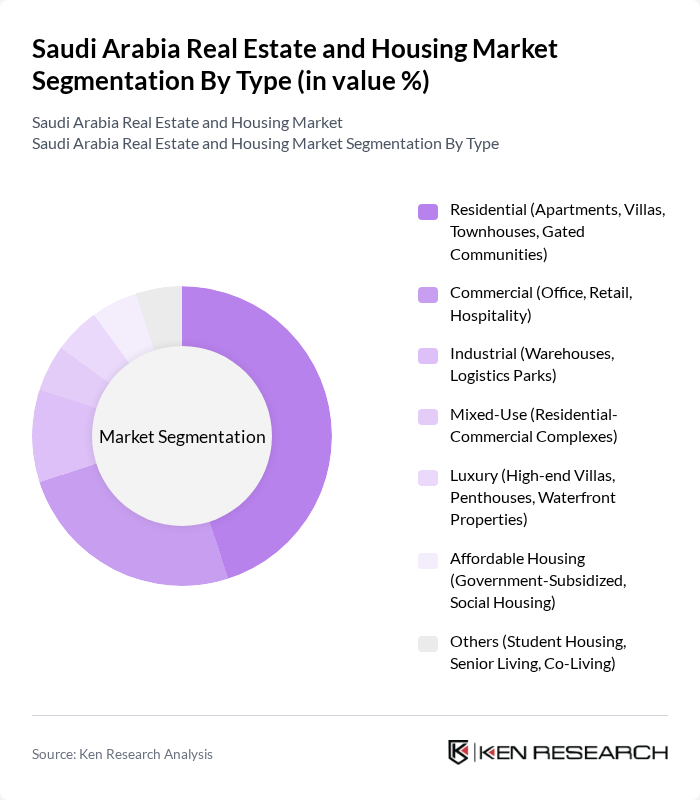

By Type:The market is segmented into various types, including residential, commercial, industrial, mixed-use, luxury, affordable housing, and others. Among these, the residential segment, which encompasses apartments, villas, townhouses, and gated communities, is the most dominant due to the increasing demand for housing driven by population growth and urbanization. The commercial segment, including office spaces and retail, is also significant, reflecting the economic diversification efforts in the country.

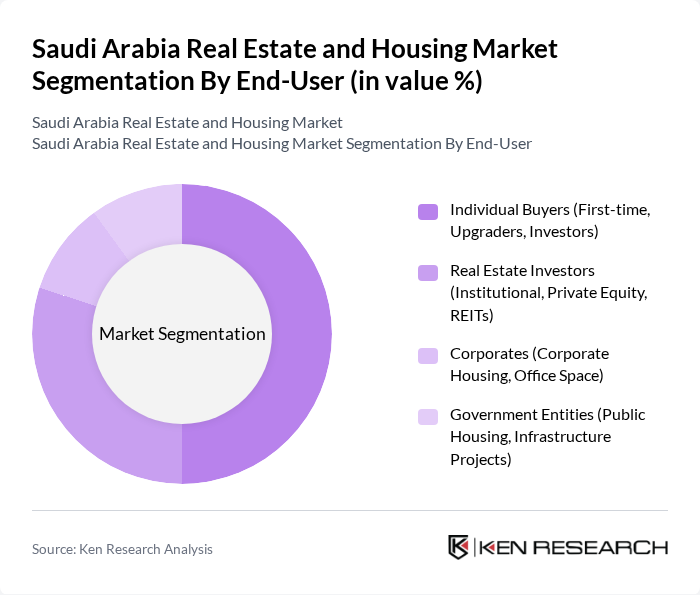

By End-User:The end-user segmentation includes individual buyers, real estate investors, corporates, and government entities. Individual buyers, particularly first-time homebuyers and investors, dominate the market due to favorable financing options and government support. Real estate investors are also significant, driven by the potential for high returns in a growing market. Corporates and government entities contribute to the demand for commercial and public housing projects.

The Saudi Arabia Real Estate and Housing Market is characterized by a dynamic mix of regional and international players. Leading participants such as ROSHN Group, Dar Al Arkan Real Estate Development Company, Saudi Real Estate Company (SRECO), Emaar The Economic City, Sedco Development, Al Akaria Saudi Real Estate Company, Al Hokair Group, Al Rajhi Real Estate Development Company, Al Khozama Management Company, Alinma Investment Company, Al-Bawani Holding Company, Al-Mabani General Contractors, Al-Futtaim Real Estate, Al-Oula Real Estate Development Company, and Al-Arrab Contracting Company contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabian real estate market is poised for significant transformation, driven by urbanization, government initiatives, and foreign investment. As the population continues to grow, the demand for affordable housing will intensify, prompting innovative solutions. Additionally, the adoption of smart technologies and sustainable practices will likely reshape the market landscape, enhancing efficiency and environmental responsibility. Overall, the sector is expected to evolve, presenting new opportunities for developers and investors alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential (Apartments, Villas, Townhouses, Gated Communities) Commercial (Office, Retail, Hospitality) Industrial (Warehouses, Logistics Parks) Mixed-Use (Residential-Commercial Complexes) Luxury (High-end Villas, Penthouses, Waterfront Properties) Affordable Housing (Government-Subsidized, Social Housing) Others (Student Housing, Senior Living, Co-Living) |

| By End-User | Individual Buyers (First-time, Upgraders, Investors) Real Estate Investors (Institutional, Private Equity, REITs) Corporates (Corporate Housing, Office Space) Government Entities (Public Housing, Infrastructure Projects) |

| By Region | Riyadh (Central Business District, Diplomatic Quarter, King Abdullah Financial District) Jeddah (Corniche, Obhur, North Jeddah) Dammam (Dammam Metropolitan Area, Dhahran, Al Khobar) Mecca (Holy Sites, Residential Zones) Medina (Central Area, New Developments) Eastern Province (Industrial Cities, Residential Clusters) Others (NEOM, Red Sea Project, Qiddiya, Aseer) |

| By Investment Source | Domestic Investment (Saudi Nationals, Local Funds) Foreign Direct Investment (FDI) (GCC, Asia, Europe, US) Public-Private Partnerships (PPP) (Infrastructure, Housing) Government Schemes (Sakani, Wafi, ROSHN) |

| By Application | Residential Development (Master-Planned Communities, Suburbs) Commercial Development (Office Towers, Malls, Hotels) Infrastructure Projects (Roads, Utilities, Public Transport) Urban Renewal Projects (Historic Districts, Slum Upgrading) |

| By Financing Type | Mortgages (Conventional, Islamic, Government-Backed) Cash Purchases Installment Plans (Developer Financing, Rent-to-Own) |

| By Policy Support | Subsidies (Down Payment Support, Interest Rate Subsidies) Tax Exemptions (VAT Exemptions, Property Tax Holidays) Incentives for Foreign Investors (Ownership Rights, Visa Benefits) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 120 | First-time homebuyers, Investors |

| Real Estate Developers | 60 | Project Managers, Business Development Heads |

| Real Estate Agents | 50 | Sales Agents, Brokers |

| Property Management Firms | 40 | Operations Managers, Asset Managers |

| Government Housing Authorities | 40 | Policy Makers, Urban Planners |

The Saudi Arabia Real Estate and Housing Market is valued at approximately USD 70 billion, driven by urbanization, government investments under Vision 2030, and increasing foreign investor participation, reflecting a robust growth trajectory in the sector.