Region:Middle East

Author(s):Dev

Product Code:KRAD6354

Pages:95

Published On:December 2025

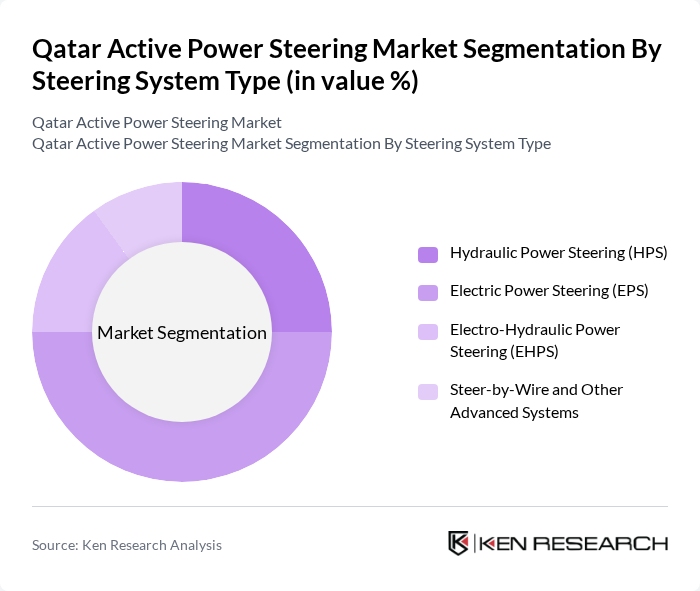

By Steering System Type:The steering system type segmentation includes Hydraulic Power Steering (HPS), Electric Power Steering (EPS), Electro-Hydraulic Power Steering (EHPS), and Steer-by-Wire and Other Advanced Systems. Among these, Electric Power Steering (EPS) is currently dominating the market due to its energy efficiency, lightweight design, and ability to integrate advanced driver-assistance systems, reflecting the global shift from hydraulic to electric steering. The growing trend towards electric and hybrid vehicles, combined with OEM focus on fuel efficiency, reduced emissions, and software-driven steering functions, is further propelling the adoption of EPS systems in Qatar in line with broader Middle East and Africa active power steering developments.

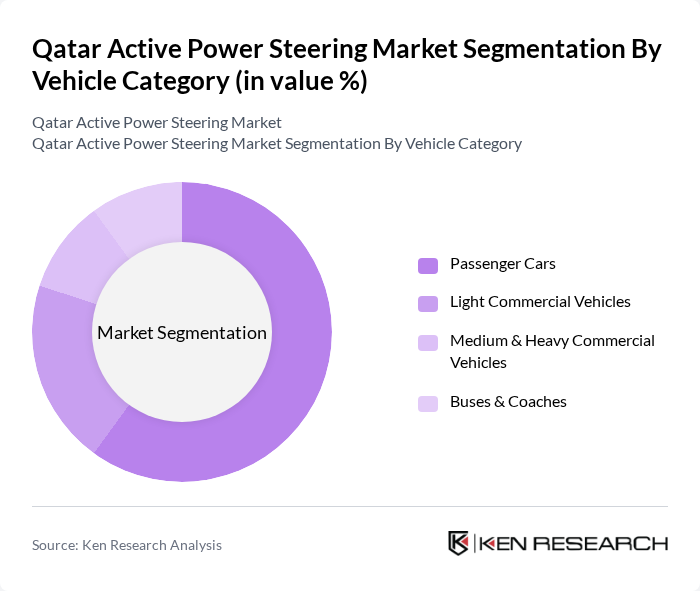

By Vehicle Category:The vehicle category segmentation encompasses Passenger Cars, Light Commercial Vehicles, Medium & Heavy Commercial Vehicles, and Buses & Coaches. Passenger Cars are leading this segment, driven by the increasing consumer preference for personal vehicles, especially SUVs and premium cars, and the growing trend of urbanization in key Qatari cities. The rise in disposable income, high vehicle ownership rates, and the demand for advanced safety and comfort features such as EPS, lane-keeping assistance, and parking assistance in personal vehicles are also contributing to the growth of this segment.

The Qatar Active Power Steering Market is characterized by a dynamic mix of regional and international players. Leading participants such as ZF Friedrichshafen AG, Robert Bosch Automotive Steering GmbH, JTEKT Corporation, Nexteer Automotive Corporation, thyssenkrupp AG, Hyundai Mobis Co., Ltd., Mando Corporation, Aisin Corporation, DENSO Corporation, Knorr-Bremse AG, AB Volvo, BMW AG, American Axle & Manufacturing Holdings, Inc. (AAM), Valeo SA, Qatar Automobiles Company (Mitsubishi Motors Distributor – Qatar) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the active power steering market in Qatar appears promising, driven by technological innovations and a shift towards electric vehicles. As the government continues to support the automotive sector through incentives and infrastructure development, the market is expected to witness increased adoption of advanced steering systems. Furthermore, the integration of smart technologies and autonomous driving features will likely enhance consumer interest, positioning the market for substantial growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Steering System Type | Hydraulic Power Steering (HPS) Electric Power Steering (EPS) Electro-Hydraulic Power Steering (EHPS) Steer-by-Wire and Other Advanced Systems |

| By Vehicle Category | Passenger Cars Light Commercial Vehicles Medium & Heavy Commercial Vehicles Buses & Coaches |

| By Application | Fleet & Logistics Vehicles Construction & Infrastructure Vehicles Oil & Gas and Industrial Support Vehicles Municipal & Government Service Vehicles |

| By Component | Steering Gear / Rack-and-Pinion Assembly Steering Column & Intermediate Shaft Sensors (Torque, Angle, Speed) Electronic Control Unit (ECU) & Software Electric Motor / Hydraulic Pump |

| By Sales Channel | OEM Fitment Independent Aftermarket Authorized Service Centers Online and B2B E-commerce |

| By Vehicle Powertrain | Internal Combustion Engine (ICE) Vehicles Hybrid Electric Vehicles (HEV) Battery Electric Vehicles (BEV) Plug-in Hybrid Electric Vehicles (PHEV) |

| By Import Source Region | Europe Asia-Pacific North America GCC and Wider Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 60 | Product Development Managers, Engineering Leads |

| Commercial Vehicle Suppliers | 50 | Supply Chain Managers, Procurement Specialists |

| Automotive Aftermarket Retailers | 40 | Store Managers, Sales Representatives |

| Service Centers and Workshops | 40 | Service Managers, Automotive Technicians |

| Industry Experts and Consultants | 40 | Automotive Analysts, Market Researchers |

The Qatar Active Power Steering Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the increasing demand for advanced vehicle technologies and consumer preferences for enhanced driving comfort and safety features.