Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1098

Pages:96

Published On:November 2025

By Type:The market is segmented into four types of electric power steering systems: Column Assist Electric Power Steering (C-EPS), Pinion Assist Electric Power Steering (P-EPS), Rack Assist Electric Power Steering (R-EPS), and Dual Pinion Electric Power Steering. Among these, the Rack Assist Electric Power Steering (R-EPS) is currently the leading sub-segment due to its widespread application in passenger vehicles and commercial vehicles, offering superior performance, modular compatibility, and efficiency. The demand for lightweight and compact steering solutions, especially in electric and hybrid vehicles, further supports the dominance of R-EPS in the market.

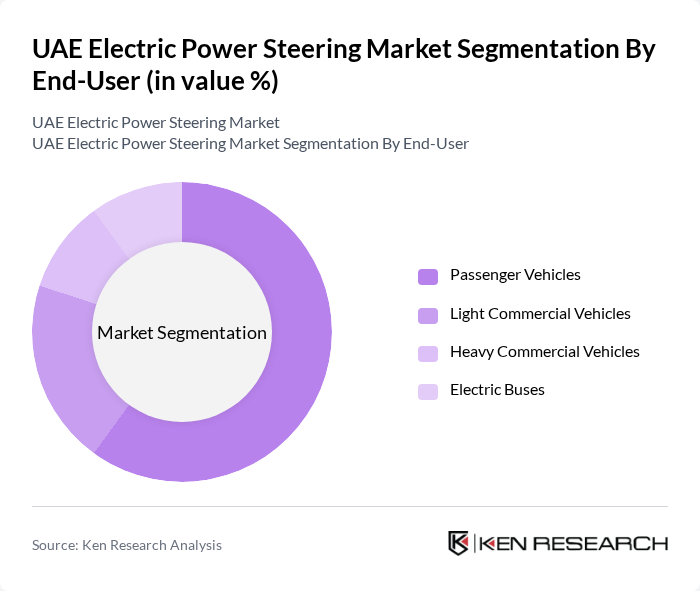

By End-User:The electric power steering market is segmented by end-user into Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles, and Electric Buses. The Passenger Vehicles segment holds the largest share, driven by increasing consumer preference for personal vehicles, the growing trend of vehicle electrification, and the integration of ADAS technologies. The rise in disposable income, rapid urbanization, and government incentives for electric vehicles in the UAE further fuel the demand for passenger vehicles equipped with advanced steering technologies.

The UAE Electric Power Steering Market is characterized by a dynamic mix of regional and international players. Leading participants such as ZF Friedrichshafen AG, Bosch Automotive Steering GmbH, JTEKT Corporation, Nexteer Automotive, Hyundai Mobis Co., Ltd., Mitsubishi Electric Corporation, thyssenkrupp AG, TRW Automotive (now part of ZF Group), Valeo S.A., Aisin Corporation, Hitachi Astemo, Ltd., DENSO Corporation, Calsonic Kansei Corporation (now Marelli Corporation), NSK Ltd., and Mando Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE electric power steering market appears promising, driven by technological advancements and government support for electric vehicles. As the market evolves, the integration of smart technologies and autonomous driving features will likely become standard. Additionally, the growing emphasis on sustainability will further propel the adoption of electric power steering systems. With increasing investments in EV infrastructure and consumer education initiatives, the market is poised for significant growth, aligning with the UAE's vision for a greener future.

| Segment | Sub-Segments |

|---|---|

| By Type | Column Assist Electric Power Steering (C-EPS) Pinion Assist Electric Power Steering (P-EPS) Rack Assist Electric Power Steering (R-EPS) Dual Pinion Electric Power Steering |

| By End-User | Passenger Vehicles Light Commercial Vehicles Heavy Commercial Vehicles Electric Buses |

| By Vehicle Type | SUVs Sedans Hatchbacks Pickup Trucks |

| By Component | Electric Motor Electronic Control Unit (ECU) Steering Column Sensors Steering Gear |

| By Distribution Channel | OEMs Aftermarket |

| By Geography | Abu Dhabi Dubai Sharjah Northern Emirates |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Local Content Requirements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 60 | Product Development Managers, Engineering Leads |

| Commercial Vehicle Suppliers | 50 | Supply Chain Managers, Procurement Specialists |

| Automotive Aftermarket Service Providers | 40 | Service Managers, Workshop Owners |

| Electric Vehicle Manufacturers | 40 | R&D Engineers, Technical Directors |

| Automotive Component Distributors | 50 | Sales Managers, Distribution Coordinators |

The UAE Electric Power Steering market is valued at approximately USD 140 million, driven by the increasing adoption of electric vehicles and advancements in automotive electronics, emphasizing fuel efficiency and safety features.