Region:Asia

Author(s):Shubham

Product Code:KRAC2205

Pages:81

Published On:October 2025

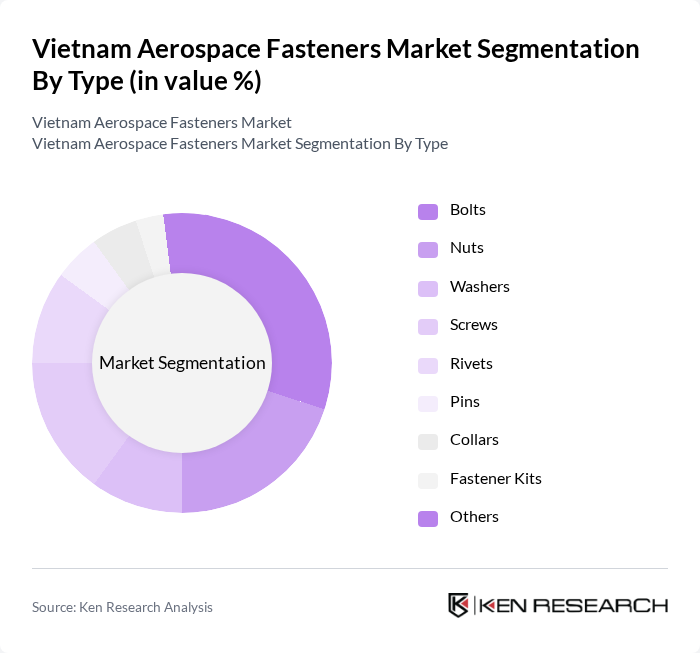

By Type:The market is segmented into various types of fasteners, including bolts, nuts, washers, screws, rivets, pins, collars, fastener kits, and others. Each type serves specific applications within the aerospace industry, with bolts and screws being the most commonly used due to their versatility and strength. The demand for these fasteners is driven by the increasing production of aircraft, fleet upgrades, and the need for reliable fastening solutions in critical aerospace applications. The growing use of lightweight and corrosion-resistant fasteners is also shaping demand, especially for high-performance and safety-critical components.

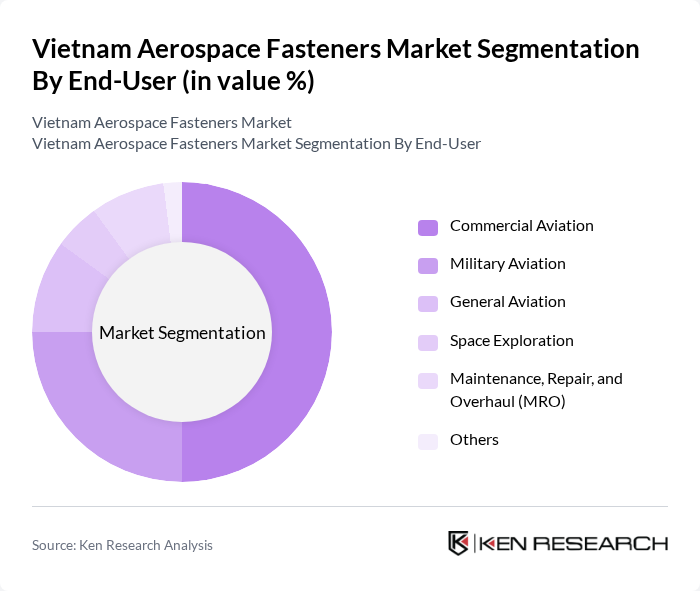

By End-User:The aerospace fasteners market is segmented by end-user into commercial aviation, military aviation, general aviation, space exploration, maintenance, repair, and overhaul (MRO), and others. The commercial aviation segment is the largest due to the growing demand for passenger air travel, expansion of airline fleets, and investments in new aircraft. Military aviation also contributes significantly, driven by defense spending, modernization programs, and the need for advanced fastening solutions in high-performance aircraft.

The Vietnam Aerospace Fasteners Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aerospace Fasteners Inc. Vietnam, Vina Fasteners Manufacturing Co., Ltd., Hoang Long Mechanical & Fasteners JSC, TriMas Corporation (Vietnam), Precision Castparts Corp. (PCC Fasteners Vietnam), Stanley Black & Decker (Vietnam), Alcoa Fastening Systems & Rings (Vietnam), Fastenal Vietnam Co., Ltd., SFS Group Vietnam, Bossard Vietnam Co., Ltd., VinFast Auto (Aerospace Components Division), Vietnam Aerospace Engineering Co., Ltd., Viet Aerospace Technologies JSC, Hanoi Mechanical Engineering Company, Saigon Mechanical Engineering Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam aerospace fasteners market appears promising, driven by the ongoing expansion of the aviation sector and increasing investments in research and development. As the government continues to support the aerospace industry through infrastructure development and regulatory reforms, local manufacturers are likely to enhance their capabilities. Additionally, the trend towards sustainable manufacturing practices will encourage innovation, positioning Vietnam as a competitive player in the global aerospace fasteners market in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Bolts Nuts Washers Screws Rivets Pins Collars Fastener Kits Others |

| By End-User | Commercial Aviation Military Aviation General Aviation Space Exploration Maintenance, Repair, and Overhaul (MRO) Others |

| By Material | Aluminum Steel Titanium Superalloys Composite Materials Others |

| By Application | Airframe Engine Landing Gear Interior Components Avionics Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Price Range | Low Price Mid Price High Price |

| By Certification Type | ISO Certified AS9100 Certified NADCAP Certified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Manufacturing Firms | 100 | Production Managers, Supply Chain Directors |

| Government Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Aerospace Component Suppliers | 80 | Sales Managers, Product Development Engineers |

| Maintenance, Repair, and Overhaul (MRO) Services | 70 | Operations Managers, Quality Control Inspectors |

| Aerospace Research Institutions | 40 | Research Analysts, Aerospace Engineers |

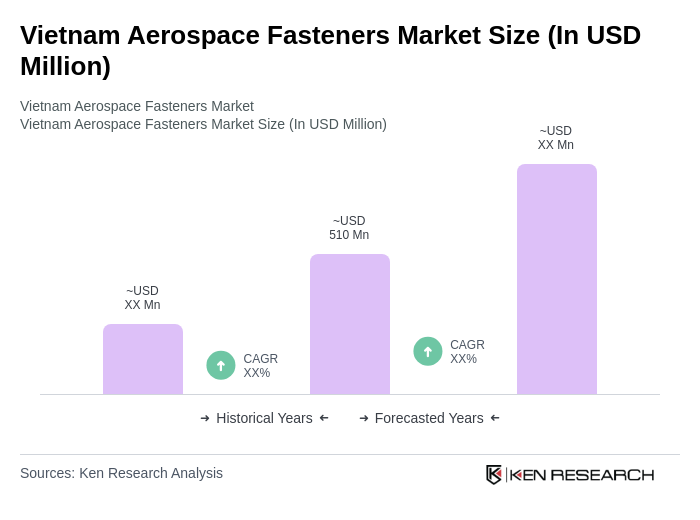

The Vietnam Aerospace Fasteners Market is valued at approximately USD 510 million, reflecting significant growth driven by the increasing demand for lightweight and high-strength fasteners in the expanding aerospace sector.