Region:Middle East

Author(s):Shubham

Product Code:KRAD0733

Pages:99

Published On:August 2025

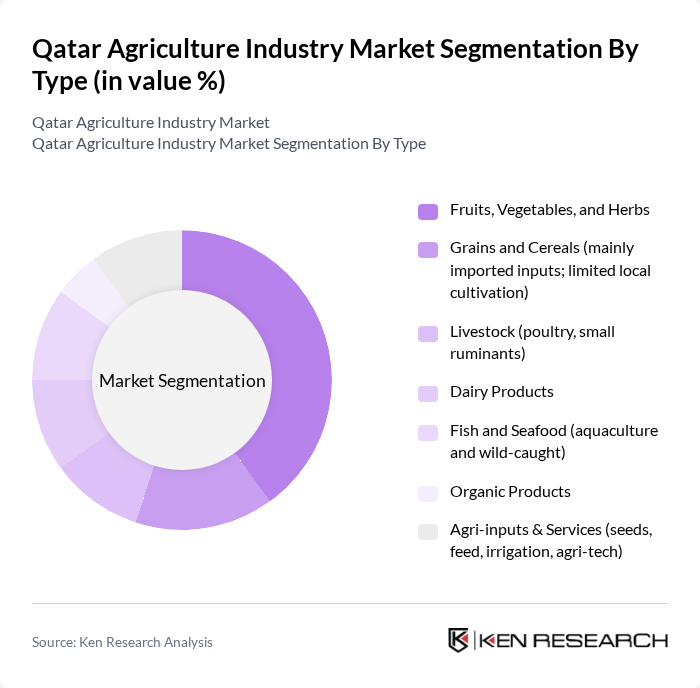

By Type:The agriculture market in Qatar is segmented into various types, including fruits, vegetables, grains, livestock, dairy products, fish and seafood, organic products, and agri-inputs & services. Among these, fruits, vegetables, and herbs are the most dominant sub-segment, driven by consumer demand for fresh produce and healthy diets, and supported by state-backed greenhouse, hydroponic, and vertical farming initiatives aimed at import substitution and self-sufficiency.

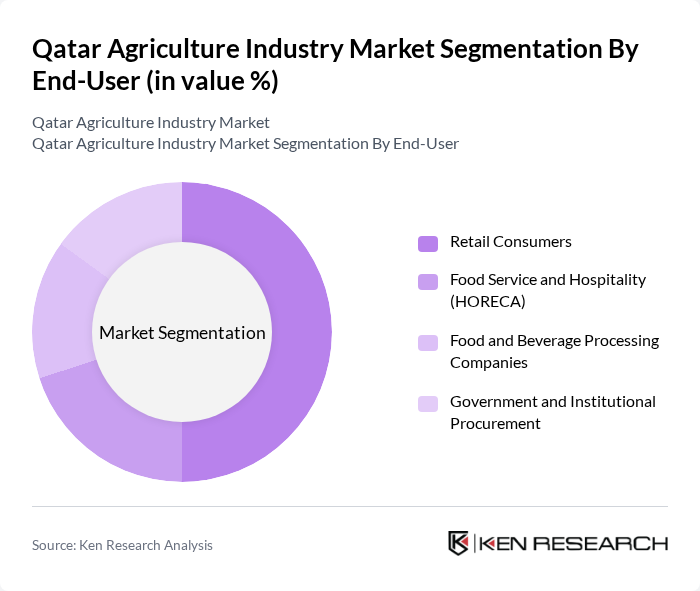

By End-User:The end-user segmentation of the agriculture market in Qatar includes retail consumers, food service and hospitality (HORECA), food and beverage processing companies, and government and institutional procurement. The retail consumer segment is the largest, driven by the growing population and increasing health consciousness among consumers, leading to a higher demand for fresh and organic produce.

The Qatar Agriculture Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Baladna Food Industries, Hassad Food, Widam Food, Al Meera Consumer Goods Company, Agrico Agricultural Development, Al Rayyan Agricultural, Mahaseel for Marketing and Agri Services, Qatarat Agricultural Development Company (QADCO), Aqua Gulf (Qatar) Aquaculture, Qatar Meat and Livestock Trading Company (Mawashi), Qatar National Food Security Program (policy body), Sidra Agriculture (Sidra Hydroponics), Al Sulaiteen Agricultural and Industrial Complex (SAIC), Qatar Fisheries Development Company, Dandy Company (Dandy Dairy) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar agriculture industry appears promising, driven by ongoing government support and technological innovations. As the population continues to grow, the demand for local produce is expected to rise, prompting further investments in sustainable practices. Additionally, the focus on food security will likely lead to enhanced collaboration between the government and private sectors, fostering a more resilient agricultural ecosystem. The integration of smart agriculture technologies will also play a crucial role in optimizing resource use and improving productivity.

| Segment | Sub-Segments |

|---|---|

| By Type | Fruits, Vegetables, and Herbs Grains and Cereals (mainly imported inputs; limited local cultivation) Livestock (poultry, small ruminants) Dairy Products Fish and Seafood (aquaculture and wild-caught) Organic Products Agri-inputs & Services (seeds, feed, irrigation, agri-tech) |

| By End-User | Retail Consumers Food Service and Hospitality (HORECA) Food and Beverage Processing Companies Government and Institutional Procurement |

| By Distribution Channel | Direct Farm Sales and Contracts Supermarkets and Hypermarkets Online Grocery and E-commerce Wholesale Markets and Traders |

| By Production Method | Conventional Farming Organic Farming Hydroponics and Controlled-Environment Agriculture Aquaponics and Recirculating Aquaculture Systems |

| By Crop Type | Leafy Greens and Salad Crops Fruit Vegetables (tomato, cucumber, pepper) Root and Tuber Crops Forage and Fodder |

| By Investment Source | Private Investments Government Funding and Sovereign Vehicles International Partnerships and Aid |

| By Policy Support | Subsidies and Input Support Tax and Land-Use Incentives R&D Grants and Innovation Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Producers | 100 | Farm Owners, Agronomists |

| Livestock Farmers | 80 | Livestock Managers, Veterinary Experts |

| Aquaculture Operators | 60 | Aquaculture Managers, Environmental Scientists |

| Agrochemical Suppliers | 70 | Sales Managers, Product Development Specialists |

| Government Agricultural Policy Makers | 50 | Policy Analysts, Agricultural Economists |

The Qatar Agriculture Industry Market is valued at approximately USD 180 million, reflecting a significant focus on food security, local production enhancement, and the adoption of advanced agricultural technologies such as hydroponics and automated irrigation systems.