Region:Middle East

Author(s):Shubham

Product Code:KRAD0637

Pages:93

Published On:August 2025

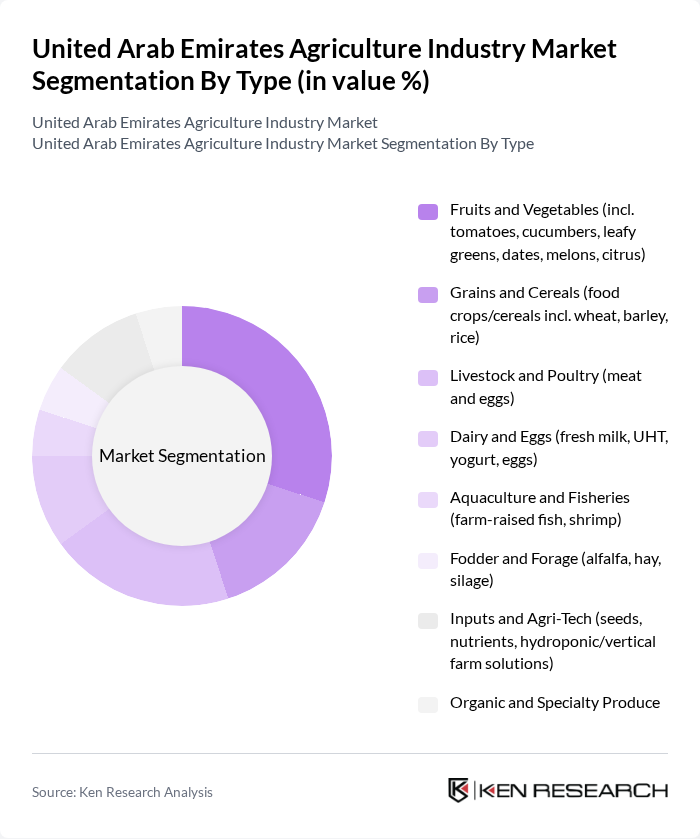

By Type:The agriculture industry in the UAE can be segmented into various types, including fruits and vegetables, grains and cereals, livestock and poultry, dairy and eggs, aquaculture and fisheries, fodder and forage, inputs and agri-tech, and organic and specialty produce. Each of these segments plays a crucial role in meeting the growing demand for food and agricultural products in the region; fruits and vegetables and specialty/high-value crops are emphasized in recent analyses due to the rise of hydroponics and controlled-environment systems supporting local fresh produce .

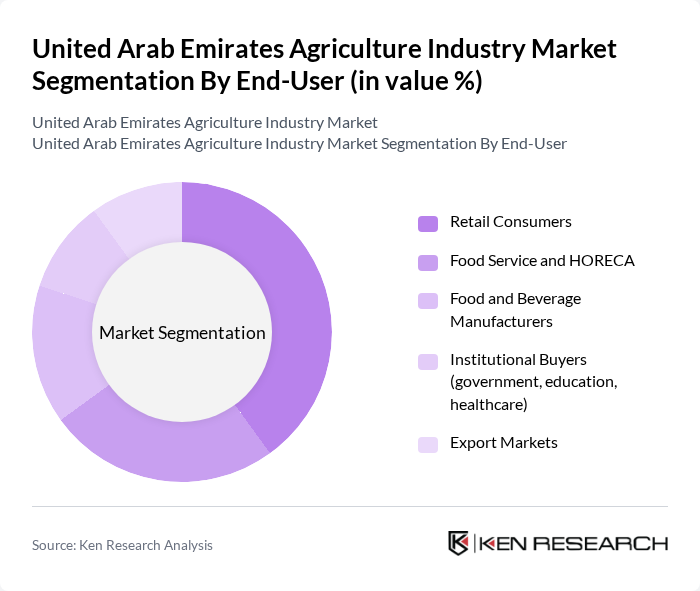

By End-User:The end-user segmentation of the agriculture industry includes retail consumers, food service and HORECA (hotels, restaurants, and catering), food and beverage manufacturers, institutional buyers (government, education, healthcare), and export markets. Each of these segments has unique requirements and contributes to the overall demand for agricultural products; retail and HORECA channels are prominent demand centers for fresh produce and animal products in the UAE’s import-reliant but increasingly localizing food ecosystem .

The United Arab Emirates Agriculture Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Farms, Agthia Group PJSC, Al Dahra Holding, Al Rawabi Dairy Company, Emirates Bio Farm, Pure Harvest Smart Farms, Bustanica (Emirates Crop One), Silal (Abu Dhabi), NRTC Group (Nassar Al Refaee Trading Company), Emirates National Poultry Farms, Al Ghurair Foods, Elite Agro Holding, Dubai Municipality — Farmers’ Souq Program, Union Cooperative Society (Farm-to-shelf programs), Al Foah (dates) — part of Agthia Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the UAE agriculture industry appears promising, driven by ongoing technological innovations and government support for sustainable practices. As the demand for local and organic produce continues to rise, the sector is likely to see increased investment in hydroponics and vertical farming. Additionally, the focus on climate-resilient crops will enhance food security, ensuring that the industry adapts to environmental challenges while meeting consumer needs effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Fruits and Vegetables (incl. tomatoes, cucumbers, leafy greens, dates, melons, citrus) Grains and Cereals (food crops/cereals incl. wheat, barley, rice) Livestock and Poultry (meat and eggs) Dairy and Eggs (fresh milk, UHT, yogurt, eggs) Aquaculture and Fisheries (farm-raised fish, shrimp) Fodder and Forage (alfalfa, hay, silage) Inputs and Agri-Tech (seeds, nutrients, hydroponic/vertical farm solutions) Organic and Specialty Produce |

| By End-User | Retail Consumers Food Service and HORECA Food and Beverage Manufacturers Institutional Buyers (government, education, healthcare) Export Markets |

| By Distribution Channel | Supermarkets and Hypermarkets Online Grocery and E-commerce Farmers' Markets and Farm Shops Wholesale and Foodservice Distributors Direct-to-Consumer Subscriptions (CSA boxes, farm delivery) |

| By Crop Type | Field Crops (cereals, pulses) Horticultural Crops (fruits, vegetables, herbs) Forage and Fodder Crops Dates and Palm Products |

| By Farming Method | Conventional Open-Field Farming Organic Farming Controlled Environment Agriculture (Hydroponics) Controlled Environment Agriculture (Aquaponics) Vertical Farming and Greenhouse Cultivation |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Sovereign and Strategic Investment (e.g., ADQ, Mubadala) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Producers | 60 | Farm Owners, Agronomists |

| Livestock Farmers | 50 | Livestock Managers, Veterinary Experts |

| Aquaculture Operators | 40 | Aquaculture Managers, Environmental Scientists |

| Agri-tech Innovators | 50 | Product Developers, Technology Officers |

| Government Agricultural Policy Makers | 40 | Policy Analysts, Regulatory Officials |

The United Arab Emirates agriculture industry market is valued at approximately USD 3.6 billion, reflecting a significant growth trend driven by investments in agri-tech, government initiatives for food security, and increasing consumer demand for locally sourced produce.