Region:Middle East

Author(s):Shubham

Product Code:KRAD0803

Pages:95

Published On:August 2025

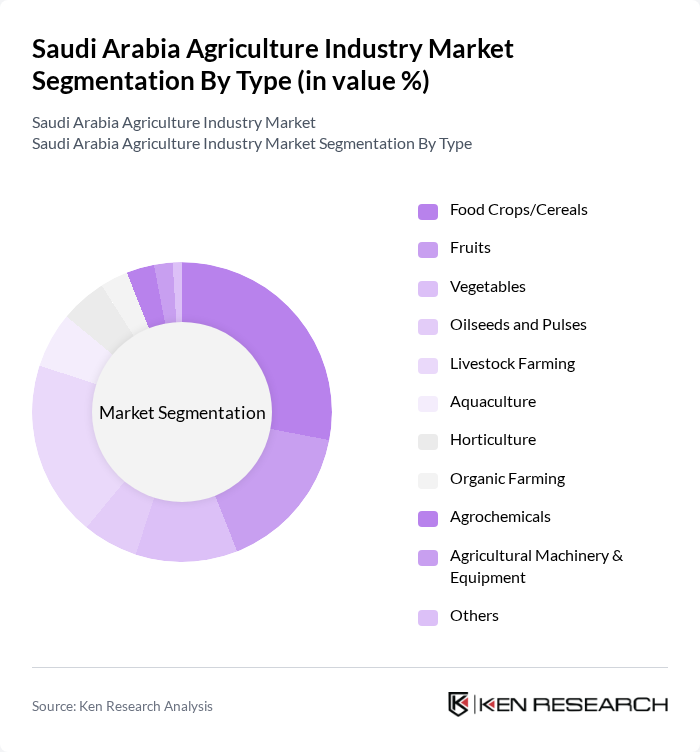

By Type:The market is segmented into Food Crops/Cereals, Fruits, Vegetables, Oilseeds and Pulses, Livestock Farming, Aquaculture, Horticulture, Organic Farming, Agrochemicals, Agricultural Machinery & Equipment, and Others. Food Crops/Cereals and Livestock Farming are the leading segments, reflecting their critical role in national food security and meeting the dietary requirements of a growing population. The sector is increasingly adopting smart farming solutions, hydroponics, and greenhouse cultivation to optimize output and resource efficiency.

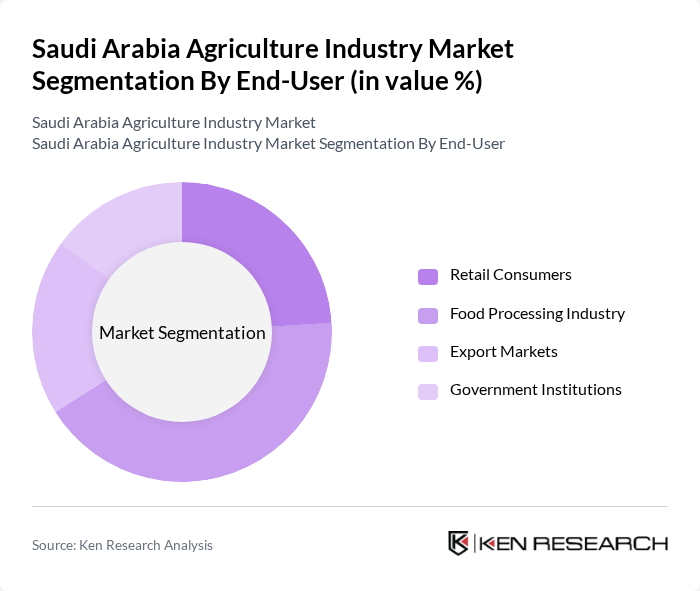

By End-User:The market is segmented by end-users, including Retail Consumers, Food Processing Industry, Export Markets, and Government Institutions. The Food Processing Industry is the dominant segment, propelled by the rising demand for packaged and processed food products and the expansion of supply chain infrastructure to meet evolving consumer preferences. The sector is also supported by government policies encouraging value addition and export-oriented production.

The Saudi Arabia Agriculture Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Savola Group, National Agricultural Development Company (NADEC), Saudi Agricultural and Livestock Investment Company (SALIC), Al-Faisaliah Group, United Farmers Holding Company, Al-Jouf Agricultural Development Company, Tabuk Agricultural Development Company, Arabian Agricultural Services Company (ARASCO), Al-Safi Danone, Al-Ahsa Development Company, Qassim Agricultural Development Company (QADCO), Al-Rajhi International for Investment, Wafrah for Industry and Development, Abdullah Al-Othaim Markets Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi agriculture industry appears promising, driven by ongoing government support and technological innovations. As the nation strives for food security, investments in sustainable practices and agri-tech are expected to increase. The rise of vertical farming and smart agriculture solutions will likely enhance productivity while addressing environmental concerns. Furthermore, the growing trend of organic farming will cater to health-conscious consumers, creating new market segments and opportunities for local producers.

| Segment | Sub-Segments |

|---|---|

| By Type | Food Crops/Cereals Fruits Vegetables Oilseeds and Pulses Livestock Farming Aquaculture Horticulture Organic Farming Agrochemicals Agricultural Machinery & Equipment Others |

| By End-User | Retail Consumers Food Processing Industry Export Markets Government Institutions |

| By Distribution Channel | Direct Sales Wholesale Distributors Online Retail Farmers' Markets |

| By Product Category | Fresh Produce Processed Foods Dairy Products Meat Products |

| By Farming Method | Conventional Farming Organic Farming Hydroponics Aquaponics Greenhouse/Controlled-Environment Agriculture |

| By Investment Type | Private Investments Government Funding Foreign Direct Investment |

| By Policy Support | Subsidies Tax Incentives Research Grants Training Programs Export Support Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Producers | 100 | Farm Owners, Agricultural Managers |

| Fruit and Vegetable Growers | 90 | Horticulturists, Cooperative Leaders |

| Livestock Farmers | 80 | Livestock Managers, Veterinary Experts |

| Agricultural Equipment Suppliers | 60 | Sales Representatives, Product Managers |

| Agri-tech Innovators | 40 | Research Scientists, Technology Developers |

The Saudi Arabia Agriculture Industry Market is valued at approximately USD 18 billion, reflecting significant growth driven by investments in agricultural technology, government initiatives for food security, and increasing consumer demand for locally sourced food products.