Region:Middle East

Author(s):Shubham

Product Code:KRAD6643

Pages:89

Published On:December 2025

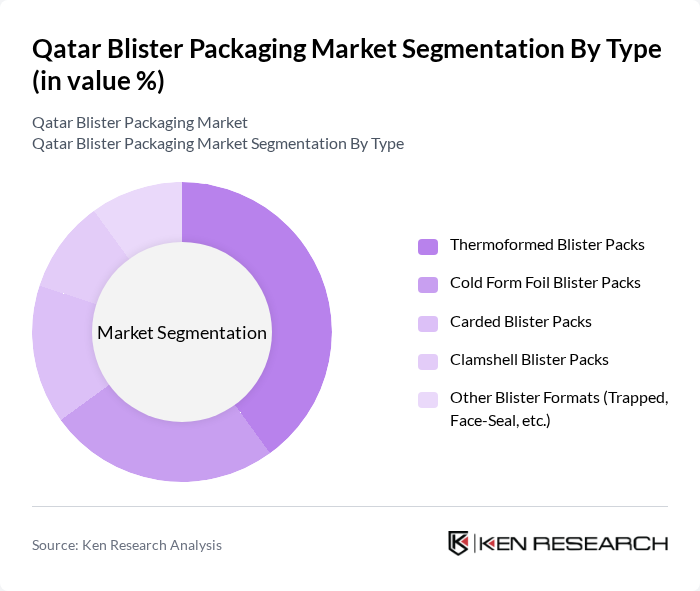

By Type:The blister packaging market can be segmented into various types, including Thermoformed Blister Packs, Cold Form Foil Blister Packs, Carded Blister Packs, Clamshell Blister Packs, and Other Blister Formats (Trapped, Face-Seal, etc.). Each type serves different applications and industries, with specific advantages in terms of product protection, barrier performance, visibility, and consumer convenience.

The leading subsegment in the blister packaging market is Thermoformed Blister Packs, which dominate due to their versatility, comparatively lower cost than cold-form foil, and suitability for high-speed production. These packs are widely used in the pharmaceutical industry for solid oral dosage forms, as they provide excellent visibility and protection against moisture and contamination when combined with appropriate lidding materials. The growing trend of unit-dose packaging in pharmaceuticals, the rise of over-the-counter medications, and the increasing demand for convenient, tamper-evident packaging in consumer goods further bolster the popularity of thermoformed packs.

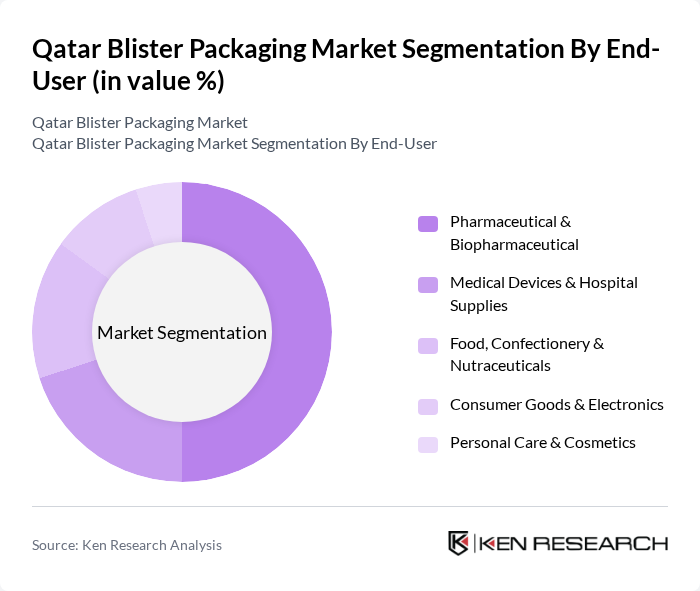

By End-User:The blister packaging market is segmented by end-user industries, including Pharmaceutical & Biopharmaceutical, Medical Devices & Hospital Supplies, Food, Confectionery & Nutraceuticals, Consumer Goods & Electronics, Personal Care & Cosmetics, and Other Industrial & Retail End-Users. Each segment has unique requirements and preferences for packaging solutions in terms of barrier properties, sterility, branding, and convenience.

The Pharmaceutical & Biopharmaceutical segment is the largest end-user of blister packaging, accounting for a significant share of the market globally and in the Middle East, where pharmaceuticals are the primary application for blisters. This dominance is attributed to stringent regulations regarding drug packaging, requirements for tamper-evident and child-resistant formats, and the need for unit-dose compliance packaging. The increasing prevalence of chronic diseases, growing prescription volumes, and the expansion of local and regional pharmaceutical manufacturing further drive the need for effective blister packaging in this sector.

The Qatar Blister Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Pharma Factory, Qatar National Plastic Factory, Al Suwaidi Plastic Factory, United Plastic Products Company (UPPC), Al Wataniah Plastic & Packaging, Al Sadd Plastics, Al Nakheel Plastic Industries, Al Jazeera Factory for Plastic Products, Doha Plastic Factory, Al Rayyan Plastic Factory, Seashore Plastic Products, Baladna Food Industries (In-house Blister & Unit-dose Packaging), Qatar Pharma (Qatar Pharmaceutical Industries Co.), Qatar National Import & Export Co. (QNIE – Packaging Distribution), Gulf Plastic Industries Qatar contribute to innovation, geographic expansion, and service delivery in this space, mainly by supplying thermoformed plastic packaging, pharmaceutical primary packaging, and food packaging solutions.

The future of the blister packaging market in Qatar appears promising, driven by the increasing focus on sustainability and technological innovation. As the healthcare sector expands, the demand for efficient and safe packaging solutions will continue to rise. Additionally, the integration of smart technologies in packaging is expected to enhance consumer engagement and product traceability. Companies that adapt to these trends will likely gain a competitive edge, positioning themselves favorably in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermoformed Blister Packs Cold Form Foil Blister Packs Carded Blister Packs Clamshell Blister Packs Other Blister Formats (Trapped, Face-Seal, etc.) |

| By End-User | Pharmaceutical & Biopharmaceutical Medical Devices & Hospital Supplies Food, Confectionery & Nutraceuticals Consumer Goods & Electronics Personal Care & Cosmetics Other Industrial & Retail End-Users |

| By Material | Plastic Films (PVC, PVDC, PET, PP) Aluminum Foil Paper & Paperboard Lidding Bio-based & Recyclable Plastics Other Laminates & Barrier Materials |

| By Application | Blister Packs for Solid Oral Dosage (Tablets) Blister Packs for Capsules & Softgels Blister Packs for Medical Devices & Diagnostics Blister Packs for Food, Confectionery & Nutraceuticals Blister Packs for Consumer Goods & Electronics Other Specialty & Unit-Dose Applications |

| By Distribution Channel | Direct Sales to Pharma & Medical Manufacturers Sales via Converters, Distributors & Traders Exports to GCC & Wider MENA Online & Tender-Based Procurement Platforms Other Channels |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Al Khor & Other Municipalities |

| By Policy Support | Government Subsidies for Industrial Projects Tax Incentives under Qatar National Vision 2030 Regulatory Support for Pharma & Medical Manufacturing Sustainability & Recycling Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Blister Packaging | 100 | Quality Assurance Managers, Production Supervisors |

| Food and Beverage Packaging | 80 | Product Managers, Supply Chain Coordinators |

| Consumer Goods Packaging | 70 | Marketing Directors, Packaging Engineers |

| Regulatory Compliance in Packaging | 60 | Compliance Officers, Regulatory Affairs Managers |

| Sustainability Initiatives in Packaging | 90 | Sustainability Managers, R&D Directors |

The Qatar Blister Packaging Market is valued at approximately USD 140 million, representing a significant segment of the broader national printing and packaging market, which is estimated at around USD 440 million.