Region:Middle East

Author(s):Dev

Product Code:KRAC1367

Pages:99

Published On:October 2025

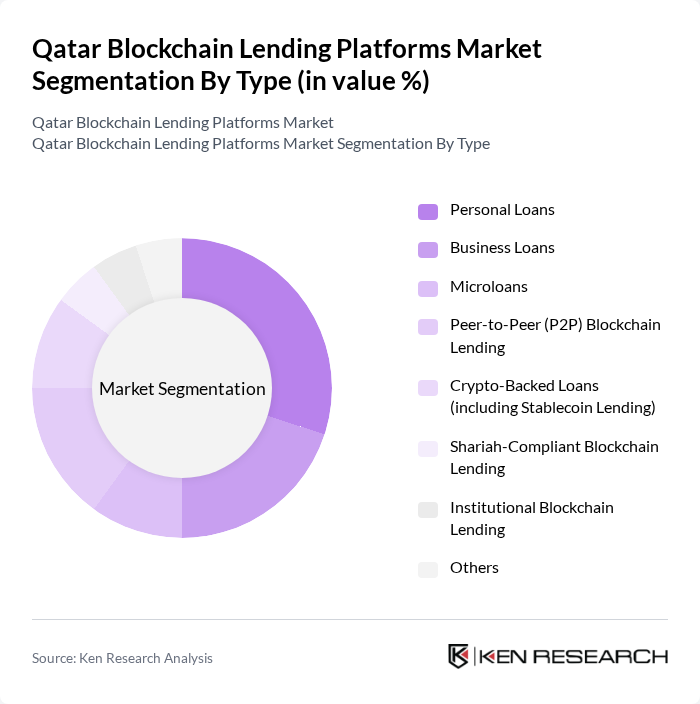

By Type:The market is segmented into various types of blockchain lending solutions, including Personal Loans, Business Loans, Microloans, Peer-to-Peer (P2P) Blockchain Lending, Crypto-Backed Loans (including Stablecoin Lending), Shariah-Compliant Blockchain Lending, Institutional Blockchain Lending, and Others. Among these, Personal Loans and P2P Blockchain Lending are particularly prominent due to their accessibility and appeal to individual borrowers and small investors. The increasing trend of digital finance, the rise of Shariah-compliant fintech, and the demand for fast, hassle-free loans have made these segments highly sought after .

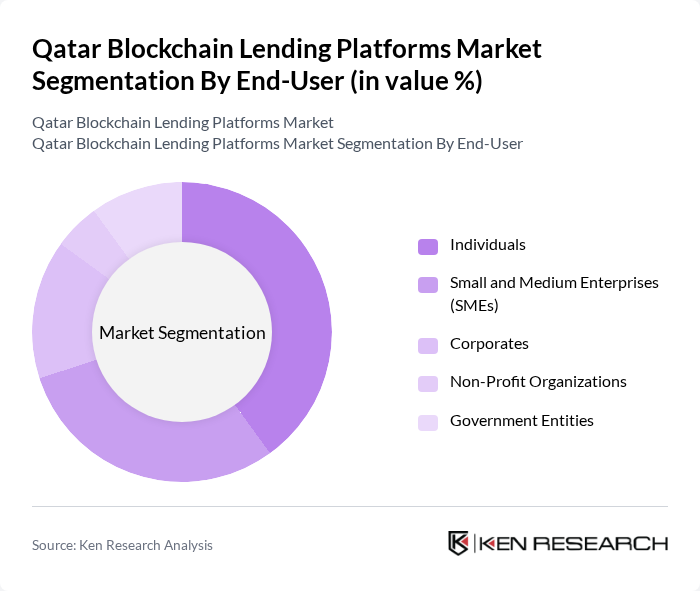

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Corporates, Non-Profit Organizations, and Government Entities. Individuals and SMEs are the leading segments, driven by the growing need for accessible financing options and the proliferation of digital lending platforms. The increasing digitalization of financial services and the introduction of Shariah-compliant and blockchain-based lending solutions have further expanded access for these groups .

The Qatar Blockchain Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as QNB Group, Qatar Islamic Bank, Doha Bank, Masraf Al Rayan, Qatar National Bank Alahli, Al Khaliji Commercial Bank, Commercial Bank of Qatar, Barwa Bank, Qatar Development Bank, Dlala Brokerage and Investment Holding Company, Fintech Galaxy, Beehive, Kiva, BitOasis, Rain Financial, CoinMENA, 7sab, PinPay, Fawry for Banking Technology and Electronic Payments, Tamweelcom contribute to innovation, geographic expansion, and service delivery in this space.

The future of blockchain lending platforms in Qatar appears promising, driven by increasing digital asset adoption and government initiatives aimed at fostering innovation. As more users become aware of the benefits of decentralized finance, the market is likely to see a surge in participation. Additionally, advancements in technology, such as the integration of artificial intelligence for risk assessment, will enhance the efficiency and security of lending processes, further attracting users and investors to this evolving sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Microloans Peer-to-Peer (P2P) Blockchain Lending Crypto-Backed Loans (including Stablecoin Lending) Shariah-Compliant Blockchain Lending Institutional Blockchain Lending Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Non-Profit Organizations Government Entities |

| By Loan Amount | Small Loans (Up to $10,000) Medium Loans ($10,001 - $100,000) Large Loans (Above $100,000) |

| By Interest Rate Type | Fixed Interest Rates Variable Interest Rates Profit-Sharing/Islamic Finance Models |

| By Loan Duration | Short-Term Loans (Up to 1 Year) Medium-Term Loans (1-5 Years) Long-Term Loans (Above 5 Years) |

| By Geographic Focus | Urban Areas Rural Areas |

| By Customer Segment | Retail Customers Institutional Customers High Net-Worth Individuals Unbanked/Underbanked Populations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Blockchain Lending Platforms | 60 | CEOs, CTOs, and Product Managers |

| Financial Institutions Adopting Blockchain | 50 | Risk Managers, Compliance Officers |

| End-users of Blockchain Lending Services | 120 | Small Business Owners, Individual Borrowers |

| Regulatory Bodies and Policy Makers | 40 | Regulators, Financial Analysts |

| Blockchain Technology Experts | 45 | Consultants, Academics, and Researchers |

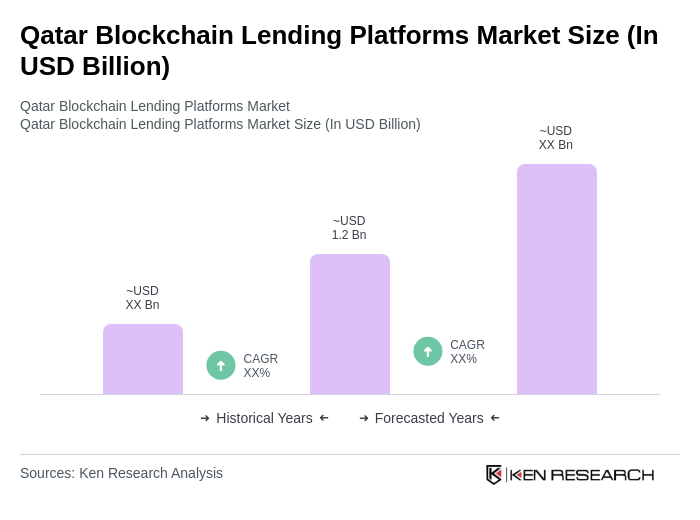

The Qatar Blockchain Lending Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital lending and blockchain technologies, as well as the demand for decentralized and Shariah-compliant lending solutions.