Region:Middle East

Author(s):Dev

Product Code:KRAC1327

Pages:81

Published On:October 2025

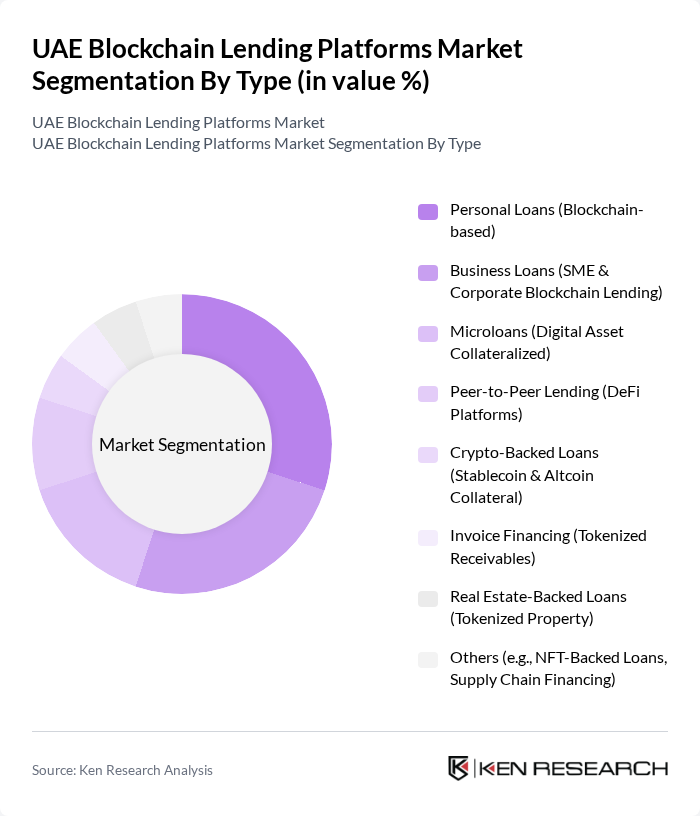

By Type:The market is segmented into various types of blockchain lending platforms, including personal loans, business loans, microloans, peer-to-peer lending, crypto-backed loans, invoice financing, real estate-backed loans, and others. Among these, personal loans and business loans remain the most prominent segments, driven by the increasing need for accessible financing options for individuals and SMEs. The rise of decentralized finance (DeFi) has also contributed to the popularity of peer-to-peer lending platforms, with protocols like Aave holding a significant share of DeFi lending activity.

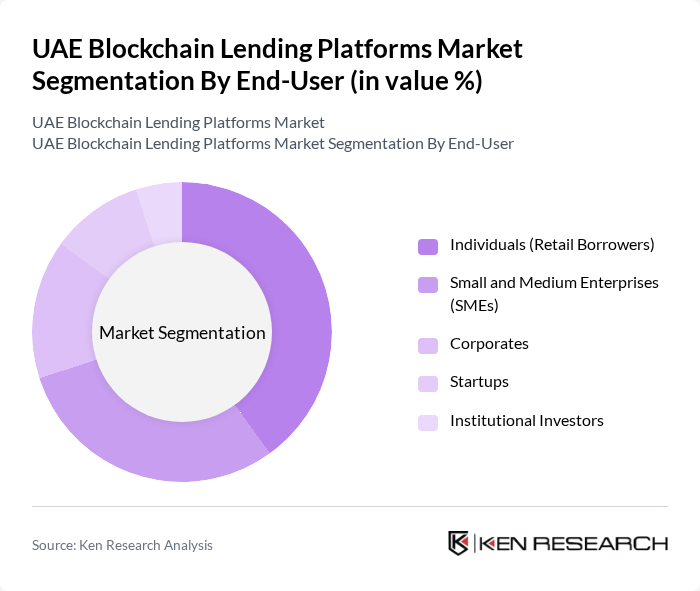

By End-User:The end-user segmentation includes individuals, small and medium enterprises (SMEs), corporates, startups, and institutional investors. Individuals and SMEs are the primary users of blockchain lending platforms, as they seek flexible financing solutions that traditional banks may not provide. The increasing digital literacy, widespread adoption of digital assets, and acceptance of blockchain technology among these groups further drive the market growth.

The UAE Blockchain Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as BitOasis, Rain Financial, Matrix Exchange, SmartCrowd, YallaCompare, Nexo, YouHodler, Aave, Binance, Finterra, Celsius Network, BlockFi, Crypto.com, Emirates NBD, Abu Dhabi Commercial Bank, RAK Bank, Smartlands, DLT Financial contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE blockchain lending market appears promising, driven by technological advancements and increasing consumer acceptance. As the government continues to support blockchain initiatives, more financial institutions are likely to explore partnerships with blockchain platforms. Additionally, the integration of artificial intelligence for risk assessment will enhance lending processes, making them more efficient and secure. This evolving landscape will likely attract more users seeking innovative financial solutions, further solidifying the UAE's position as a leader in blockchain technology.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans (Blockchain-based) Business Loans (SME & Corporate Blockchain Lending) Microloans (Digital Asset Collateralized) Peer-to-Peer Lending (DeFi Platforms) Crypto-Backed Loans (Stablecoin & Altcoin Collateral) Invoice Financing (Tokenized Receivables) Real Estate-Backed Loans (Tokenized Property) Others (e.g., NFT-Backed Loans, Supply Chain Financing) |

| By End-User | Individuals (Retail Borrowers) Small and Medium Enterprises (SMEs) Corporates Startups Institutional Investors |

| By Loan Amount | Under AED 10,000 AED 10,000 - AED 50,000 AED 50,000 - AED 100,000 Over AED 100,000 |

| By Interest Rate Type | Fixed Rate Variable Rate Dynamic/Algorithmic Rate (Smart Contract Based) |

| By Loan Duration | Short-Term Loans (?12 months) Medium-Term Loans (1-3 years) Long-Term Loans (>3 years) |

| By Geographic Focus | Urban Areas Rural Areas Free Zones (DIFC, ADGM, DMCC) |

| By Customer Segment | Retail Customers Institutional Customers High Net-Worth Individuals Government Entities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Blockchain Lending Platforms | 40 | CEOs, Founders, and CTOs of blockchain startups |

| Financial Institutions Adopting Blockchain | 40 | Innovation Managers, Digital Transformation Leads |

| Regulatory Bodies and Compliance Experts | 40 | Regulatory Affairs Officers, Compliance Managers |

| End-users of Blockchain Lending Services | 100 | Small Business Owners, Individual Borrowers |

| Blockchain Technology Consultants | 40 | Consultants, Analysts specializing in fintech and blockchain |

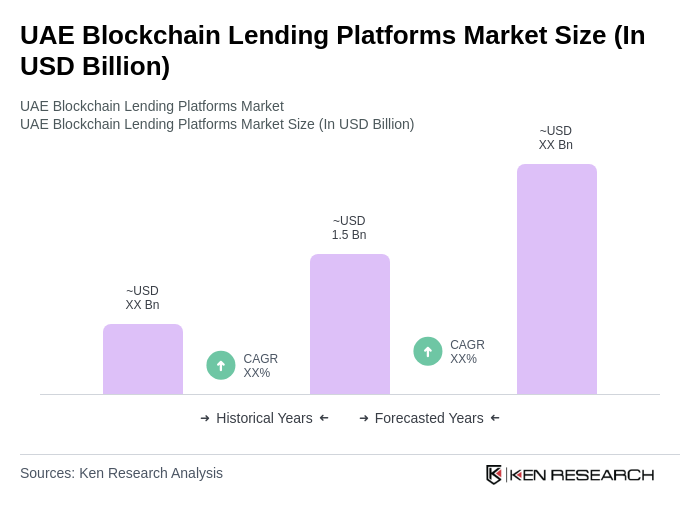

The UAE Blockchain Lending Platforms Market is valued at approximately USD 1.5 billion, driven by the increasing adoption of blockchain technology in financial services and the demand for decentralized finance (DeFi) solutions.