Region:Middle East

Author(s):Dev

Product Code:KRAC1259

Pages:86

Published On:October 2025

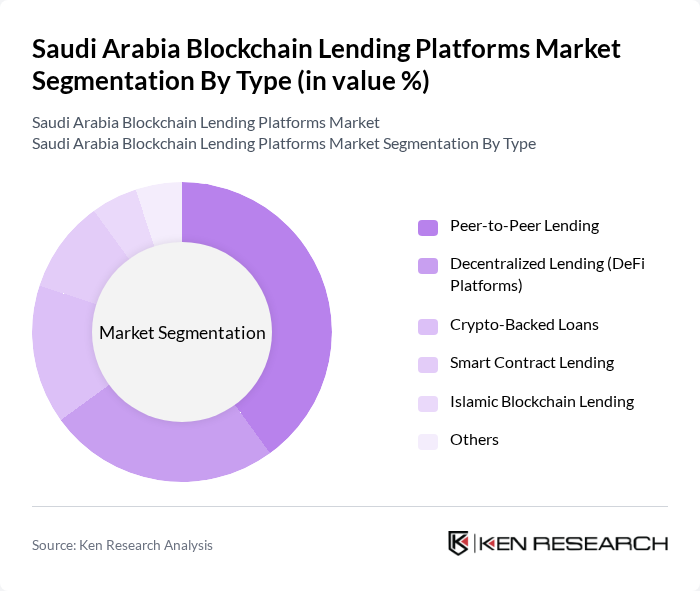

By Type:The market is segmented into various types of blockchain lending platforms, including Peer-to-Peer Lending, Decentralized Lending (DeFi Platforms), Crypto-Backed Loans, Smart Contract Lending, Islamic Blockchain Lending, and Others. Among these, Peer-to-Peer Lending has emerged as a dominant segment due to its ability to connect borrowers directly with lenders, reducing costs and increasing efficiency. The growing acceptance of decentralized finance (DeFi) platforms is also notable, as they offer innovative solutions that cater to a tech-savvy audience seeking alternative financing options. The rise of smart contract lending and crypto-backed loans reflects the broader trend of digital asset adoption and automation in financial services .

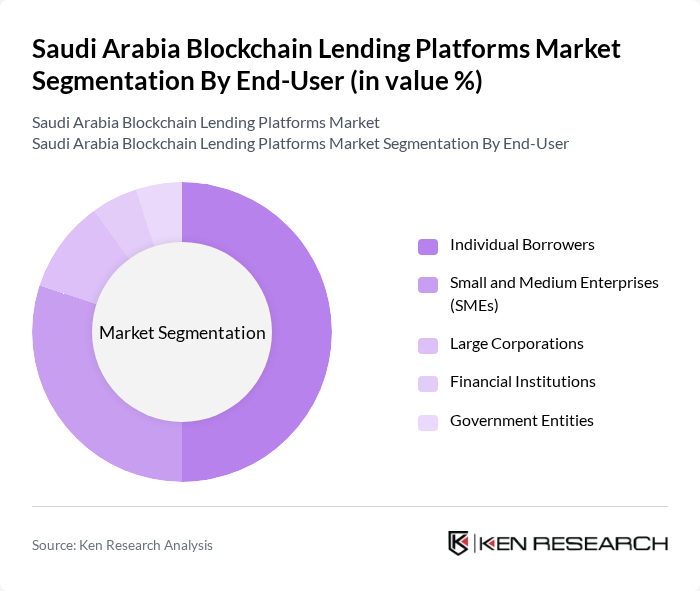

By End-User:The end-user segmentation includes Individual Borrowers, Small and Medium Enterprises (SMEs), Large Corporations, Financial Institutions, and Government Entities. Individual Borrowers represent the largest segment, driven by the increasing need for personal loans and the convenience offered by blockchain platforms. SMEs are also significant users, as they seek flexible financing options to support their growth and operational needs. The trend towards digitalization among businesses further fuels the demand for blockchain lending solutions. Financial institutions and government entities are increasingly leveraging blockchain for secure, transparent, and efficient lending processes .

The Saudi Arabia Blockchain Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rain Financial, BitOasis, Lean Technologies, Raqamyah Platform, Tamam, STC Pay, Alinma Bank, Al Rajhi Bank, SABB, Bank Aljazira, Saudi Investment Bank, Emkan Finance, Halalah, Tamweelcom, HyperPay contribute to innovation, geographic expansion, and service delivery in this space.

The future of blockchain lending platforms in Saudi Arabia appears promising, driven by technological advancements and increasing consumer interest. As the government continues to support blockchain initiatives, the market is likely to see enhanced regulatory clarity, fostering innovation. Additionally, the integration of artificial intelligence in lending processes is expected to streamline operations and improve user experiences. With a focus on mobile solutions and sustainable lending practices, the sector is poised for significant growth in the coming years, attracting both local and international players.

| Segment | Sub-Segments |

|---|---|

| By Type | Peer-to-Peer Lending Decentralized Lending (DeFi Platforms) Crypto-Backed Loans Smart Contract Lending Islamic Blockchain Lending Others |

| By End-User | Individual Borrowers Small and Medium Enterprises (SMEs) Large Corporations Financial Institutions Government Entities |

| By Application | Personal Loans Business Loans Educational Loans Real Estate Loans Supply Chain Financing |

| By Investment Source | Institutional Investors Retail Investors Crowdfunding Platforms Venture Capital Funds Others |

| By Risk Assessment Methodology | Credit Scoring Models Blockchain-Based Identity Verification Historical Data Analysis AI-Driven Risk Assessment Others |

| By User Demographics | Age Groups Income Levels Geographic Distribution Digital Literacy Level |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Blockchain Lending Platforms | 60 | CEOs, Founders, and CTOs of blockchain lending companies |

| Financial Institutions | 50 | Risk Managers, Investment Analysts, and Compliance Officers |

| Regulatory Bodies | 40 | Policy Makers, Financial Regulators, and Legal Advisors |

| End Users of Lending Platforms | 100 | Small Business Owners, Individual Borrowers, and Financial Advisors |

| Blockchain Technology Experts | 45 | Consultants, Researchers, and Academics in blockchain technology |

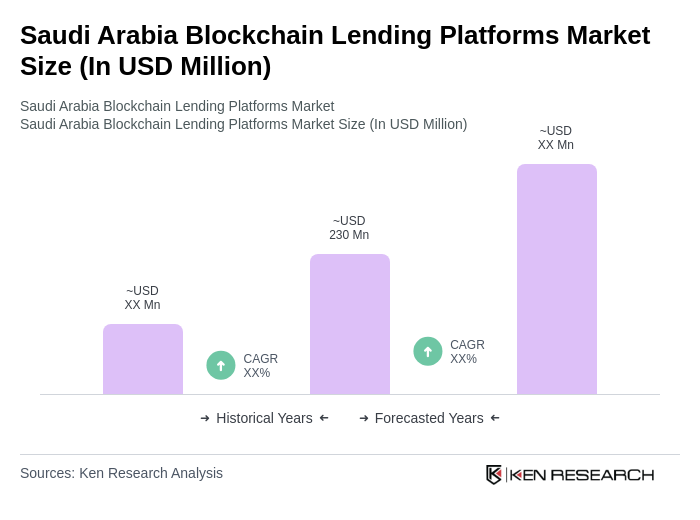

The Saudi Arabia Blockchain Lending Platforms Market is valued at approximately USD 230 million, reflecting significant growth driven by the adoption of blockchain technology in financial services and the demand for alternative lending solutions.