Region:Middle East

Author(s):Rebecca

Product Code:KRAD2802

Pages:91

Published On:November 2025

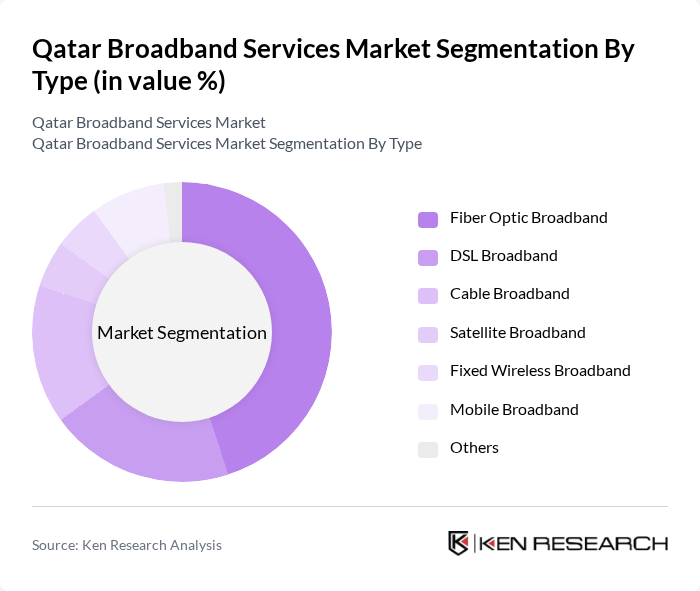

By Type:The market is segmented into various types of broadband services, including Fiber Optic Broadband, DSL Broadband, Cable Broadband, Satellite Broadband, Fixed Wireless Broadband, Mobile Broadband, and Others. Fiber Optic Broadband is the leading segment due to its high-speed capabilities and reliability, which are essential for both residential and commercial users. The increasing demand for data-intensive applications, cloud-based services, and streaming platforms has further solidified its position in the market .

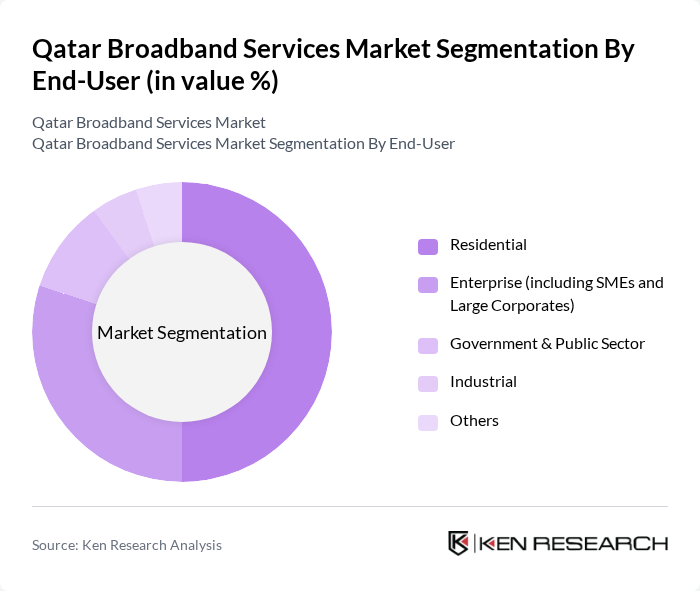

By End-User:The end-user segmentation includes Residential, Enterprise (including SMEs and Large Corporates), Government & Public Sector, Industrial, and Others. The Residential segment dominates the market, driven by the increasing number of households requiring reliable internet access for work, education, and entertainment. The shift towards smart homes, IoT devices, and remote learning has also contributed to the growing demand for broadband services in this segment .

The Qatar Broadband Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ooredoo Qatar Q.P.S.C., Vodafone Qatar P.Q.S.C., Qatar National Broadband Network (Qnbn), Gulf Bridge International (GBI), MEEZA QSTP LLC, Qatar Data Center, Es’hailSat – Qatar Satellite Company, Starlink (SpaceX Qatar), Qatar Fiber Optic Cable Company, Qatar Internet Exchange (QIX), Huawei Technologies Qatar, Nokia Solutions and Networks Qatar, Ericsson Qatar, Microsoft Qatar, Google Cloud Qatar contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Qatar broadband services market appears promising, driven by ongoing government initiatives and technological advancements. In future, the expansion of 5G networks is expected to enhance connectivity and support the growing demand for high-speed internet. Additionally, the integration of artificial intelligence in service delivery will likely improve customer experiences and operational efficiencies. As the market evolves, providers will need to adapt to changing consumer preferences and technological trends to remain competitive and capitalize on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Fiber Optic Broadband DSL Broadband Cable Broadband Satellite Broadband Fixed Wireless Broadband Mobile Broadband Others |

| By End-User | Residential Enterprise (including SMEs and Large Corporates) Government & Public Sector Industrial Others |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Lusail Al Khor Dukhan Others |

| By Technology | Fiber to the Home (FTTH) Fiber to the Node (FTTN) Hybrid Fiber-Coaxial (HFC) LTE/5G Technology Satellite Internet (e.g., Starlink) Others |

| By Application | Residential Connectivity Business Connectivity Smart Home Applications Cloud Services IoT & M2M Solutions OTT & Streaming Services Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Broadband Users | 100 | Homeowners, Renters |

| Small and Medium Enterprises (SMEs) | 60 | Business Owners, IT Managers |

| Large Corporations | 40 | Corporate IT Directors, Network Administrators |

| Government Agencies | 40 | Public Sector IT Managers, Procurement Officers |

| Telecommunications Service Providers | 40 | Product Managers, Marketing Directors |

The Qatar Broadband Services Market is valued at approximately USD 2.1 billion, reflecting significant growth driven by high-speed internet demand, digital consumption, and government investments in infrastructure, including fiber and 5G networks.