Region:Middle East

Author(s):Shubham

Product Code:KRAD3675

Pages:88

Published On:November 2025

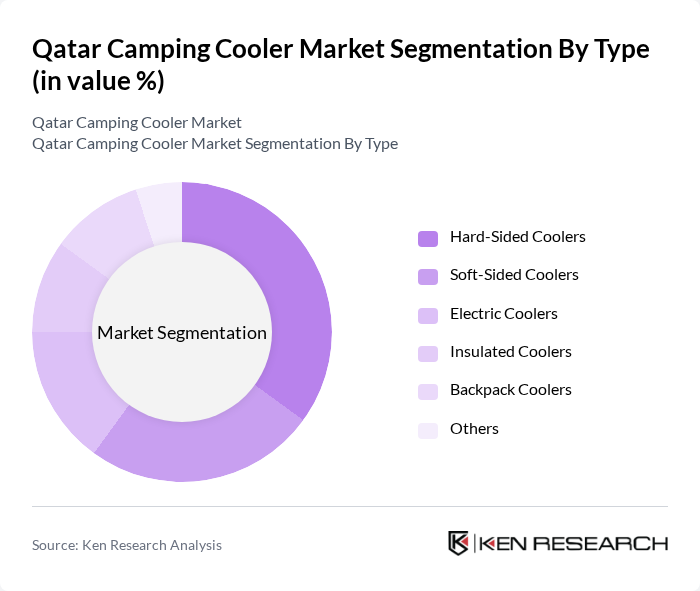

By Type:The camping cooler market can be segmented into Hard-Sided Coolers, Soft-Sided Coolers, Electric Coolers, Insulated Coolers, Backpack Coolers, and Others. Each type serves different consumer needs. Hard-sided coolers are favored for their durability and insulation properties, making them suitable for extended outdoor trips and group activities. Soft-sided coolers are preferred for their lightweight design and portability, ideal for day trips and urban outings. Electric coolers are gaining traction due to their convenience and ability to maintain precise temperatures, especially for longer journeys. Insulated and backpack coolers cater to niche needs, such as hiking and minimalist travel, where weight and mobility are prioritized .

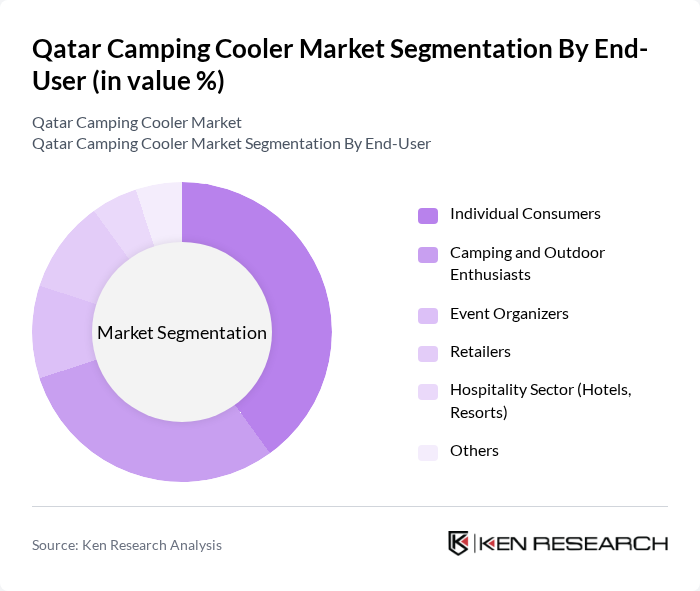

By End-User:The end-user segmentation includes Individual Consumers, Camping and Outdoor Enthusiasts, Event Organizers, Retailers, Hospitality Sector (Hotels, Resorts), and Others. Individual consumers and outdoor enthusiasts represent the largest segments, driven by the growing trend of outdoor activities, family outings, and the increasing influence of social media on lifestyle choices. The hospitality sector is also a significant contributor, as hotels and resorts seek to provide enhanced outdoor experiences for their guests by offering premium and sustainable cooler options .

The Qatar Camping Cooler Market is characterized by a dynamic mix of regional and international players. Leading participants such as Igloo Products Corp., Coleman Company, Inc., YETI Holdings, Inc., Pelican Products, Inc., Arctic Zone (California Innovations Inc.), Rubbermaid Commercial Products LLC, Engel Coolers, Camp Chef, Cabela's (Bass Pro Shops), RTIC Outdoors LLC, Lifetime Products, Inc., Scepter Canada Inc., Dometic Group AB, K2 Coolers, Safari Outdoor (Qatar), and Al Fardan Trading (Qatar) contribute to innovation, geographic expansion, and service delivery in this space. These companies are recognized for their focus on product durability, advanced insulation technology, and the introduction of eco-friendly materials, aligning with the latest consumer trends and regulatory requirements .

The Qatar camping cooler market is poised for significant growth, driven by increasing outdoor activities and a rising tourism sector. Innovations in cooler technology, such as smart features and eco-friendly materials, are expected to attract environmentally conscious consumers. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice and convenience. As the camping culture continues to evolve, brands that adapt to these trends will likely capture a larger market share.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard-Sided Coolers Soft-Sided Coolers Electric Coolers Insulated Coolers Backpack Coolers Others |

| By End-User | Individual Consumers Camping and Outdoor Enthusiasts Event Organizers Retailers Hospitality Sector (Hotels, Resorts) Others |

| By Distribution Channel | Online Retail Offline Retail (Specialty Stores, Hypermarkets) Direct Sales Wholesale/Distributors Others |

| By Price Range | Budget Coolers Mid-Range Coolers Premium Coolers Luxury Coolers Others |

| By Material | Plastic Coolers Metal Coolers Fabric/Flexible Coolers Composite Coolers Others |

| By Size (Capacity) | Small (<25 Quart) Medium (25–50 Quart) Large (50–75 Quart) Extra Large (>75 Quart) Others |

| By Brand | Local Brands (e.g., Safari Outdoor, Al Fardan Trading) International Brands (e.g., YETI, Coleman, Igloo, Dometic) Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Camping Coolers | 100 | Store Managers, Sales Representatives |

| Consumer Preferences for Outdoor Gear | 120 | Outdoor Enthusiasts, Camping Participants |

| Distribution Channel Insights | 80 | Logistics Managers, Supply Chain Coordinators |

| Market Trends in Camping Equipment | 70 | Industry Analysts, Market Researchers |

| Impact of Tourism on Camping Gear Sales | 60 | Tourism Operators, Event Coordinators |

The Qatar Camping Cooler Market is valued at approximately USD 15 million, reflecting the growing demand for portable cooling solutions driven by increased outdoor activities and leisure travel, particularly during the hot summer months.