Region:Middle East

Author(s):Dev

Product Code:KRAC4157

Pages:82

Published On:October 2025

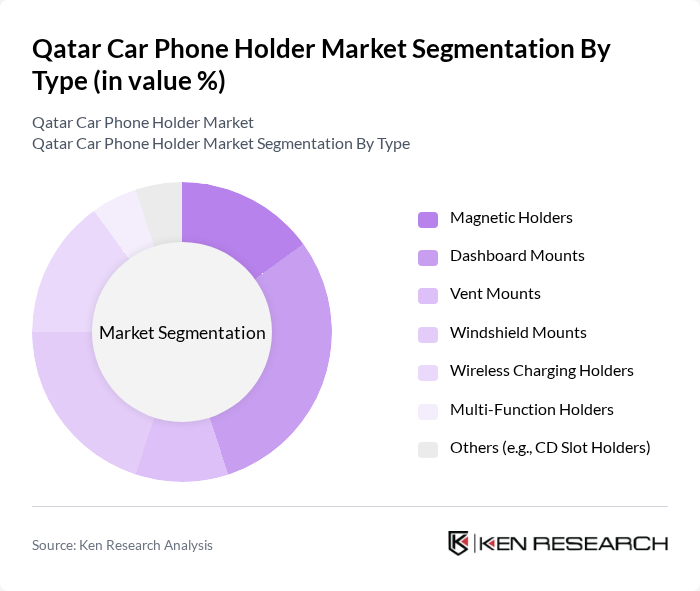

By Type:The market is segmented into various types of car phone holders, including Magnetic Holders, Dashboard Mounts, Vent Mounts, Windshield Mounts, Wireless Charging Holders, Multi-Function Holders, and Others (e.g., CD Slot Holders). Among these, Dashboard Mounts are particularly popular due to their ease of use and stability, making them a preferred choice for consumers. The trend towards multifunctionality has also led to a rise in demand for Wireless Charging Holders, which combine convenience with technology.

By End-User:The end-user segmentation includes Individual Consumers, Fleet Operators, Ride-Sharing Services, and Corporate Users. Individual Consumers dominate the market, driven by the increasing number of smartphone users and the need for safe driving solutions. Fleet Operators and Ride-Sharing Services are also significant contributors, as they prioritize safety and efficiency in their operations, leading to a growing demand for reliable car phone holders.

The Qatar Car Phone Holder Market is characterized by a dynamic mix of regional and international players. Leading participants such as Belkin International, Inc., Kenu, Inc., iOttie, Inc., Scosche Industries, Inc., Spigen Inc., Anker Innovations Limited, Mpow Technology, Inc., Aukey Technology Limited, RAM Mounts, TechMatte, LLC, Baseus Technology Group, Ugreen Group Limited, VAVA, ZAGG Inc., Targus Group International, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar car phone holder market appears promising, driven by technological advancements and evolving consumer preferences. As the automotive industry embraces electric vehicles, the integration of smart technology in car accessories is expected to rise. Additionally, the increasing focus on sustainability will likely lead to a demand for eco-friendly materials in product design. These trends indicate a shift towards innovative, user-centric solutions that enhance the driving experience while adhering to safety regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Magnetic Holders Dashboard Mounts Vent Mounts Windshield Mounts Wireless Charging Holders Multi-Function Holders Others (e.g., CD Slot Holders) |

| By End-User | Individual Consumers Fleet Operators Ride-Sharing Services Corporate Users |

| By Sales Channel | Online Retail Offline Retail Direct Sales Distributors |

| By Price Range | Budget Holders (QAR 10 - QAR 50) Mid-Range Holders (QAR 50 - QAR 150) Premium Holders (QAR 150+) |

| By Material | Plastic Holders Metal Holders Silicone Holders |

| By Brand Preference | Local Brands International Brands Private Labels |

| By Usage Scenario | Daily Commuting Long-Distance Travel Off-Roading Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Car Phone Holders | 100 | Store Managers, Sales Representatives |

| Consumer Preferences and Buying Behavior | 120 | Car Owners, Smartphone Users |

| Market Trends and Innovations | 60 | Product Managers, Industry Analysts |

| Distribution Channels Analysis | 50 | Logistics Managers, Supply Chain Coordinators |

| Impact of Technology on Car Accessories | 40 | Tech Enthusiasts, Automotive Engineers |

The Qatar Car Phone Holder Market is valued at approximately USD 28 million, reflecting a growing demand driven by increased smartphone usage and the need for hands-free solutions among drivers, particularly in urban areas like Doha and Al Rayyan.