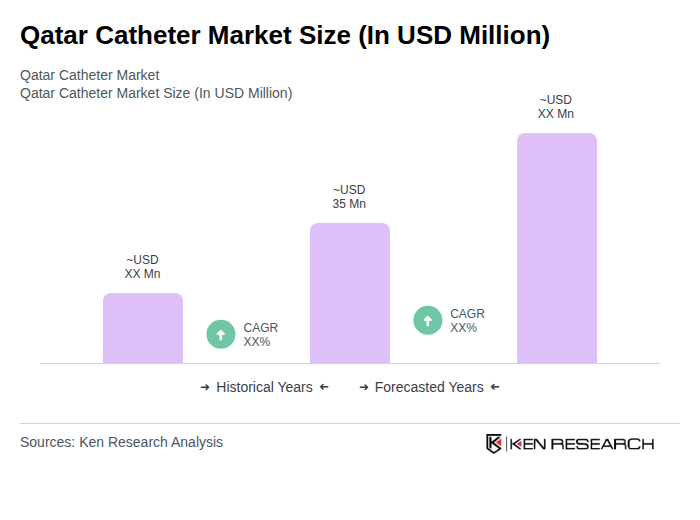

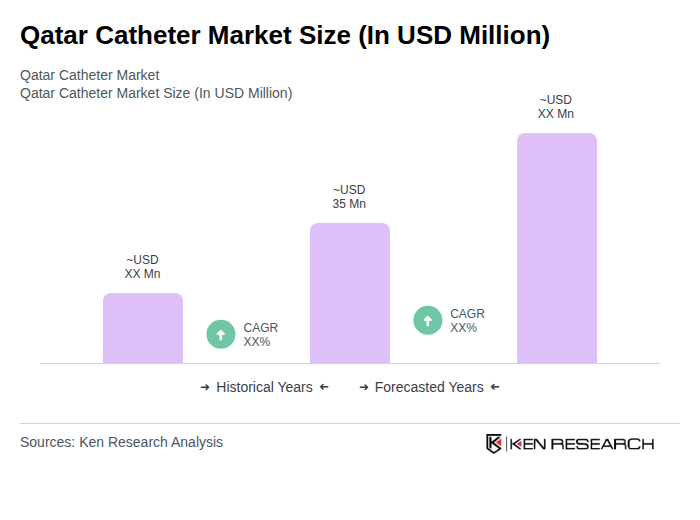

Qatar Catheter Market Overview

- The Qatar Catheter Market is valued at USD 35 million, based on a five-year historical analysis and triangulation from GCC and Qatar midline catheter segment data. This growth is primarily driven by the increasing prevalence of chronic diseases such as cardiovascular disease, diabetes, and kidney disease in the GCC region, the growing adoption of minimally invasive and catheter-based procedures, advancements in catheter materials (including antimicrobial and hydrophilic coatings), and a growing aging population requiring medical interventions. The demand for various types of catheters, including urinary, cardiovascular, thermodilution, and midline catheters, has surged due to the rising number of surgical procedures, intensive care admissions, and expanded hospital capacity across Qatar and the wider GCC.

- Doha is the dominant city in the Qatar Catheter Market, primarily due to its advanced healthcare infrastructure and concentration of leading hospitals and medical facilities such as Hamad Medical Corporation (HMC) tertiary hospitals, Sidra Medicine, and major private hospitals. The presence of specialized healthcare providers, high procedure volumes, and a growing number of government-led healthcare initiatives and public–private partnerships contribute to the market's expansion in this region. Additionally, Al Rayyan and Al Wakrah are also significant contributors, benefiting from their proximity to Doha, ongoing healthcare investments, and the presence of large facilities such as Al Wakra Hospital and new community hospitals serving rapidly growing populations.

- In 2023, the Qatari government reinforced medical device safety requirements through the Medical Devices and Supplies Registration and Pricing Guidelines issued by the Ministry of Public Health (MOPH), which operate under the framework of Law No. 16 of 2016 on the Regulation of Medical Products, Pricing, and General Supervision of its Circulation. These instruments require importers and manufacturers of catheters and other invasive devices to register products with MOPH, demonstrate conformity to international standards such as ISO 10993 for biocompatibility, and provide evidence of safety and performance, thereby enhancing patient safety and reducing the risk of infections associated with catheter use. Manufacturers and local agents must comply with these requirements, including quality management documentation and post-market surveillance obligations, to ensure that their products meet the necessary health and safety standards and remain eligible for procurement by public providers such as HMC and PHCC.

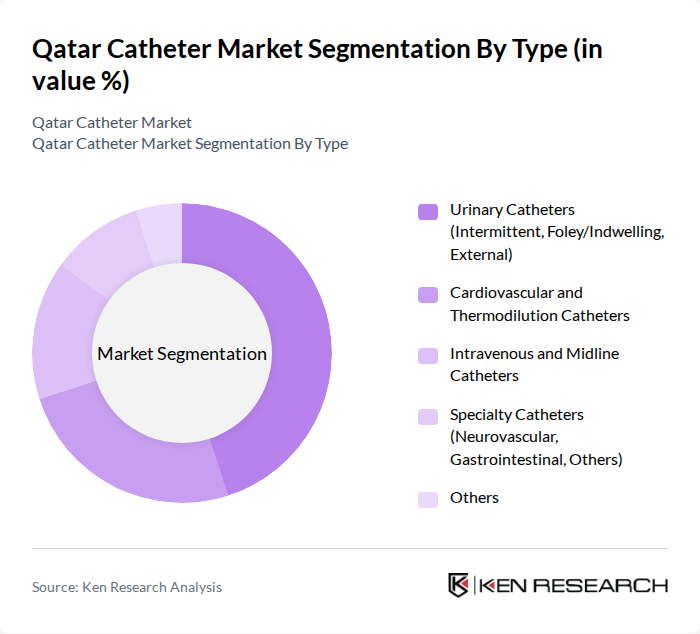

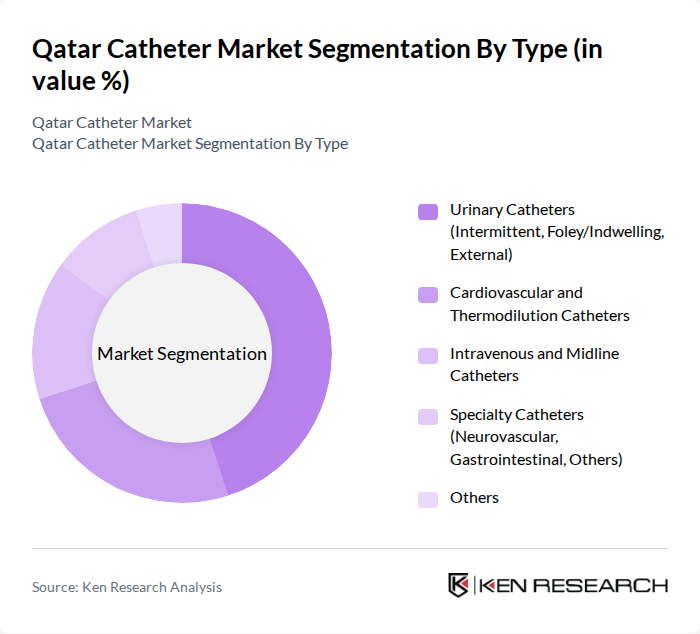

Qatar Catheter Market Segmentation

By Type:The catheter market can be segmented into various types, including urinary catheters, cardiovascular and thermodilution catheters, intravenous and midline catheters, specialty catheters, and others. Among these, urinary catheters, particularly Foley and intermittent types, dominate utilization in acute care and long-term care settings due to their widespread use for urinary retention, peri-operative management, and incontinence. The increasing incidence of urinary incontinence, post-operative urinary dysfunction, and long-term catheterization needs in elderly and chronically ill patients are key factors driving this segment's growth, alongside infection-control focused designs such as coated and closed-system catheters.

By End-User:The end-user segmentation includes hospitals (public and private), ambulatory surgical centers, specialty clinics, home healthcare providers, and others, which aligns with observed patterns in the Qatar midline catheters segment. Hospitals are the leading end-user segment, driven by the high volume of inpatient and day-surgery procedures, intensive care admissions, and the need for catheterization in emergency, oncology, nephrology, cardiology, and critical care settings. The increasing number of healthcare facilities, expansion of specialized centers, and promotion of home infusion and decentralized care models in Qatar further support demand from ambulatory surgical centers and home healthcare providers.

Qatar Catheter Market Competitive Landscape

The Qatar Catheter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boston Scientific Corporation, Medtronic plc, B. Braun Melsungen AG, Becton, Dickinson and Company (BD), Teleflex Incorporated, Smiths Medical (ICU Medical, Inc.), Cardinal Health, Inc., Terumo Corporation, ConvaTec Group PLC, Coloplast A/S, Hollister Incorporated, Fresenius Kabi AG, AngioDynamics, Inc., Merit Medical Systems, Inc., Vygon S.A. contribute to innovation, geographic expansion, and service delivery in this space, and are also cited as key suppliers in Qatar’s midline catheter segment.

Qatar Catheter Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases:The rise in chronic diseases such as diabetes and cardiovascular conditions is a significant growth driver for the Qatar catheter market. In future, approximately 1.8 million people in Qatar are projected to be living with diabetes, representing a 25% increase from 2020. This growing patient population necessitates the use of catheters for various medical procedures, thereby driving demand. Furthermore, the healthcare system is adapting to these needs, enhancing catheter availability and usage across medical facilities.

- Advancements in Catheter Technology:Technological innovations in catheter design and materials are propelling market growth. In future, the introduction of smart catheters equipped with sensors is expected to enhance patient monitoring and reduce complications. The global investment in medical technology is projected to reach $600 billion, with a significant portion allocated to catheter development. These advancements not only improve patient outcomes but also increase the efficiency of healthcare delivery, making catheters more appealing to healthcare providers in Qatar.

- Rising Geriatric Population:Qatar's geriatric population is expected to reach 1.3 million by future, reflecting a 40% increase since 2020. This demographic shift is crucial as older adults often require catheterization for various medical conditions. The government’s focus on enhancing elderly care services, including specialized healthcare facilities, is likely to boost catheter usage. As the population ages, the demand for effective and reliable catheter solutions will continue to rise, further driving market growth.

Market Challenges

- High Cost of Advanced Catheters:The high cost associated with advanced catheter technologies poses a significant challenge in Qatar. Premium catheters can range from $150 to $600 each, making them less accessible for some healthcare facilities, particularly in the public sector. This financial barrier can limit the adoption of innovative catheter solutions, hindering overall market growth. As healthcare budgets tighten, the affordability of these products remains a critical concern for providers and patients alike.

- Stringent Regulatory Requirements:The regulatory landscape for medical devices in Qatar is complex and stringent, which can delay the introduction of new catheter technologies. Compliance with international safety standards, such as ISO 13485, is mandatory, requiring extensive documentation and testing. In future, the average time for regulatory approval is estimated to be around 14-20 months, which can stifle innovation and limit market entry for new products. This regulatory burden can deter investment in catheter development and commercialization.

Qatar Catheter Market Future Outlook

The Qatar catheter market is poised for significant growth driven by technological advancements and demographic shifts. As the healthcare infrastructure expands, particularly in response to the increasing prevalence of chronic diseases, the demand for innovative catheter solutions will rise. Additionally, the integration of smart technologies and a focus on patient-centric designs will enhance the effectiveness of catheterization. The market is expected to adapt to these trends, fostering a more robust healthcare environment that prioritizes patient outcomes and accessibility.

Market Opportunities

- Expansion of Healthcare Infrastructure:Qatar's investment in healthcare infrastructure is projected to exceed $15 billion in future. This expansion includes new hospitals and specialized clinics, creating a favorable environment for catheter adoption. Enhanced facilities will facilitate better access to advanced catheter technologies, ultimately improving patient care and outcomes.

- Growth in Telemedicine and Remote Monitoring:The rise of telemedicine in Qatar, with an estimated 40% of consultations expected to be remote in future, presents a unique opportunity for catheter manufacturers. Remote monitoring technologies can be integrated with catheters, allowing for real-time data collection and patient management, thereby enhancing the overall healthcare experience and driving demand for innovative catheter solutions.