Region:Middle East

Author(s):Geetanshi

Product Code:KRAB6802

Pages:89

Published On:October 2025

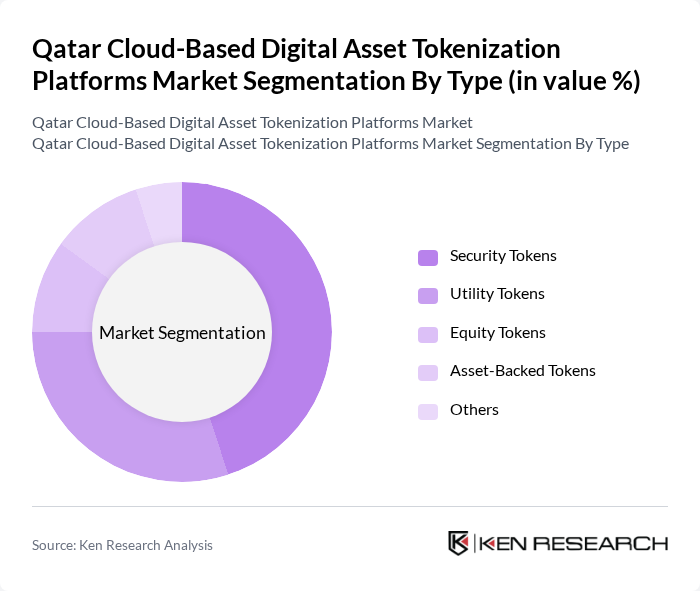

By Type:The market is segmented into various types of tokens, including Security Tokens, Utility Tokens, Equity Tokens, Asset-Backed Tokens, and Others. Among these, Security Tokens are leading the market due to their compliance with regulatory standards and their ability to represent ownership in real-world assets. Utility Tokens follow closely, driven by their application in decentralized applications and platforms.

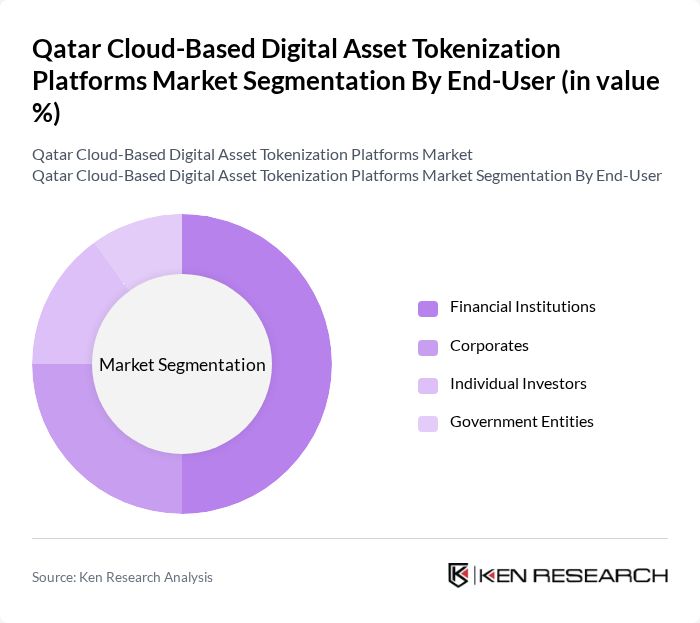

By End-User:The end-user segmentation includes Financial Institutions, Corporates, Individual Investors, and Government Entities. Financial Institutions dominate this segment as they leverage tokenization for asset management and trading, enhancing operational efficiency and compliance. Corporates are increasingly adopting tokenization for fundraising and liquidity management, while Individual Investors are drawn to the accessibility and potential returns offered by tokenized assets.

The Qatar Cloud-Based Digital Asset Tokenization Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Binance, Coinbase, BitOasis, Kraken, eToro, Huobi, Gemini, Bitstamp, Pionex, OKEx, KuCoin, Bittrex, Poloniex, Gate.io, WazirX contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar cloud-based digital asset tokenization market appears promising, driven by technological advancements and increasing institutional interest. As regulatory frameworks become clearer, more businesses are likely to adopt tokenization solutions. Additionally, the integration of artificial intelligence and machine learning into these platforms is expected to enhance security and user experience. The growing trend of decentralized finance (DeFi) will also play a pivotal role in shaping the market landscape, attracting diverse participants and fostering innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Security Tokens Utility Tokens Equity Tokens Asset-Backed Tokens Others |

| By End-User | Financial Institutions Corporates Individual Investors Government Entities |

| By Application | Real Estate Tokenization Art and Collectibles Supply Chain Management Digital Identity Verification |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Services |

| By Regulatory Compliance | Fully Compliant Platforms Partially Compliant Platforms Non-Compliant Platforms |

| By Investment Size | Small Investments Medium Investments Large Investments |

| By User Experience Level | Novice Users Intermediate Users Advanced Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Institutions Utilizing Tokenization | 100 | Chief Financial Officers, Blockchain Strategy Managers |

| Real Estate Tokenization Projects | 75 | Real Estate Developers, Investment Analysts |

| Art and Collectibles Tokenization | 50 | Art Curators, Collectors, Gallery Owners |

| Supply Chain Asset Tokenization | 80 | Supply Chain Managers, Logistics Coordinators |

| Regulatory Perspectives on Tokenization | 60 | Regulatory Affairs Specialists, Compliance Officers |

The Qatar Cloud-Based Digital Asset Tokenization Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of blockchain technology and increasing demand for digital assets.