Saudi Arabia Cloud-Based Digital Asset Tokenization Platforms Market Overview

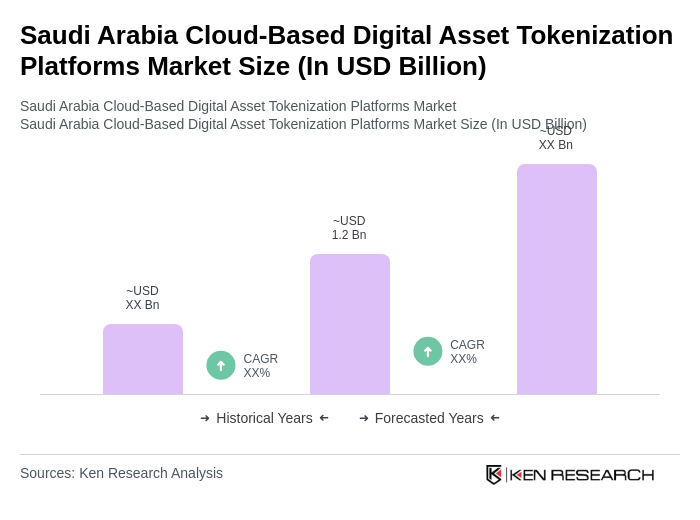

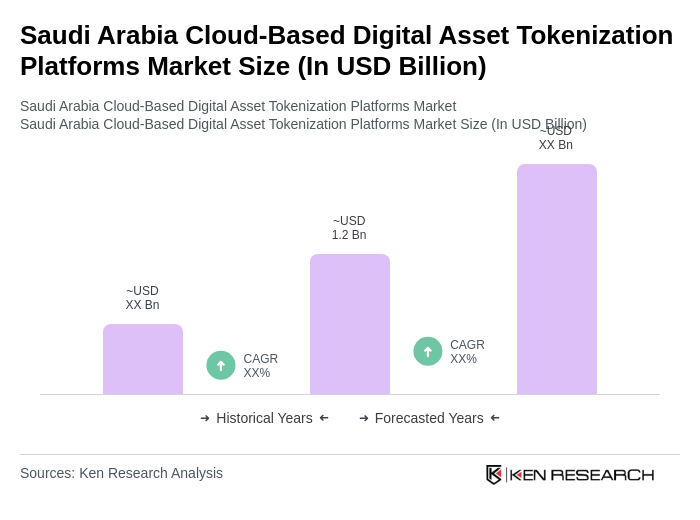

- The Saudi Arabia Cloud-Based Digital Asset Tokenization Platforms Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of blockchain technology, rising demand for digital assets, and the need for secure and efficient transaction methods. The market is also supported by the growing interest in cryptocurrencies and the digitization of traditional assets.

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their robust financial infrastructure, technological advancements, and government support for digital innovation. Riyadh, as the capital, serves as a hub for financial institutions and tech startups, while Jeddah and Dammam benefit from their strategic locations and access to international markets.

- In 2023, the Saudi Arabian government implemented regulations to promote the use of blockchain technology in financial services. This includes guidelines for digital asset tokenization, ensuring compliance with Sharia law, and fostering a secure environment for investors. The initiative aims to enhance transparency and trust in the digital asset ecosystem.

Saudi Arabia Cloud-Based Digital Asset Tokenization Platforms Market Segmentation

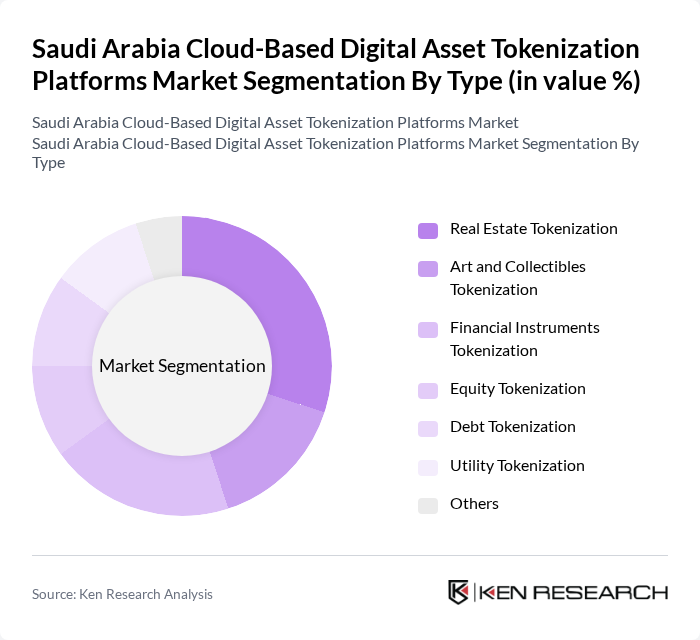

By Type:The market is segmented into various types of tokenization, including Real Estate Tokenization, Art and Collectibles Tokenization, Financial Instruments Tokenization, Equity Tokenization, Debt Tokenization, Utility Tokenization, and Others. Each of these subsegments caters to different asset classes and investor needs, contributing to the overall growth of the market.

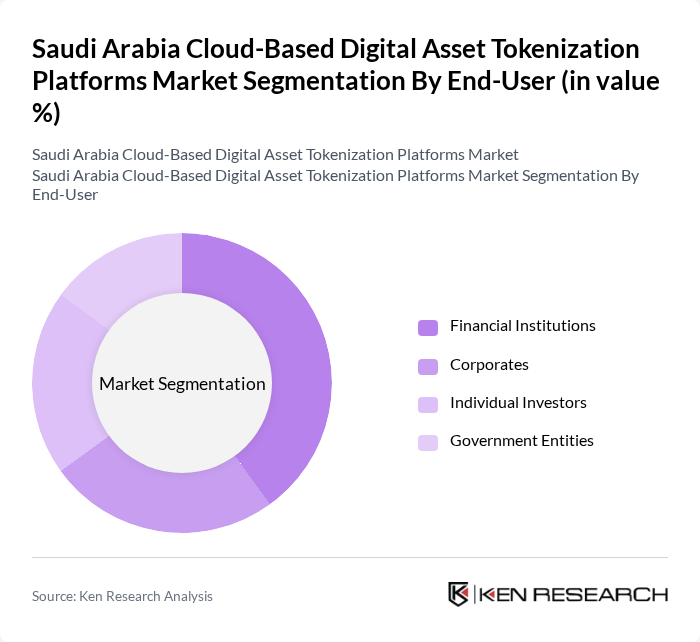

By End-User:The end-user segmentation includes Financial Institutions, Corporates, Individual Investors, and Government Entities. Each of these groups utilizes tokenization for various purposes, such as investment, fundraising, and compliance, thereby driving the market's expansion.

Saudi Arabia Cloud-Based Digital Asset Tokenization Platforms Market Competitive Landscape

The Saudi Arabia Cloud-Based Digital Asset Tokenization Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Binance, BitOasis, Rain Financial, SEDCO Capital, ArabianChain Technology, Tamkeen Technologies, Fasset, CoinMENA, Numbase, MenaPay, RAK Bank, Alinma Bank, STC Pay, Al Rajhi Bank, Saudi Investment Bank contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Cloud-Based Digital Asset Tokenization Platforms Market Industry Analysis

Growth Drivers

- Increasing Demand for Digital Asset Management:The digital asset management sector in Saudi Arabia is projected to reach $1.5 billion by 2024, driven by the growing need for efficient asset tracking and management solutions. This demand is fueled by the increasing number of businesses adopting digital assets, with over 60% of companies in the region planning to integrate digital asset management systems. The rise in e-commerce and digital transactions further supports this trend, highlighting the necessity for robust management platforms.

- Government Support for Blockchain Technology:The Saudi government has allocated approximately $500 million towards blockchain initiatives as part of its Vision 2030 plan. This investment aims to enhance the country's digital infrastructure and promote innovation in financial technologies. With over 70% of government agencies exploring blockchain applications, the supportive regulatory environment is expected to accelerate the adoption of cloud-based digital asset tokenization platforms, fostering a conducive ecosystem for growth.

- Rise in Investment in Fintech Solutions:In future, Saudi Arabia's fintech sector attracted $1.2 billion in investments, marking a 30% increase from the previous year. This surge is indicative of the growing interest in innovative financial solutions, including digital asset tokenization. The influx of venture capital and private equity into fintech startups is expected to drive technological advancements and enhance the capabilities of tokenization platforms, positioning them as essential tools for modern financial management.

Market Challenges

- Regulatory Uncertainties:The lack of clear regulations surrounding digital asset tokenization poses significant challenges for market participants. As of future, only 40% of fintech companies in Saudi Arabia report having a comprehensive understanding of the regulatory landscape. This uncertainty can hinder investment and innovation, as businesses may be reluctant to engage in tokenization without established guidelines, potentially stalling market growth and adoption.

- High Initial Setup Costs:The initial investment required to establish cloud-based digital asset tokenization platforms can exceed $1 million, which is a barrier for many startups and small enterprises. This high cost includes technology infrastructure, compliance measures, and skilled personnel. As a result, only 25% of potential market entrants are currently able to afford the necessary resources, limiting competition and innovation within the sector.

Saudi Arabia Cloud-Based Digital Asset Tokenization Platforms Market Future Outlook

The future of the Saudi Arabia cloud-based digital asset tokenization market appears promising, driven by increasing digitalization and government initiatives. By future, the market is expected to witness a significant uptick in adoption rates, particularly among SMEs seeking to leverage tokenization for asset management. Additionally, the integration of advanced technologies such as AI and machine learning will enhance platform capabilities, making them more attractive to users. As regulatory frameworks evolve, they will likely provide clearer guidelines, fostering a more secure environment for investment and innovation.

Market Opportunities

- Expansion of Digital Currencies:The increasing acceptance of digital currencies, with over 1.5 million users in Saudi Arabia by future, presents a significant opportunity for tokenization platforms. This growing user base can drive demand for services that facilitate the management and trading of digital assets, creating a robust market for innovative solutions.

- Partnerships with Financial Institutions:Collaborations between tokenization platforms and established financial institutions can enhance credibility and market reach. With 60% of banks in Saudi Arabia exploring blockchain partnerships, these alliances can lead to the development of integrated solutions that streamline asset management processes, benefiting both parties and expanding market access.