Region:Middle East

Author(s):Rebecca

Product Code:KRAD7422

Pages:90

Published On:December 2025

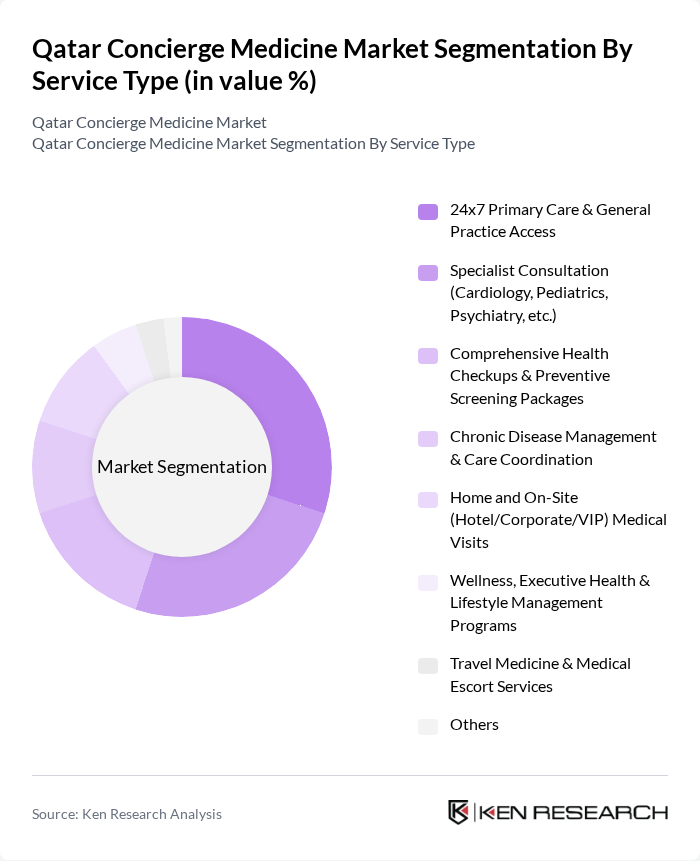

By Service Type:The service type segmentation includes various offerings that cater to the diverse needs of clients seeking concierge medical services. The subsegments include 24x7 Primary Care & General Practice Access, Specialist Consultation (Cardiology, Pediatrics, Psychiatry, etc.), Comprehensive Health Checkups & Preventive Screening Packages, Chronic Disease Management & Care Coordination, Home and On-Site (Hotel/Corporate/VIP) Medical Visits, Wellness, Executive Health & Lifestyle Management Programs, Travel Medicine & Medical Escort Services, and Others. Among these, the 24x7 Primary Care & General Practice Access is the leading subsegment, driven by the increasing demand for immediate and accessible healthcare services, longer appointment times, and continuity of care that are core value propositions of concierge medicine globally and in the Middle East.

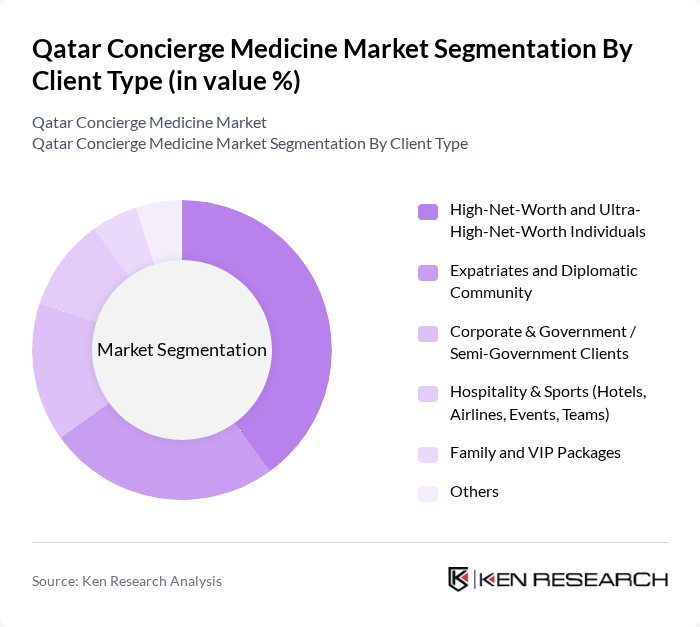

By Client Type:The client type segmentation encompasses various groups that utilize concierge medical services, including High-Net-Worth and Ultra-High-Net-Worth Individuals, Expatriates and Diplomatic Community, Corporate & Government / Semi-Government Clients, Hospitality & Sports (Hotels, Airlines, Events, Teams), Family and VIP Packages, and Others. The High-Net-Worth and Ultra-High-Net-Worth Individuals segment is the most significant, as this demographic seeks personalized healthcare solutions, direct 24x7 access to physicians, preventive and executive health checkups, and coordinated specialist care that align with global concierge medicine usage patterns.

The Qatar Concierge Medicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Premium Care Clinic (Doha), Concierge Physician Services – Sidra Medicine, Hamad Medical Corporation – VIP & Executive Health Services, The View Hospital (an Affiliated Partner of Cedars?Sinai), Al Ahli Hospital – Executive & Corporate Health Programs, Doha Clinic Hospital – VIP & International Patient Services, Aster Medical Center Qatar – Aster Premium & Corporate Health Plans, Al Emadi Hospital – Executive Checkup & Concierge Packages, Al Jazeera Medical Center, Naseem Healthcare – VIP & Corporate Wellness Services, Turkish Hospital Doha – Executive & Family Health Programs, Sidra Medicine – International & Executive Patient Services, Allevia Medical Center, Al Safwa Specialized Clinics, Alfardan Medical with Northwestern Medicine (AMNM) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar concierge medicine market appears promising, driven by increasing health awareness and technological advancements. As the population continues to grow and affluence rises, more individuals are likely to seek personalized healthcare solutions. Additionally, the integration of telemedicine and digital health tools will enhance service delivery, making concierge medicine more appealing. The focus on preventive care and wellness will further shape the market, creating opportunities for innovative service offerings and partnerships.

| Segment | Sub-Segments |

|---|---|

| By Service Type | x7 Primary Care & General Practice Access Specialist Consultation (Cardiology, Pediatrics, Psychiatry, etc.) Comprehensive Health Checkups & Preventive Screening Packages Chronic Disease Management & Care Coordination Home and On?Site (Hotel/Corporate/VIP) Medical Visits Wellness, Executive Health & Lifestyle Management Programs Travel Medicine & Medical Escort Services Others |

| By Client Type | High-Net-Worth and Ultra-High-Net-Worth Individuals Expatriates and Diplomatic Community Corporate & Government / Semi?Government Clients Hospitality & Sports (Hotels, Airlines, Events, Teams) Family and VIP Packages Others |

| By Payment Model | Annual / Multi?Year Membership (Retainer) Pay?Per?Visit Concierge Packages Corporate / Institutional Contracts Insurance?Linked Concierge Plans Hybrid Models Others |

| By Geographic Coverage | Doha Metropolitan Area Al Rayyan & Surrounding Municipalities Industrial & Logistic Zones (Ras Laffan, Mesaieed, etc.) Other Regions in Qatar Cross?Border / International Coverage |

| By Age Group | Pediatric (0–17 Years) Adult (18–59 Years) Geriatric (60+ Years) Multi?Generational / Family Plans Others |

| By Technology Utilization | Telehealth & Virtual Consultation Platforms Mobile Concierge & Appointment Applications Remote Monitoring & Wearable?Enabled Care Integrated Electronic Medical Record (EMR) & Patient Portals AI?Enabled Triage & Care Navigation Tools Others |

| By Service Delivery Model | Clinic?Based Concierge Practices Hospital?Affiliated Concierge Programs Home?Based and On?Demand Mobile Units Virtual?First / Digital?Only Concierge Models Corporate On?Site Clinics & Embedded Concierge Desks Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Concierge Medicine Providers | 60 | Practice Owners, Medical Directors |

| Patients Utilizing Concierge Services | 120 | Current Patients, Prospective Patients |

| Healthcare Policy Experts | 40 | Healthcare Economists, Regulatory Analysts |

| Insurance Providers | 50 | Underwriters, Policy Managers |

| Healthcare Consultants | 50 | Market Analysts, Strategy Consultants |

The Qatar Concierge Medicine Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by increasing demand for personalized healthcare services and a rising expatriate population seeking premium medical care.