Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3774

Pages:91

Published On:October 2025

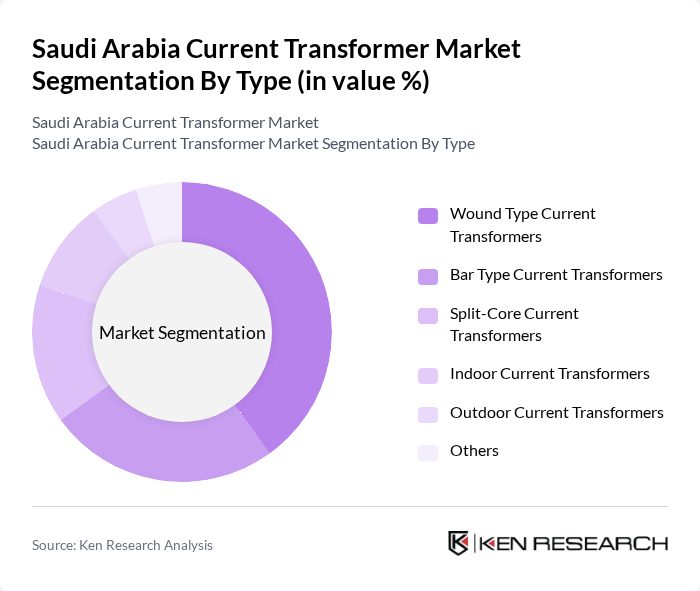

By Type:The market is segmented into various types of current transformers, including Wound Type, Bar Type, Split-Core, Indoor, Outdoor, and Others. Among these, Wound Type Current Transformers are leading due to their high accuracy and reliability in power measurement applications. The increasing demand for precise measurement in industrial and utility applications drives the preference for this type. Bar Type and Split-Core transformers are also gaining traction, particularly in retrofit applications where space is a constraint. The adoption of digital and smart current transformers is also rising, especially in new grid and renewable integration projects .

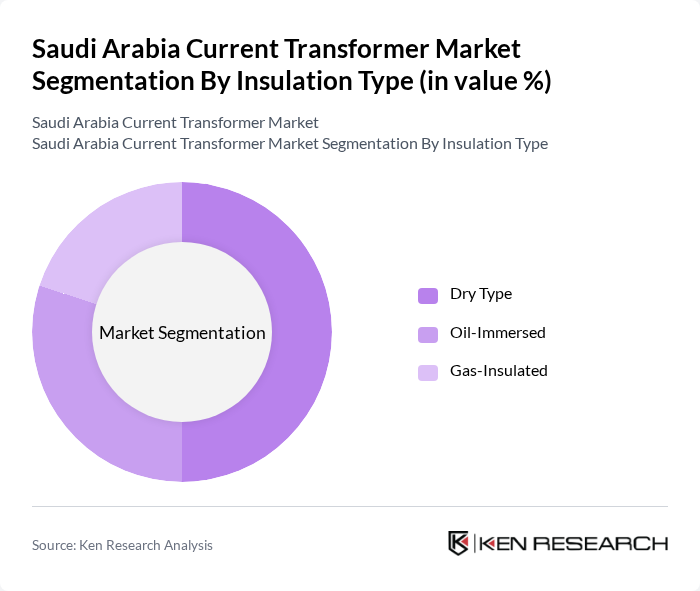

By Insulation Type:This segmentation includes Dry Type, Oil-Immersed, and Gas-Insulated current transformers. The Dry Type segment is currently leading the market due to its safety, low maintenance, and environmental benefits. The increasing focus on safety standards in electrical installations is driving the demand for Dry Type transformers. Oil-Immersed transformers are also significant, particularly in high-voltage applications, while Gas-Insulated transformers are gaining popularity in urban areas where space is limited. There is also a trend towards eco-friendly and low-loss insulation materials in new installations .

The Saudi Arabia Current Transformer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Energy Saudi Arabia Ltd., ABB Electrical Industries Co. Ltd. (ABB Saudi Arabia), Schneider Electric Saudi Arabia, General Electric Saudi Arabia (GE Saudi Advanced Turbines), Mitsubishi Electric Saudi Ltd., Saudi Transformers Company Ltd. (STC), Alfanar Electrical Systems, WESCOSA (Western Electrical Company Ltd.), Hitachi Energy Saudi Arabia, Hyundai Electric & Energy Systems Co., Ltd., CG Power Systems Saudi Arabia Ltd., Arteche Middle East FZE, Instrument Transformers Limited (ITL), LEM International SA, Fuji Electric Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia current transformer market is poised for significant growth, driven by the increasing integration of renewable energy sources and the expansion of electrical infrastructure. As the government continues to prioritize energy efficiency and sustainability, the adoption of smart grid technologies will likely accelerate. Furthermore, the emergence of hybrid current transformers and IoT integration will enhance operational efficiency, positioning the market for innovative advancements and improved energy management solutions in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Wound Type Current Transformers Bar Type Current Transformers Split-Core Current Transformers Indoor Current Transformers Outdoor Current Transformers Others |

| By Insulation Type | Dry Type Oil-Immersed Gas-Insulated |

| By Application | Power Generation Transmission and Distribution Renewable Energy Integration Industrial Measurement & Protection Smart Grids |

| By End-User | Utilities (Saudi Electricity Company, etc.) Industrial (Oil & Gas, Petrochemicals, Manufacturing) Commercial Residential |

| By Region | Central (Riyadh) Western (Jeddah, Makkah, Madinah) Eastern (Dammam, Jubail) Southern Northern |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Power Generation Sector | 100 | Plant Managers, Electrical Engineers |

| Distribution Utilities | 80 | Operations Managers, Network Planners |

| Manufacturing Facilities | 60 | Procurement Managers, Facility Engineers |

| Renewable Energy Projects | 50 | Project Managers, Sustainability Officers |

| Research and Development Departments | 40 | R&D Engineers, Product Development Managers |

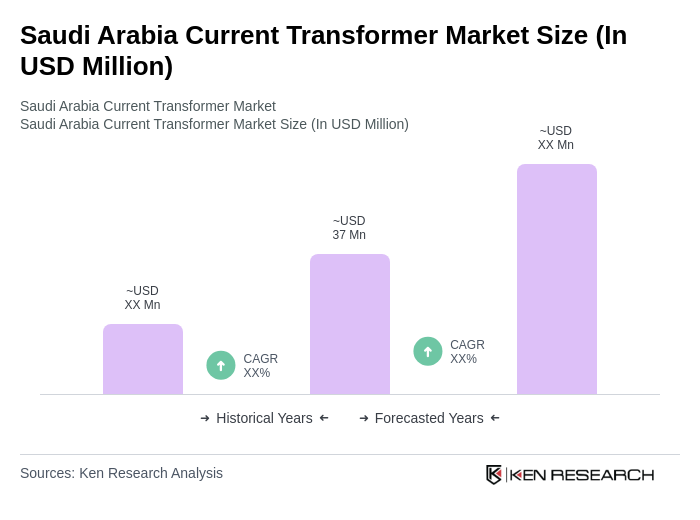

The Saudi Arabia Current Transformer Market is valued at approximately USD 37 million, driven by the increasing demand for electricity, expansion of the power generation sector, and integration of renewable energy sources into the national grid.