Region:Middle East

Author(s):Dev

Product Code:KRAC1317

Pages:95

Published On:October 2025

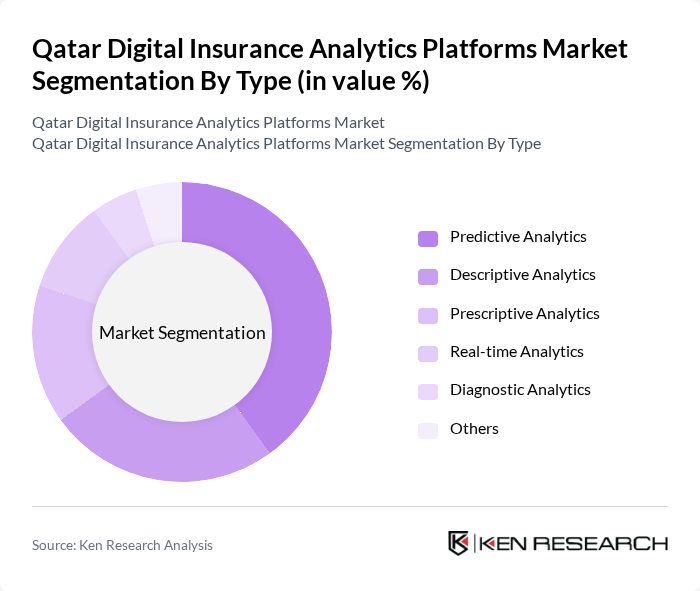

By Type:The market is segmented into Predictive Analytics, Descriptive Analytics, Prescriptive Analytics, Real-time Analytics, Diagnostic Analytics, and Others. Predictive analytics leads the market due to its ability to forecast trends, optimize pricing, and enhance decision-making processes. Descriptive analytics is widely used for historical data analysis and reporting, while prescriptive analytics supports strategic planning and operational improvements. Real-time analytics enables instant insights for customer engagement and claims management, and diagnostic analytics is utilized for root cause analysis in risk and fraud investigations .

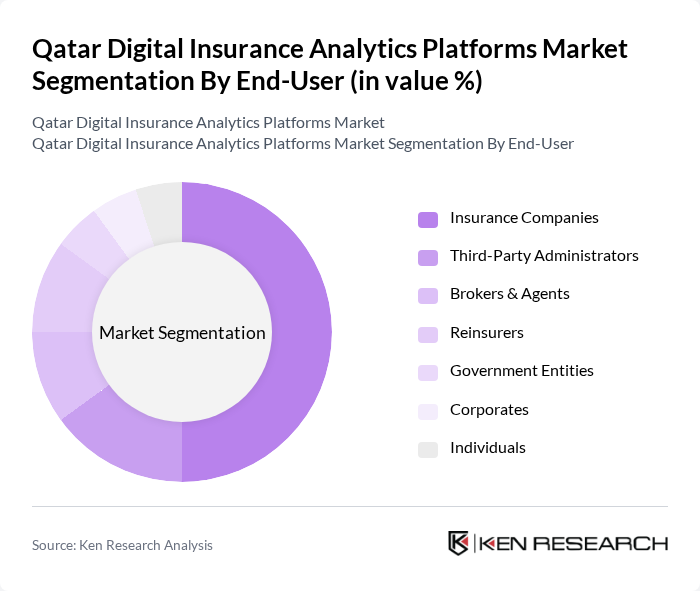

By End-User:The end-user segmentation includes Insurance Companies, Third-Party Administrators, Brokers & Agents, Reinsurers, Government Entities, Corporates, and Individuals. Insurance companies are the dominant end-users, leveraging analytics to optimize underwriting processes, enhance customer service, and improve claims management. Third-party administrators and brokers increasingly utilize digital platforms for efficient policy administration and customer acquisition. Reinsurers rely on analytics for risk modeling and portfolio management, while government entities and corporates adopt these solutions for regulatory compliance and employee benefits management. Individuals benefit from personalized insurance offerings and transparent claims processing .

The Qatar Digital Insurance Analytics Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Insurance Company (QIC), Doha Insurance Group, Qatar General Insurance & Reinsurance Company, Al Khaleej Takaful Insurance, Qatar Islamic Insurance Company, Damaan Islamic Insurance Company (Beema), QIC Group, AXA Gulf (now GIG Gulf), Allianz Qatar, MetLife Qatar, AIG Qatar, Zurich Insurance Group, Chubb Qatar, RSA Insurance Group, Takaful International Company, Qatar Life & Medical Insurance Company (QLM), Gulf Insurance Group (GIG Qatar), Qatar Re, Al-Ahli Takaful Company, Qatar Islamic Bank (Insurance Division) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar digital insurance analytics platforms market appears promising, driven by ongoing technological advancements and increasing regulatory support. As insurers continue to prioritize customer-centric strategies, the integration of AI and machine learning will enhance predictive analytics capabilities. Furthermore, the growing emphasis on real-time data processing will enable insurers to respond swiftly to market changes, fostering innovation and competitive advantage. This dynamic environment is likely to attract new entrants and stimulate further investment in analytics solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Descriptive Analytics Prescriptive Analytics Real-time Analytics Diagnostic Analytics Others |

| By End-User | Insurance Companies Third-Party Administrators Brokers & Agents Reinsurers Government Entities Corporates Individuals |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Application | Risk Assessment Fraud Detection Customer Segmentation Claims Management Underwriting Optimization Regulatory Compliance Analytics Customer Experience Analytics Others |

| By Sales Channel | Direct Sales Online Platforms Brokers & Agents Distributors |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Digital Platforms | 100 | Product Managers, Digital Strategy Leads |

| Health Insurance Analytics Solutions | 80 | Data Analysts, IT Managers |

| Property Insurance Digital Transformation | 70 | Operations Directors, Business Development Managers |

| Insurtech Startups in Qatar | 50 | Founders, CTOs, Innovation Officers |

| Regulatory Impact on Digital Insurance | 40 | Compliance Officers, Regulatory Affairs Managers |

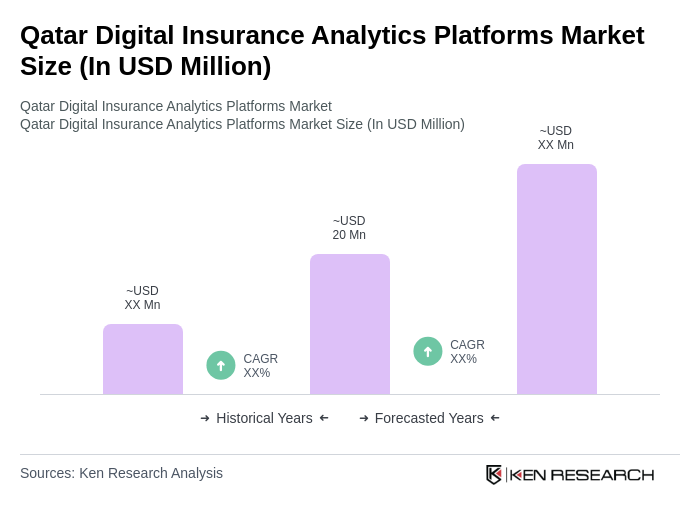

The Qatar Digital Insurance Analytics Platforms Market is valued at approximately USD 20 million, reflecting a significant growth trend driven by the adoption of advanced technologies in the insurance sector.