Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0295

Pages:95

Published On:August 2025

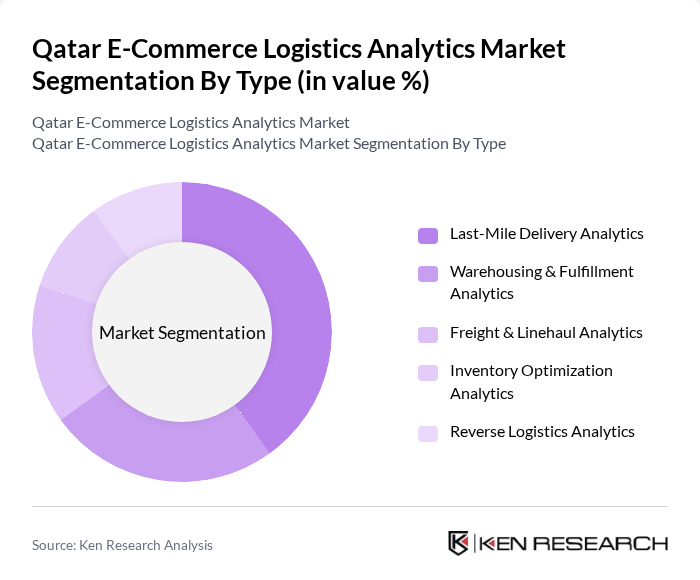

By Type:The market is segmented into Last-Mile Delivery Analytics, Warehousing & Fulfillment Analytics, Freight & Linehaul Analytics, Inventory Optimization Analytics, and Reverse Logistics Analytics. Last-Mile Delivery Analytics is currently the leading sub-segment, driven by the increasing demand for efficient, real-time delivery solutions in urban areas. The rise of e-commerce and consumer expectations for rapid, transparent delivery have heightened the need for advanced tracking, route optimization, and data-driven performance management, making this segment crucial for logistics providers .

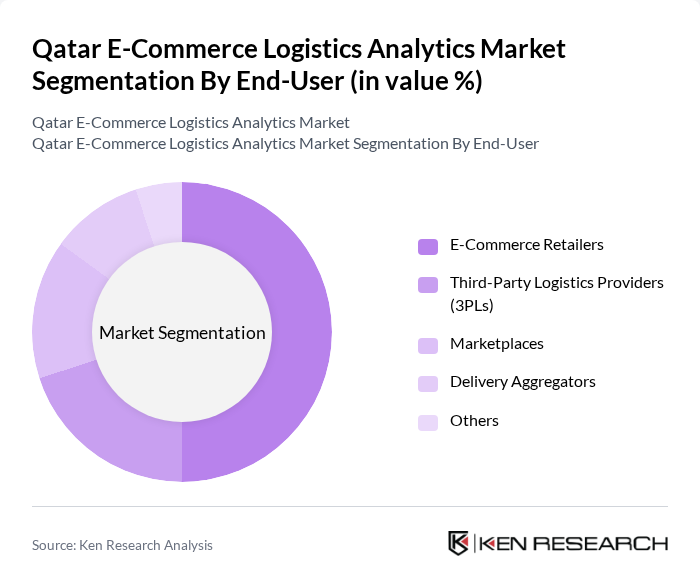

By End-User:The end-user segmentation includes E-Commerce Retailers, Third-Party Logistics Providers (3PLs), Marketplaces, Delivery Aggregators, and Others. E-Commerce Retailers dominate this segment as they increasingly rely on logistics analytics to enhance operational efficiency, improve delivery times, and elevate customer satisfaction. The growing trend of online shopping and the adoption of omnichannel strategies have led retailers to invest in analytics solutions to streamline their logistics processes and remain competitive .

The Qatar E-Commerce Logistics Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Post, Aramex, DHL Express, FedEx, UPS, Q-Express, Mena Logistics, Gulf Warehousing Company (GWC), Qatar Logistics, Al-Futtaim Logistics, Agility Logistics, Kuehne + Nagel, DB Schenker, CEVA Logistics, XPO Logistics, Amazon Logistics, AliExpress Logistics, Talabat Logistics, Carrefour Qatar (Majid Al Futtaim Retail L.L.C.), and Lulu Hypermarket Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar e-commerce logistics analytics market appears promising, driven by technological advancements and changing consumer preferences. As businesses increasingly adopt AI and machine learning, logistics operations will become more efficient, enabling faster deliveries and improved customer experiences. Additionally, the growth of cross-border e-commerce will necessitate enhanced analytics capabilities, allowing companies to navigate complex logistics challenges and capitalize on new market opportunities in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Last-Mile Delivery Analytics Warehousing & Fulfillment Analytics Freight & Linehaul Analytics Inventory Optimization Analytics Reverse Logistics Analytics |

| By End-User | E-Commerce Retailers Third-Party Logistics Providers (3PLs) Marketplaces Delivery Aggregators Others |

| By Delivery Method | Standard Delivery Express Delivery Same-Day Delivery Scheduled Delivery Cross-Border Delivery |

| By Technology Used | Data Analytics Platforms Cloud-Based Logistics Solutions IoT & Real-Time Tracking Artificial Intelligence & Machine Learning Blockchain Integration |

| By Geographic Coverage | Doha Metropolitan Area Secondary Cities Rural & Remote Areas International Corridors Free Zones & Industrial Parks |

| By Customer Segment | Individual Consumers SMEs Large Enterprises Government & Public Sector Others |

| By Service Type | Core Logistics Analytics Services Value-Added Analytics (e.g., Route Optimization, Demand Forecasting) Consulting & Implementation Services Technology Integration Services Custom Analytics Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Retail Logistics | 100 | Logistics Managers, E-commerce Directors |

| Last-Mile Delivery Services | 60 | Operations Managers, Delivery Coordinators |

| Returns Management in E-commerce | 50 | Customer Service Managers, Returns Specialists |

| Warehouse Management Solutions | 40 | Warehouse Managers, Supply Chain Analysts |

| Consumer Insights on Delivery Preferences | 80 | Online Shoppers, Market Research Analysts |

The Qatar E-Commerce Logistics Analytics Market is valued at approximately USD 1.0 billion, driven by the rapid growth of the e-commerce sector, increased internet and smartphone penetration, and a rising consumer preference for online shopping.