Region:Europe

Author(s):Geetanshi

Product Code:KRAA0191

Pages:93

Published On:August 2025

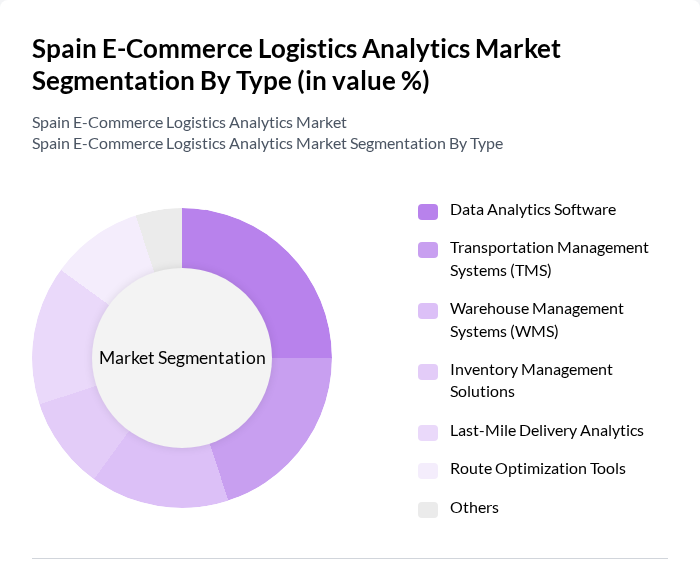

By Type:The market is segmented into various types, including Data Analytics Software, Transportation Management Systems (TMS), Warehouse Management Systems (WMS), Inventory Management Solutions, Last-Mile Delivery Analytics, Route Optimization Tools, and Others. Each of these subsegments plays a crucial role in enhancing logistics efficiency and customer satisfaction. Data Analytics Software enables real-time monitoring and predictive analytics; TMS and WMS streamline transportation and warehouse operations; Inventory Management Solutions optimize stock levels; Last-Mile Delivery Analytics and Route Optimization Tools improve delivery speed and reduce costs .

The Data Analytics Software segment is currently leading the market due to the increasing need for businesses to leverage data for decision-making and operational efficiency. Companies are investing in analytics tools to gain insights into consumer behavior, optimize supply chains, and enhance customer experiences. The growing trend of big data and machine learning is further propelling the demand for advanced analytics solutions, making this segment a key driver in the logistics analytics landscape .

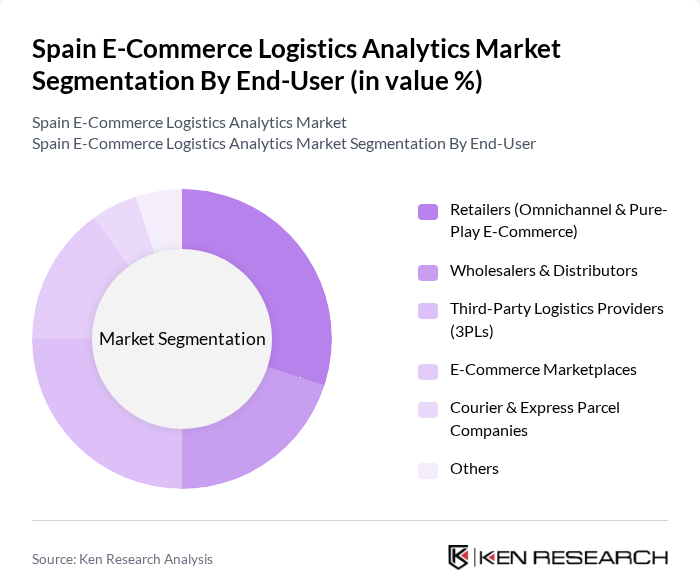

By End-User:The market is segmented by end-users, including Retailers (Omnichannel & Pure-Play E-Commerce), Wholesalers & Distributors, Third-Party Logistics Providers (3PLs), E-Commerce Marketplaces, Courier & Express Parcel Companies, and Others. Each end-user category has unique requirements and contributes to the overall growth of the logistics analytics market. Retailers focus on inventory and order management, while 3PLs and courier companies emphasize route optimization and delivery tracking .

The Retailers segment, particularly those operating in omnichannel and pure-play e-commerce, is the dominant force in the market. This is attributed to the rapid growth of online shopping, which has led retailers to seek advanced logistics analytics solutions to streamline operations, manage inventory effectively, and enhance customer satisfaction. The increasing competition in the e-commerce space further drives retailers to adopt innovative logistics strategies, solidifying their position as the leading end-user in the market .

The Spain E-Commerce Logistics Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SEUR, Correos, DHL Supply Chain, XPO Logistics, MRW, Geodis, Kuehne + Nagel, Amazon Logistics, DPD España, UPS, TNT Express, Zeleris, Logista, Transcoma, Celeritas, Amphora Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Spain e-commerce logistics analytics market appears promising, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt AI and machine learning, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainable logistics solutions will likely reshape the industry landscape, aligning with global environmental goals. The integration of innovative delivery methods, such as drones, will further enhance last-mile delivery capabilities, meeting the growing consumer demand for speed and reliability.

| Segment | Sub-Segments |

|---|---|

| By Type | Data Analytics Software Transportation Management Systems (TMS) Warehouse Management Systems (WMS) Inventory Management Solutions Last-Mile Delivery Analytics Route Optimization Tools Others |

| By End-User | Retailers (Omnichannel & Pure-Play E-Commerce) Wholesalers & Distributors Third-Party Logistics Providers (3PLs) E-Commerce Marketplaces Courier & Express Parcel Companies Others |

| By Delivery Method | Standard Delivery Express Delivery Same-Day Delivery Click and Collect / Locker Pickup Cross-Border Delivery Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Cross-Border Logistics Regional Hubs Others |

| By Technology Used | Cloud-Based Solutions On-Premise Solutions Mobile Applications IoT-Enabled Devices & Sensors AI & Machine Learning Analytics Others |

| By Customer Segment | B2B B2C C2C Government & Public Sector SMEs Large Enterprises Others |

| By Service Type | Consulting & Advisory Services Implementation & Integration Services Managed Analytics Services Maintenance and Support Services Training & Change Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Fulfillment Strategies | 100 | Logistics Coordinators, E-commerce Directors |

| Last-Mile Delivery Solutions | 80 | Operations Managers, Delivery Service Providers |

| Returns Management Practices | 70 | Customer Experience Managers, Returns Analysts |

| Warehouse Automation Trends | 60 | Warehouse Managers, Technology Officers |

| Logistics Cost Optimization | 85 | Financial Analysts, Supply Chain Strategists |

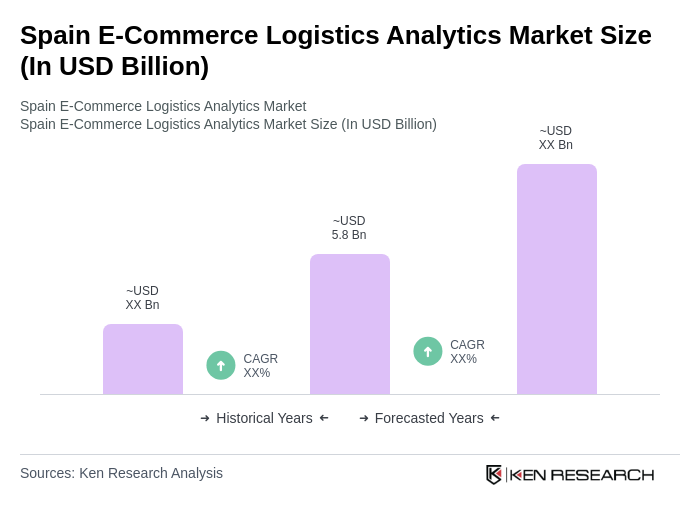

The Spain E-Commerce Logistics Analytics Market is valued at approximately USD 5.8 billion, reflecting significant growth driven by the expansion of online retail and the adoption of advanced analytics technologies to optimize logistics operations.