Region:Middle East

Author(s):Shubham

Product Code:KRAE0010

Pages:82

Published On:December 2025

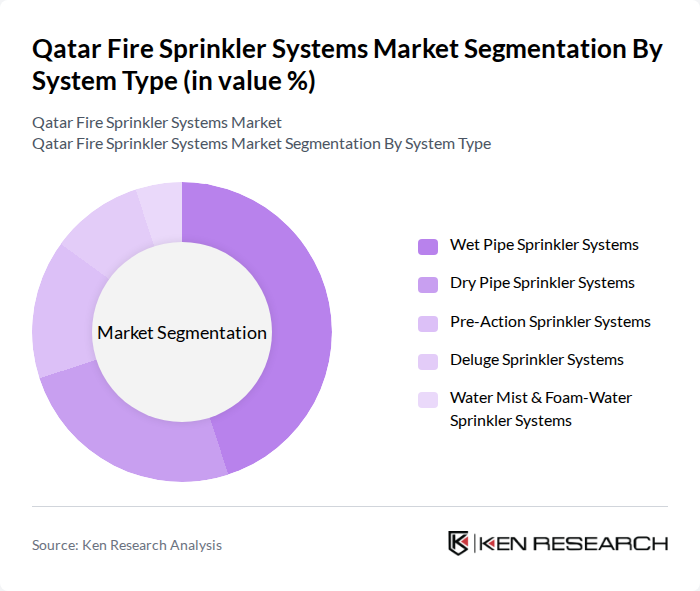

By System Type:The market is segmented into various system types, including Wet Pipe Sprinkler Systems, Dry Pipe Sprinkler Systems, Pre-Action Sprinkler Systems, Deluge Sprinkler Systems, and Water Mist & Foam-Water Sprinkler Systems. Among these, Wet Pipe Sprinkler Systems dominate the market due to their reliability and effectiveness in providing immediate fire suppression, in line with global trends where wet pipe systems are the most widely used for commercial and residential occupancies. The increasing adoption of these systems in residential, commercial, and mixed?use buildings is driven by their ease of installation and maintenance, their compatibility with NFPA and QCDD design requirements, and their cost-effectiveness compared with more complex dry or pre-action systems for non-freezing environments such as Qatar.

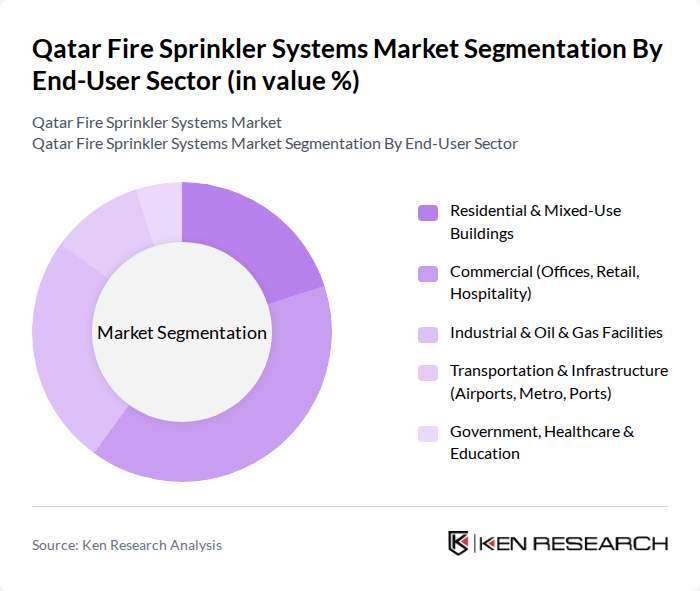

By End-User Sector:The market is segmented into Residential & Mixed-Use Buildings, Commercial (Offices, Retail, Hospitality), Industrial & Oil & Gas Facilities, Transportation & Infrastructure (Airports, Metro, Ports), and Government, Healthcare & Education. The Commercial sector leads the market, driven by the increasing number of office buildings, hotels, malls, and mixed-use developments that require advanced fire protection systems to comply with QCDD and international safety regulations and to protect assets and occupants. Industrial and oil & gas facilities, as well as warehouses and logistics centers, also represent a significant share due to higher fire risk classifications and the need for specialized sprinkler, deluge, and foam-water systems in line with regional fire suppression trends.

The Qatar Fire Sprinkler Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as NAFFCO Qatar (National Fire Fighting Manufacturing FZCO), G4S Fire & Safety Systems Qatar, Johnson Controls – Tyco Fire & Security Qatar, SFFECO Global – Qatar Operations, Protec Fire & Security Group – Qatar, Desert Line Projects – Fire Protection Division, Redco International Trading & Contracting – Fire Protection, Al Jaber Engineering – MEP & Fire Protection, Boom General Contractors – Fire & Life Safety Systems, Qatar Fire Protection Services WLL, Al Aman Fire Protection & Safety, Al Asmakh Fire Protection Systems, Nasser Al Ali Enterprises – Fire Fighting Systems, EMCO Qatar (Engineering Maintenance Company) – Fire Systems, Al Tawasul Fire & Security Systems contribute to innovation, geographic expansion, and service delivery in this space, increasingly focusing on integrated fire and life-safety solutions, turnkey design–build packages, and long-term maintenance contracts.

As Qatar continues to invest in infrastructure and urban development, the fire sprinkler systems market is poised for significant growth. The integration of smart technologies and eco-friendly materials will likely shape future innovations. Additionally, the government's commitment to enhancing fire safety regulations will further drive demand. By focusing on retrofitting existing buildings and expanding commercial real estate, the market is expected to adapt to evolving safety standards and consumer preferences, ensuring a robust future.

| Segment | Sub-Segments |

|---|---|

| By System Type | Wet Pipe Sprinkler Systems Dry Pipe Sprinkler Systems Pre-Action Sprinkler Systems Deluge Sprinkler Systems Water Mist & Foam-Water Sprinkler Systems |

| By End-User Sector | Residential & Mixed-Use Buildings Commercial (Offices, Retail, Hospitality) Industrial & Oil & Gas Facilities Transportation & Infrastructure (Airports, Metro, Ports) Government, Healthcare & Education |

| By Project Type | New Construction Retrofit & Upgrades Operation & Maintenance Services Design & Engineering Services |

| By Installation Type | Above-Ground Piping & Sprinkler Networks Underground Piping & Water Supply Systems Pump Rooms & Control Valve Assemblies Integrated Fire & Life Safety Systems |

| By Region | Doha Al Rayyan Al Wakrah Al Khor & Al Thakhira |

| By Technology Level | Conventional (Stand-alone) Sprinkler Systems Addressable & Networked Sprinkler Systems IoT-Enabled / Smart Sprinkler Systems Integrated Fire Protection & Building Management Systems |

| By Service & Maintenance Type | Scheduled Inspection & Testing Corrective & Emergency Maintenance Retrofit, Upgrade & Compliance Services Annual Maintenance Contracts (AMCs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Fire Safety | 120 | Facility Managers, Safety Compliance Officers |

| Residential Fire Protection Systems | 90 | Homeowners, Property Managers |

| Industrial Fire Safety Solutions | 80 | Plant Managers, Safety Engineers |

| Hospitality Sector Fire Systems | 70 | Hotel Managers, Safety Coordinators |

| Government Infrastructure Projects | 60 | Project Managers, Urban Planners |

The Qatar Fire Sprinkler Systems Market is valued at approximately USD 160 million, driven by increasing construction activities, stringent fire safety regulations, and heightened awareness of fire safety among businesses and homeowners.