Region:Middle East

Author(s):Dev

Product Code:KRAD5157

Pages:92

Published On:December 2025

By Product Type:The product type segmentation includes various categories such as gynecological endoscopy devices, diagnostic imaging systems, endometrial ablation devices, female sterilization and contraceptive devices, hand instruments, gynecological chairs and examination tables, and others. Among these, gynecological endoscopy devices are leading the market due to their minimally invasive nature and increasing adoption in surgical procedures. The demand for diagnostic imaging systems is also significant, driven by the need for accurate diagnosis and monitoring of gynecological conditions.

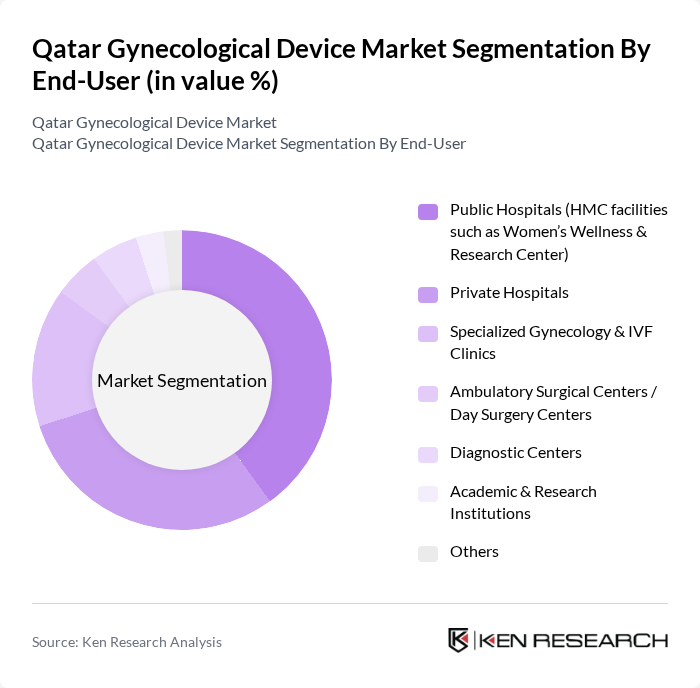

By End-User:The end-user segmentation includes public hospitals, private hospitals, specialized gynecology and IVF clinics, ambulatory surgical centers, diagnostic centers, academic and research institutions, and others. Public hospitals are the leading end-user segment, primarily due to government initiatives to enhance women's healthcare services. Private hospitals and specialized clinics also play a significant role, driven by the increasing demand for personalized and advanced gynecological care.

The Qatar Gynecological Device Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hologic, Inc., CooperSurgical, Inc., Boston Scientific Corporation, Olympus Corporation, KARL STORZ SE & Co. KG, Johnson & Johnson (Ethicon; DePuy Synthes), Medtronic plc, Stryker Corporation, Becton, Dickinson and Company (BD), Siemens Healthineers AG, GE HealthCare Technologies Inc., Fujifilm Holdings Corporation, Richard Wolf GmbH, Smith & Nephew plc, Intuitive Surgical, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar gynecological device market appears promising, driven by ongoing investments in healthcare infrastructure and technology. With the government's commitment to enhancing women's health services, the market is likely to witness increased adoption of advanced devices. Additionally, the integration of telemedicine and remote monitoring solutions is expected to facilitate access to gynecological care, particularly in underserved areas, thereby expanding the market's reach and improving patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Gynecological Endoscopy Devices (laparoscopes, hysteroscopes) Diagnostic Imaging Systems (ultrasound, colposcopes) Endometrial Ablation Devices Female Sterilization & Contraceptive Devices Hand Instruments (forceps, specula, curettes) Gynecological Chairs & Examination Tables Others |

| By End-User | Public Hospitals (HMC facilities such as Women’s Wellness & Research Center) Private Hospitals Specialized Gynecology & IVF Clinics Ambulatory Surgical Centers / Day Surgery Centers Diagnostic Centers Academic & Research Institutions Others |

| By Clinical Application | Uterine Fibroids & Abnormal Uterine Bleeding Ovarian Disorders & Endometriosis Cervical Cancer Screening & Colposcopy Pregnancy & Obstetric Care (fetal monitoring, prenatal imaging) Fertility Assessment & Assisted Reproductive Technology (ART) Pelvic Organ Prolapse & Urinary Incontinence Others |

| By Distribution Channel | Direct Tenders to Public Hospitals Local Distributors / Importers Direct Sales to Private Providers Online / E-Procurement Portals Retail & Hospital Pharmacies (select devices & consumables) Others |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Al Khor & Al Thakhira Others |

| By Device Risk Class (per regulatory classification) | Class I Devices (low risk – basic instruments, specula) Class II Devices (moderate risk – ultrasound, colposcopes, endoscopy) Class III Devices (high risk – implants, contraceptive systems) Others |

| By Technology | Conventional / Non-digital Devices Digital & Imaging-Integrated Devices Minimally Invasive & Robotic-Assisted Systems Single-use & Disposable Gynecological Devices Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gynecological Device Usage in Hospitals | 90 | Gynecologists, Hospital Administrators |

| Market Insights from Medical Device Distributors | 70 | Sales Managers, Distribution Executives |

| Patient Experience and Satisfaction Surveys | 140 | Women aged 18-65, Healthcare Consumers |

| Regulatory Compliance Insights | 50 | Regulatory Affairs Specialists, Compliance Officers |

| Technological Adoption in Gynecological Practices | 60 | Healthcare IT Managers, Clinical Technology Officers |

The Qatar Gynecological Device Market is valued at approximately USD 30 million, reflecting a growing demand driven by increased awareness of women's health issues and advancements in medical technology.