Region:Middle East

Author(s):Shubham

Product Code:KRAB7289

Pages:89

Published On:October 2025

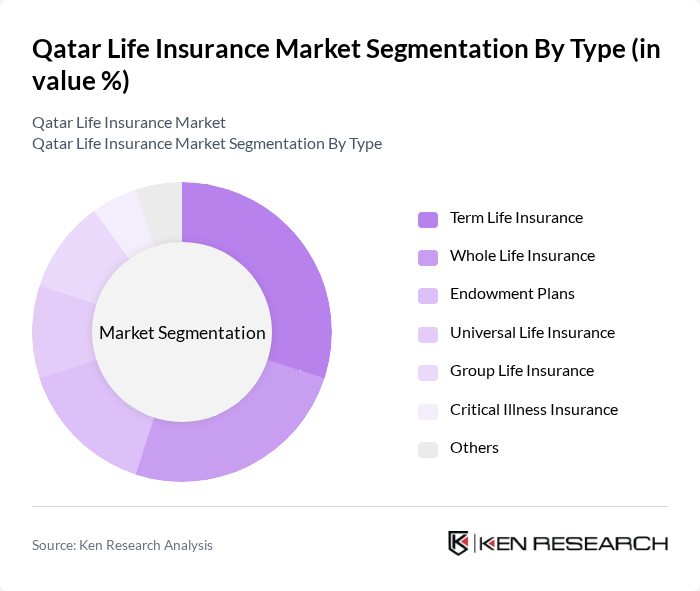

By Type:The life insurance market can be segmented into various types, including Term Life Insurance, Whole Life Insurance, Endowment Plans, Universal Life Insurance, Group Life Insurance, Critical Illness Insurance, and Others. Each of these sub-segments caters to different consumer needs and preferences, with Term Life Insurance being particularly popular due to its affordability and straightforward nature.

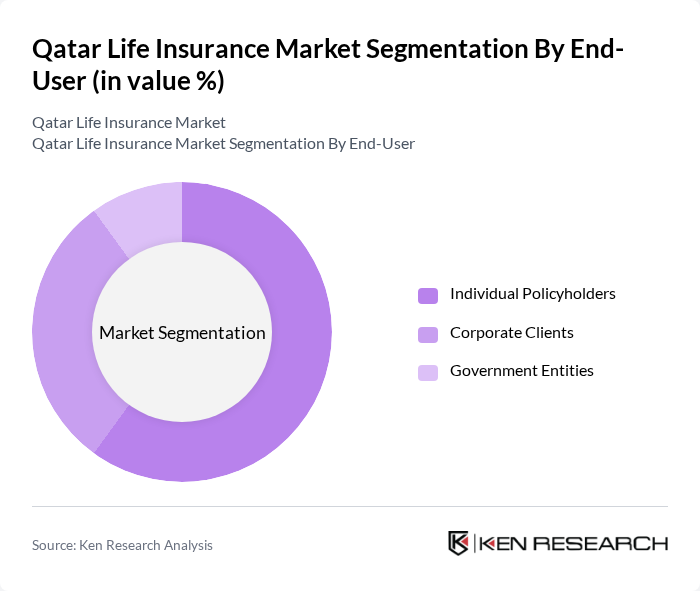

By End-User:The end-user segmentation includes Individual Policyholders, Corporate Clients, and Government Entities. Individual policyholders dominate the market as they seek personal financial security and protection for their families. Corporate clients also contribute significantly, as businesses provide life insurance benefits to employees, enhancing their overall compensation packages.

The Qatar Life Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Insurance Company, Doha Insurance Company, Al Khaleej Takaful Insurance, Qatar Life & Medical Insurance Company, Qatar General Insurance and Reinsurance Company, Damaan Islamic Insurance Company, Gulf Insurance Group, Qatar Islamic Insurance Company, AIG Qatar, MetLife Qatar, Allianz Qatar, AXA Gulf, Zurich Insurance Group, Takaful International Company, National Life & General Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar life insurance market appears promising, driven by increasing digitalization and a focus on customer-centric models. Insurers are expected to leverage technology to enhance service delivery and streamline operations, improving customer engagement. Additionally, the growing demand for personalized insurance products will likely lead to innovative offerings tailored to individual needs. As the regulatory framework evolves, it will support market growth while ensuring consumer protection, fostering a more robust insurance landscape in Qatar.

| Segment | Sub-Segments |

|---|---|

| By Type | Term Life Insurance Whole Life Insurance Endowment Plans Universal Life Insurance Group Life Insurance Critical Illness Insurance Others |

| By End-User | Individual Policyholders Corporate Clients Government Entities |

| By Distribution Channel | Direct Sales Insurance Brokers Online Platforms Banks and Financial Institutions |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Customer Demographics | Age Group (18-30) Age Group (31-50) Age Group (51 and above) |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Claims Settlement Ratio | High Settlement Ratio Medium Settlement Ratio Low Settlement Ratio |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Life Insurance Policies | 150 | Policyholders, Financial Advisors |

| Group Life Insurance Plans | 100 | HR Managers, Corporate Insurance Buyers |

| Retirement and Pension Products | 80 | Financial Planners, Retirees |

| Health and Life Insurance Bundles | 70 | Insurance Brokers, Family Policyholders |

| Insurance Awareness and Education | 90 | Consumers, Community Leaders |

The Qatar Life Insurance Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by increased awareness of financial security, a rising expatriate population, and higher disposable incomes among residents.