Region:Middle East

Author(s):Rebecca

Product Code:KRAC1137

Pages:98

Published On:October 2025

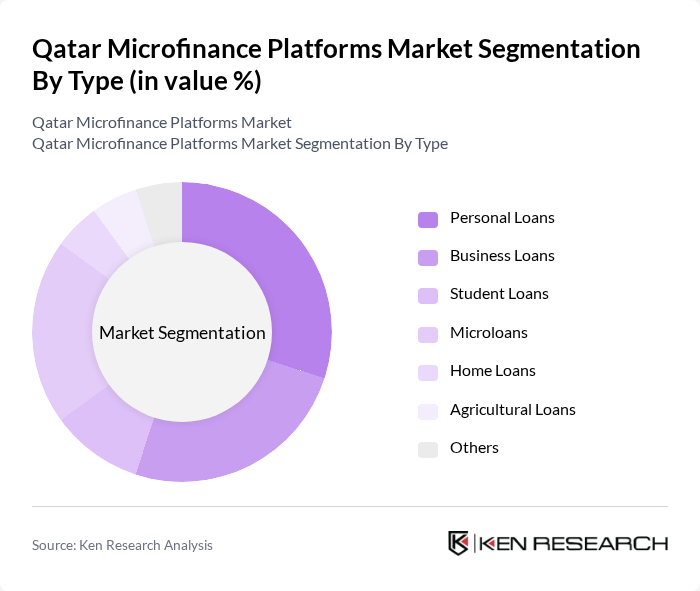

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Student Loans, Microloans, Home Loans, Agricultural Loans, and Others. Among these,Personal LoansandMicroloansare particularly popular due to their accessibility and flexibility, catering to a wide range of consumers and small businesses. The increasing adoption of digital and mobile lending platforms has further accelerated the uptake of these loan types, especially among young entrepreneurs and self-employed individuals .

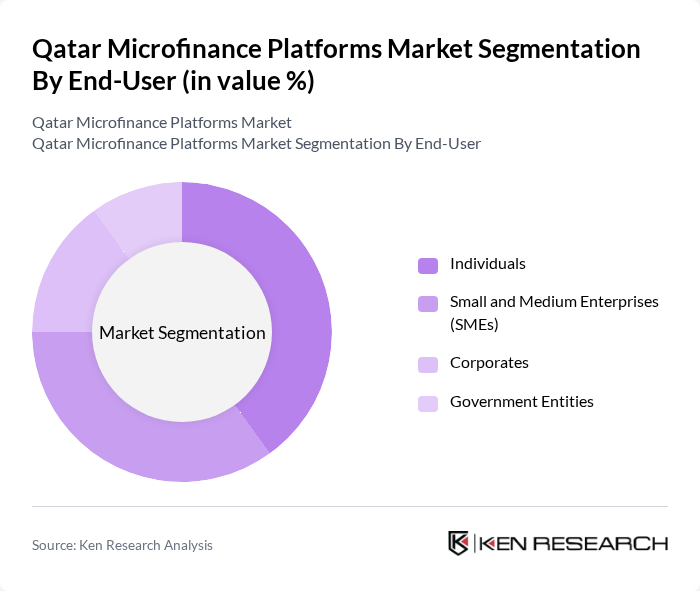

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Corporates, and Government Entities.IndividualsandSMEsdominate this segment, as they are the primary beneficiaries of microfinance services, seeking financial support for personal needs and business growth. The increasing focus on entrepreneurship, digital transformation, and financial inclusion has led to a surge in microfinance adoption among these groups .

The Qatar Microfinance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar National Bank, Doha Bank, Qatar Islamic Bank, Qatar Development Bank, Al Khaliji Commercial Bank, Masraf Al Rayan, Qatar Microfinance Company, Al Ahli Bank, Dukhan Bank, Qatar Finance and Investment Company, Gulf International Bank, International Bank of Qatar, Beehive, Kiva, and Qatar Charity contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar microfinance platforms market appears promising, driven by technological advancements and a supportive regulatory environment. As digital solutions become more prevalent, MFIs are expected to leverage mobile banking and data analytics to enhance service delivery and credit assessment. Furthermore, the growing interest from international investors is likely to inject additional capital into the sector, fostering innovation and expanding access to financial services for underserved populations.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Microloans Home Loans Agricultural Loans Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Government Entities |

| By Loan Amount | Small Loans (up to QAR 10,000) Medium Loans (QAR 10,001 - QAR 50,000) Large Loans (above QAR 50,000) |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Retailers |

| By Repayment Period | Short-term (up to 1 year) Medium-term (1-3 years) Long-term (above 3 years) |

| By Interest Rate Type | Fixed Interest Rates Variable Interest Rates Tiered Interest Rates |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Microfinance Client Satisfaction | 120 | Small Business Owners, Micro-entrepreneurs |

| Impact of Microfinance on Employment | 100 | HR Managers, Business Development Officers |

| Microfinance Product Awareness | 100 | Financial Advisors, Community Leaders |

| Challenges Faced by Microfinance Institutions | 80 | Microfinance Executives, Policy Makers |

| Future Trends in Microfinance | 90 | Economists, Financial Analysts |

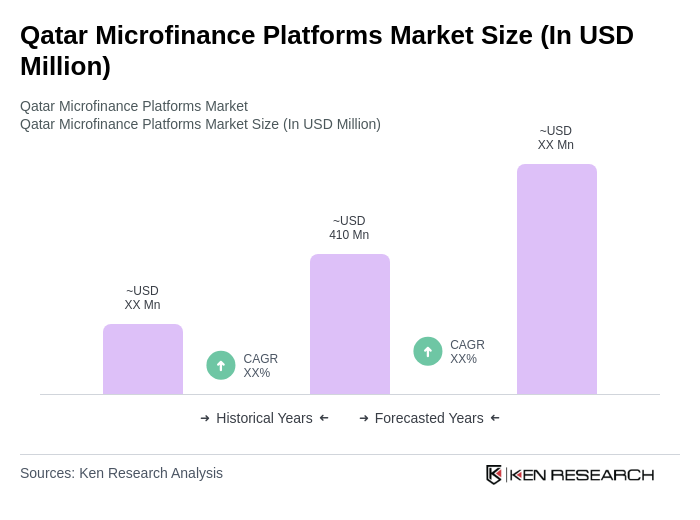

The Qatar Microfinance Platforms Market is valued at approximately USD 410 million, reflecting significant growth driven by increasing demand for financial inclusion, particularly among small and medium enterprises (SMEs) and low-income individuals.