Region:Middle East

Author(s):Rebecca

Product Code:KRAC1154

Pages:99

Published On:October 2025

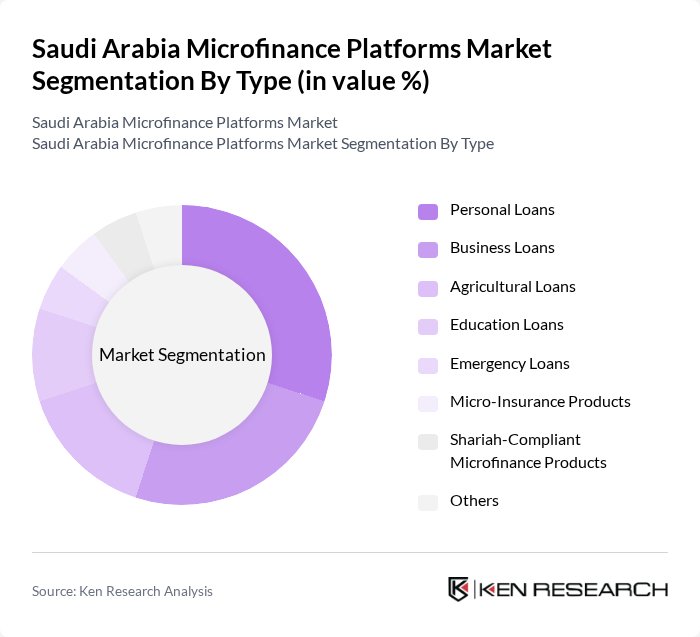

By Type:The microfinance platforms in Saudi Arabia can be categorized into various types, including personal loans, business loans, agricultural loans, education loans, emergency loans, micro-insurance products, Shariah-compliant microfinance products, and others. Each type serves distinct customer needs and preferences, contributing to the overall market dynamics. Personal loans have gained significant traction through digital lending platforms that offer convenient mobile-based applications and faster approval processes. Business loans cater to the expanding entrepreneurial ecosystem supported by government initiatives, while Shariah-compliant products address the specific requirements of customers seeking Islamic finance solutions.

The personal loans segment is currently dominating the market due to the high demand for quick and accessible financing options among individuals. This trend is driven by the increasing number of young professionals and families seeking financial support for personal expenses, home improvements, and consumer goods. The digital transformation of financial services has made personal loans more appealing, with mobile banking and digital wallet adoption enabling seamless application processes and rapid disbursements. The tech-savvy population increasingly prefers digital-first banking experiences that provide personalized financial services and convenient access to credit.

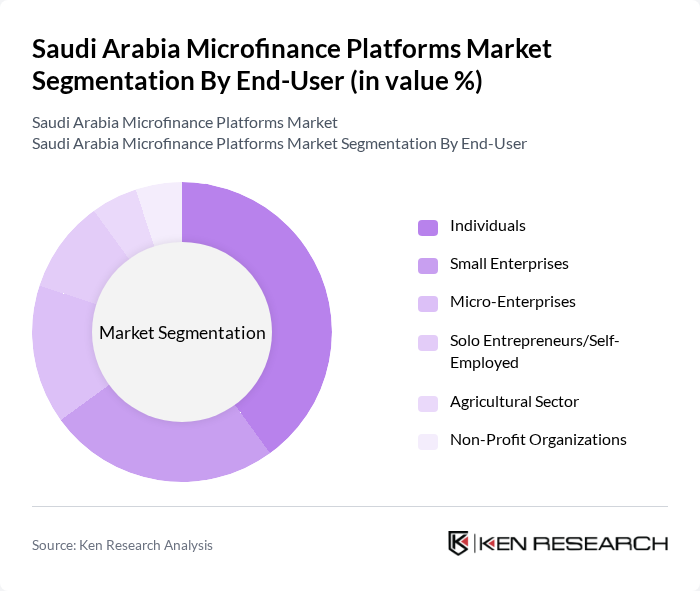

By End-User:The end-users of microfinance platforms in Saudi Arabia include individuals, small enterprises, micro-enterprises, solo entrepreneurs/self-employed, the agricultural sector, and non-profit organizations. Each of these segments plays a crucial role in the overall microfinance ecosystem. The individual segment benefits from enhanced digital banking services and diverse product offerings, while small and micro-enterprises leverage microfinance for business expansion and working capital needs. Solo entrepreneurs and self-employed professionals increasingly access microfinance solutions to support their ventures in the growing gig economy.

Individuals represent the largest end-user segment in the microfinance market, primarily due to the growing need for personal financial solutions and increased consumer spending patterns. This demographic includes a diverse range of borrowers, from students seeking education loans to families requiring funds for emergencies and lifestyle improvements. The increasing financial literacy and awareness of available microfinance options, combined with favorable regulatory adjustments and the rise in demand for personal credit, have further fueled this segment's growth, making it a key driver in the overall market.

The Saudi Arabia Microfinance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alinma Bank, Saudi Microfinance Network (Shabakat Al-Tamweel Al-Sagheer), Drahim Platform, Tamweel Aloula, Emkan Finance, Al Rajhi Bank, Riyad Bank, National Commercial Bank (NCB, now part of Saudi National Bank), Bank Aljazira, Arab National Bank, Saudi Investment Bank, Alawwal Bank (now merged with SABB), Gulf International Bank, Banque Saudi Fransi, SABB (Saudi British Bank) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the microfinance sector in Saudi Arabia appears promising, driven by ongoing government initiatives and technological advancements. As financial inclusion efforts continue, more individuals will gain access to microfinance services, particularly in underserved regions. Additionally, the integration of artificial intelligence in credit scoring is expected to enhance risk assessment, reducing default rates. The focus on sustainable lending practices will also shape the market, aligning with global trends towards responsible finance and environmental considerations.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Agricultural Loans Education Loans Emergency Loans Micro-Insurance Products Shariah-Compliant Microfinance Products Others |

| By End-User | Individuals Small Enterprises Micro-Enterprises Solo Entrepreneurs/Self-Employed Agricultural Sector Non-Profit Organizations |

| By Distribution Channel | Online Platforms Mobile Applications Physical Branches Partnerships with NGOs Agent Networks |

| By Loan Size | Micro Loans (up to SAR 5,000) Small Loans (SAR 5,001 - SAR 20,000) Medium Loans (SAR 20,001 - SAR 50,000) |

| By Repayment Period | Short-term (up to 1 year) Medium-term (1-3 years) Long-term (3+ years) |

| By Customer Demographics | Youth Women Entrepreneurs Rural Farmers Low-Income Households |

| By Policy Support | Government Subsidies Tax Incentives Training and Capacity Building Programs Digital Transformation Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Microfinance User Experience | 120 | Small Business Owners, Micro-entrepreneurs |

| Microfinance Institution Operations | 85 | Branch Managers, Loan Officers |

| Regulatory Impact Assessment | 65 | Policy Makers, Financial Regulators |

| Community Outreach Programs | 60 | Community Leaders, NGO Representatives |

| Financial Literacy Initiatives | 75 | Educators, Financial Advisors |

The Saudi Arabia Microfinance Platforms Market is valued at approximately SAR 2.6 billion, reflecting a significant growth driven by increasing demand for financial inclusion and government initiatives aimed at promoting entrepreneurship and small business development.