Region:Middle East

Author(s):Rebecca

Product Code:KRAD7390

Pages:90

Published On:December 2025

By Product Type:

The product type segmentation includes Tobacco-derived Nicotine Pouches, Synthetic Nicotine (TFN) Pouches, Low-Strength (?4 mg) Nicotine Pouches, Medium-Strength (6–8 mg) Nicotine Pouches, and High-Strength (?10 mg) Nicotine Pouches. Tobacco-derived Nicotine Pouches currently account for the majority of global nicotine pouch consumption, supported by their established supply chains and brand recognition. In Qatar, tobacco?derived formats are similarly favored in permitted channels, reflecting familiarity among adult users transitioning from traditional tobacco. The increasing trend towards synthetic nicotine (TFN) pouches is also notable at the global level, as they offer a tobacco?free composition that appeals to health?conscious users and to consumers focused on avoiding tobacco?derived ingredients. Medium?strength pouches (6–8 mg) are particularly popular in international markets, as they balance nicotine delivery with tolerability for a wide range of users, which supports their leading share within strength?based portfolios.

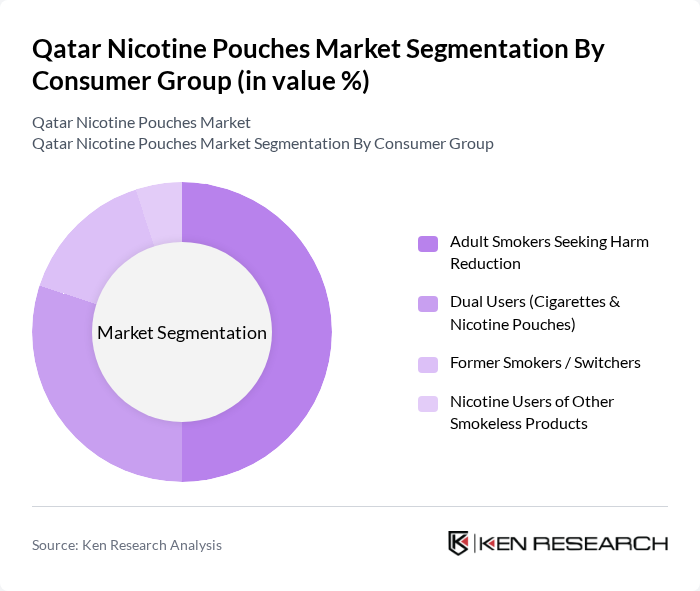

By Consumer Group:

This segmentation includes Adult Smokers Seeking Harm Reduction, Dual Users (Cigarettes & Nicotine Pouches), Former Smokers / Switchers, and Nicotine Users of Other Smokeless Products. The Adult Smokers Seeking Harm Reduction segment is the most significant globally, as many smokers are transitioning to nicotine pouches to reduce exposure to smoke and combustion?related toxicants, in line with broader harm?reduction trends. This shift is driven by increased awareness of the dangers of smoking, stricter smoke?free policies, and growing interest in discreet oral products. Dual users also represent a substantial portion of the market, as they often use both cigarettes and nicotine pouches—especially in environments where smoking is restricted—indicating a transitional stage in behavior before full switching or cessation.

The Qatar Nicotine Pouches Market is characterized by a dynamic mix of regional and international players. Leading participants such as Swedish Match AB (ZYN), British American Tobacco p.l.c. (Velo, Lyft), Philip Morris International Inc. (Shiro), Altria Group, Inc. (On! Nicotine Pouches), Japan Tobacco International SA (Nordic Spirit), Imperial Brands PLC (Skruf, Zone X), JT International Middle East FZ?LLC, British American Tobacco Middle East, Philip Morris Management Services (Middle East) Limited – Qatar Branch, Qatar Duty Free Company Q.S.C., Al Meera Consumer Goods Company Q.P.S.C., Carrefour Qatar (Majid Al Futtaim Retail LLC), Family Food Centre W.L.L., Spinneys Qatar LLC, Lulu Hypermarket Qatar (EMKE Group) contribute to innovation, geographic expansion, portfolio diversification, and the development of organized retail and travel?retail distribution for nicotine pouch products in the country.

The future of the nicotine pouches market in Qatar appears promising, driven by increasing health awareness and a shift towards smokeless alternatives. As consumer preferences evolve, manufacturers are likely to focus on product innovation and flavor diversification to attract a broader audience. Additionally, the rise of e-commerce platforms will facilitate easier access to nicotine pouches, enhancing market penetration. Strategic partnerships between manufacturers and retailers will further strengthen distribution channels, ensuring sustained growth in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Tobacco?derived Nicotine Pouches Synthetic Nicotine (TFN) Pouches Low?Strength (?4 mg) Nicotine Pouches Medium?Strength (6–8 mg) Nicotine Pouches High?Strength (?10 mg) Nicotine Pouches |

| By Consumer Group | Adult Smokers Seeking Harm Reduction Dual Users (Cigarettes & Nicotine Pouches) Former Smokers / Switchers Nicotine Users of Other Smokeless Products |

| By Distribution Channel | Duty?Free & Travel Retail (Airports, Airlines) Supermarkets & Hypermarkets Convenience Stores & Petrol Stations Vape Shops & Specialty Nicotine Stores Online Channels (D2C & Marketplaces) |

| By Flavor Profile | Mint & Menthol Fruit & Citrus Coffee & Dessert Unflavored / Tobacco?like |

| By Packaging Format | Round Plastic Cans Metal Tins Slim Pocket Packs Multipack / Value Packs |

| By Price Tier | Premium Imported Brands Mass?Market International Brands Value / Economy Brands |

| By Consumer Demographics | Age Group (18–24, 25–34, 35–44, 45+) Gender Expatriates vs Qatari Nationals Income Level |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Nicotine Pouches | 150 | Regular Users, Occasional Users, Non-Users |

| Retail Distribution Insights | 100 | Store Managers, Retail Buyers, Category Managers |

| Health Perspectives on Nicotine Products | 80 | Healthcare Professionals, Public Health Officials |

| Market Entry Strategies for New Brands | 70 | Marketing Directors, Brand Managers, Business Development Executives |

| Regulatory Impact Assessment | 60 | Regulatory Affairs Specialists, Compliance Officers |

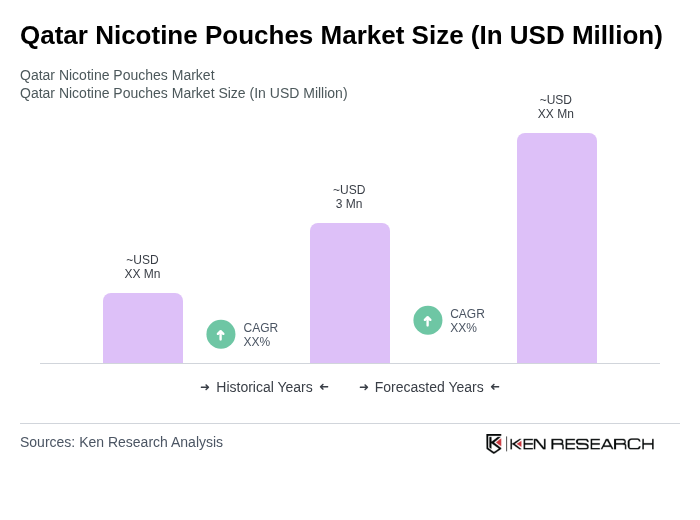

The Qatar Nicotine Pouches Market is valued at approximately USD 3 million, reflecting a growing trend towards smokeless alternatives among consumers, particularly expatriates and in travel-retail channels.