Region:Middle East

Author(s):Rebecca

Product Code:KRAD4285

Pages:91

Published On:December 2025

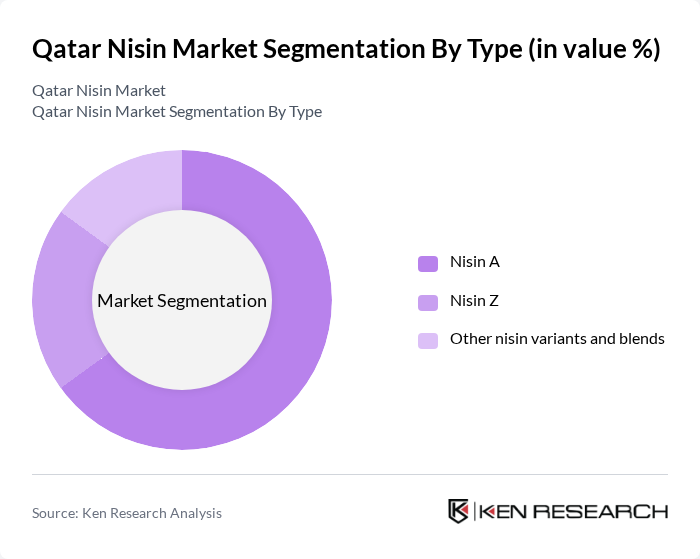

By Type:The market is segmented into three main types: Nisin A, Nisin Z, and other nisin variants and blends. Nisin A is the most widely used type due to its effectiveness against a broad spectrum of bacteria, making it a preferred choice among food manufacturers. Nisin Z, while effective, is less common, and other variants are utilized for specific applications or formulations.

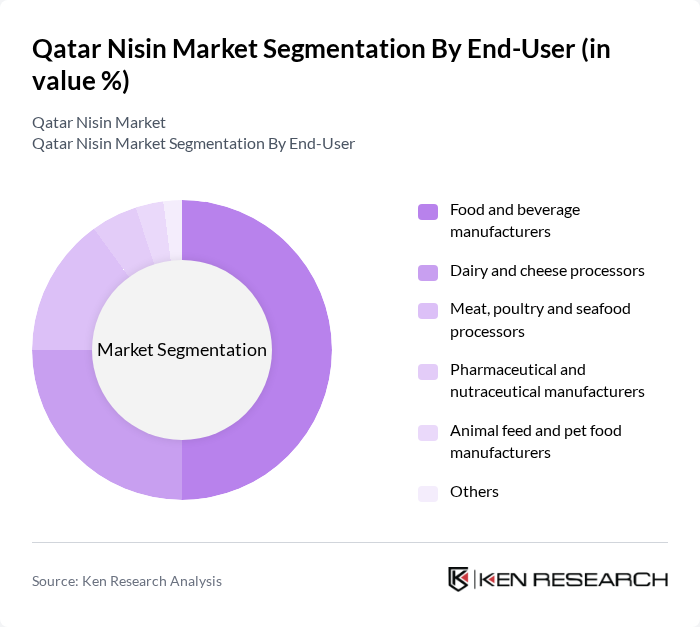

By End-User:The end-user segmentation includes food and beverage manufacturers, dairy and cheese processors, meat, poultry and seafood processors, pharmaceutical and nutraceutical manufacturers, animal feed and pet food manufacturers, and others. Food and beverage manufacturers dominate the market due to the high demand for nisin as a natural preservative in various food products, particularly in meat and dairy applications.

The Qatar Nisin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Royal DSM N.V. (DSM-Firmenich), DuPont de Nemours, Inc. (Danisco Danisco Nisin business / IFF), Kerry Group plc, Chr. Hansen Holding A/S, Siveele B.V., Zhejiang Silver-Elephant Bio-Engineering Co., Ltd., Shandong Freda Biotechnology Co., Ltd., Zhejiang Sunger Bio-Technology Co., Ltd., A&B Ingredients, Inc., Kemin Industries, Inc., Brenntag SE, Univar Solutions Inc., IMCD Group, Barentz International B.V., Local GCC and Qatar-focused specialty ingredient distributors contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nisin market in Qatar appears promising, driven by increasing consumer demand for natural ingredients and the expansion of the food processing sector. As health consciousness continues to rise, the preference for clean label products will likely enhance the market's growth. Additionally, government support for food safety regulations will further bolster the adoption of Nisin. However, addressing production costs and enhancing awareness among small-scale producers will be crucial for maximizing market potential in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Nisin A Nisin Z Other nisin variants and blends |

| By End-User | Food and beverage manufacturers Dairy and cheese processors Meat, poultry and seafood processors Pharmaceutical and nutraceutical manufacturers Animal feed and pet food manufacturers Others |

| By Application | Meat, poultry and seafood products Dairy products and cheese Bakery and confectionery products Beverages and ready-to-drink products Canned and frozen food products Others |

| By Distribution Channel | Direct sales to food manufacturers Regional distributors and importers Online B2B platforms Others |

| By Packaging Type | Bulk industrial packaging (drums, bags, cartons) Intermediate packaging for formulators Small packs for R&D and niche applications Others |

| By Region | Doha Al Rayyan Al Wakrah Al Khor and other municipalities |

| By Product Form | Powder Liquid Encapsulated and controlled-release forms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Product Manufacturers | 100 | Production Managers, Quality Control Officers |

| Meat Processing Companies | 80 | Operations Managers, Food Safety Inspectors |

| Bakery Product Producers | 70 | Product Development Managers, Supply Chain Coordinators |

| Food Retailers and Distributors | 90 | Category Managers, Procurement Specialists |

| Food Safety Regulatory Bodies | 40 | Regulatory Affairs Managers, Compliance Officers |

The Qatar Nisin Market is valued at approximately USD 10 million, reflecting a growing demand for natural preservatives in the food and beverage industry, driven by consumer awareness of food safety and quality.