Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3949

Pages:97

Published On:November 2025

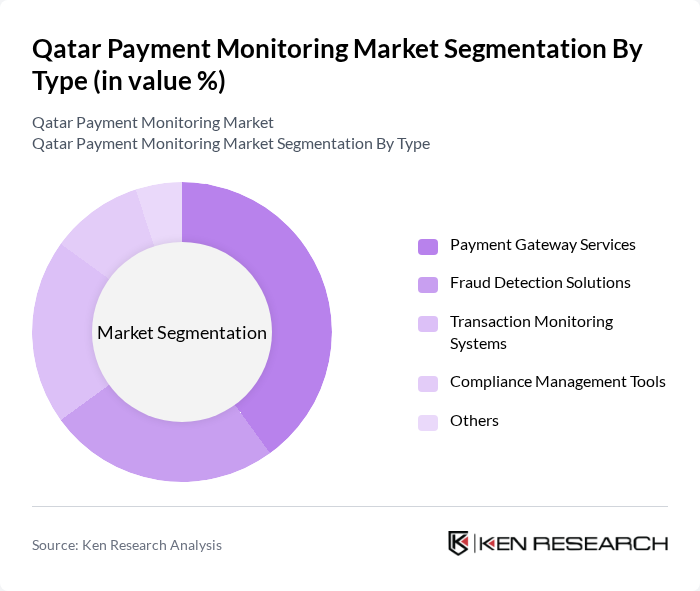

By Type:The market is segmented into various types, including Payment Gateway Services, Fraud Detection Solutions, Transaction Monitoring Systems, Compliance Management Tools, and Others. Among these, Payment Gateway Services are currently leading the market due to the increasing number of online transactions and the need for secure payment processing. The demand for Fraud Detection Solutions is also rising as businesses seek to protect themselves from financial losses associated with fraudulent activities.

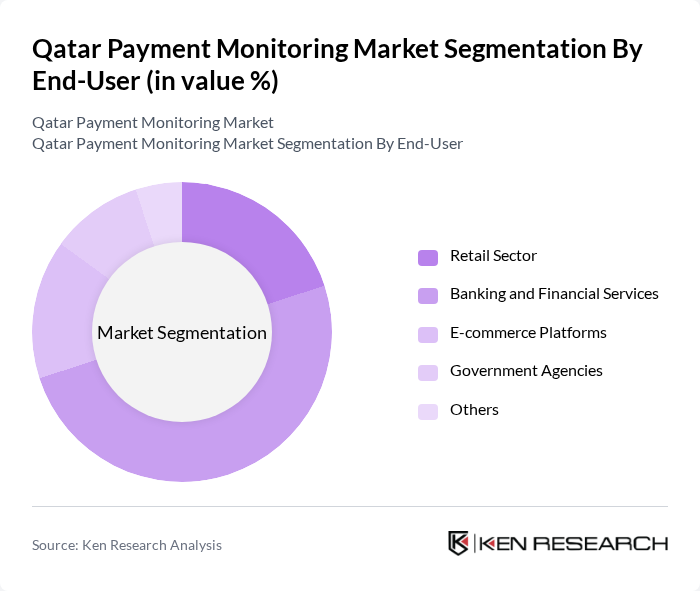

By End-User:The end-user segmentation includes Retail Sector, Banking and Financial Services, E-commerce Platforms, Government Agencies, and Others. The Banking and Financial Services sector is the dominant segment, driven by stringent regulatory requirements and the need for robust payment monitoring systems to mitigate risks. E-commerce Platforms are also witnessing significant growth as online shopping continues to rise, necessitating secure payment solutions.

The Qatar Payment Monitoring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar National Bank, Doha Bank, Commercial Bank of Qatar, QIIB (Qatar Islamic Bank), Ooredoo, Vodafone Qatar, DNB ASA, Mastercard, Visa Inc., Fawry, PayFort, STC Pay, Alipay, PayPal, and Stripe contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar payment monitoring market appears promising, driven by technological advancements and increasing consumer demand for secure payment solutions. As digital payment adoption continues to rise, the integration of artificial intelligence and machine learning in fraud detection will become crucial. Additionally, the ongoing development of blockchain technology is expected to enhance transaction transparency and security, further solidifying the market's growth trajectory. The focus on regulatory compliance will also shape the landscape, ensuring that payment providers adapt to new standards effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Gateway Services Fraud Detection Solutions Transaction Monitoring Systems Compliance Management Tools Others |

| By End-User | Retail Sector Banking and Financial Services E-commerce Platforms Government Agencies Others |

| By Payment Method | Credit/Debit Cards Mobile Wallets Bank Transfers Cryptocurrency Transactions Others |

| By Industry Vertical | Healthcare Travel and Hospitality Telecommunications Education Others |

| By Geographic Presence | Urban Areas Rural Areas Others |

| By Customer Segment | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Others |

| By Compliance Level | Fully Compliant Solutions Partially Compliant Solutions Non-Compliant Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Payment Preferences | 150 | General Consumers, Young Professionals |

| Merchant Payment Processing Insights | 100 | Small Business Owners, Retail Managers |

| Banking Sector Perspectives | 80 | Bank Executives, Payment Strategy Managers |

| Fintech Innovations and Trends | 70 | Fintech Founders, Product Development Leads |

| Regulatory Impact on Payment Systems | 60 | Regulatory Officials, Compliance Officers |

The Qatar Payment Monitoring Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital payment solutions, regulatory frameworks, and a focus on fraud detection and compliance management.