Region:Middle East

Author(s):Rebecca

Product Code:KRAD6199

Pages:95

Published On:December 2025

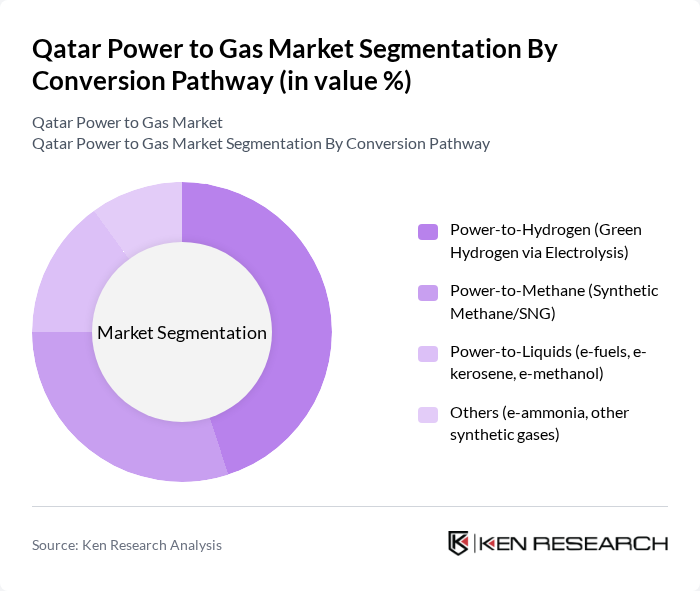

By Conversion Pathway:The Power to Gas market can be segmented into four main pathways: Power-to-Hydrogen, Power-to-Methane, Power-to-Liquids, and Others. In line with global and regional trends, Power-to-Hydrogen is emerging as the leading subsegment, driven by the increasing focus on hydrogen as a clean energy carrier for decarbonizing industry, power, and mobility. In Qatar, this is reinforced by the country’s strong natural gas and LNG base, existing industrial demand for hydrogen and ammonia, and interest in future export opportunities for low?carbon hydrogen and derivatives. The growing potential demand for hydrogen in refining, petrochemicals, fertilizers and, over the longer term, heavy transport and shipping is propelling this segment forward.

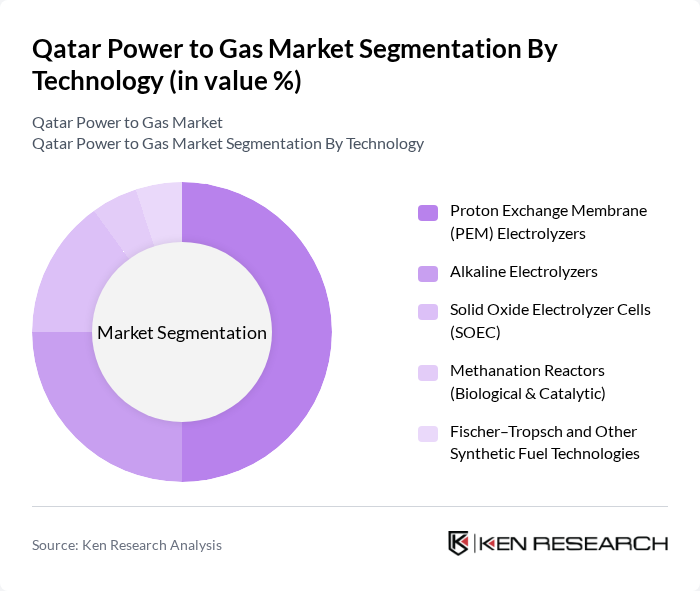

By Technology:The market can also be segmented by technology, including PEM Electrolysis, Alkaline Electrolysis, SOEC, Methanation, and Synthetic Fuel Synthesis. Globally, Proton Exchange Membrane (PEM) and Alkaline electrolyzers account for the majority of installed electrolysis capacity, with PEM favored in applications that require flexible operation and rapid response to variable renewable power. In the context of Qatar’s early?stage projects and feasibility studies, PEM Electrolyzers are positioned to lead future deployments due to their efficiency, compact footprint, and suitability for integration with utility?scale solar plants and industrial users. The increasing global adoption of PEM technology in commercial green hydrogen projects, combined with Qatar’s ongoing solar expansion and grid digitalization, is a significant factor supporting its dominance in the prospective technology mix.

The Qatar Power to Gas Market is characterized by a dynamic mix of regional and international players embedded in the wider power, gas, LNG and industrial ecosystem. Leading participants such as QatarEnergy (including QatarEnergy Renewable Solutions), QatarEnergy LNG (formerly Qatargas), Nebras Power Q.P.S.C., Qatar General Electricity & Water Corporation (Kahramaa), Qatar Electricity & Water Company Q.P.S.C. (QEWC), Siraj Energy, Qatar Solar Technologies (QSTec), Ras Laffan Power Company Limited Q.S.C., Mesaieed Power Company Q.S.C., Qatar Fertiliser Company (QAFCO), Qatar Fuel (WOQOD), QatarGas Transport Company Ltd. (Nakilat), Siemens Energy Qatar, ABB Qatar W.L.L., Shell Qatar contribute to innovation, geographic expansion, and service delivery in this space through large?scale power generation, LNG and gas processing, solar generation, grid infrastructure and industrial demand centers that can anchor future Power to Gas projects.

The future of the Qatar Power to Gas market appears promising, driven by increasing investments in renewable energy and technological advancements. In future, the integration of Power to Gas systems is expected to enhance energy security and sustainability. Additionally, the government's commitment to achieving carbon neutrality by 2030 will likely accelerate the adoption of innovative energy solutions, positioning Qatar as a leader in the transition to a low-carbon economy.

| Segment | Sub-Segments |

|---|---|

| By Conversion Pathway (Power-to-Hydrogen, Power-to-Methane, Power-to-Liquids, Others) | Power-to-Hydrogen (Green Hydrogen via Electrolysis) Power-to-Methane (Synthetic Methane/SNG) Power-to-Liquids (e-fuels, e-kerosene, e-methanol) Others (e-ammonia, other synthetic gases) |

| By Technology (PEM Electrolysis, Alkaline Electrolysis, SOEC, Methanation & Synthetic Fuel Synthesis) | Proton Exchange Membrane (PEM) Electrolyzers Alkaline Electrolyzers Solid Oxide Electrolyzer Cells (SOEC) Methanation Reactors (Biological & Catalytic) Fischer–Tropsch and Other Synthetic Fuel Technologies |

| By Renewable Power Source for P2G (Solar PV, Solar CSP, Wind, Grid-Mix/Other) | Utility-Scale Solar PV (e.g., Al Kharsaah Solar PV) Distributed/Rooftop Solar PV Solar CSP and Hybrid Solar-Gas Plants Wind and Other Renewable Sources Grid-Mix / Surplus Power |

| By End-Use Sector (Gas Grid Injection, Industrial Feedstock, Mobility & Transport, Power & Heat, Export-Oriented Projects) | Injection into Natural Gas Grid & LNG Value Chain Industrial Feedstock (Refining, Petrochemicals, Steel, Ammonia) Mobility & Transport (Shipping, Heavy-Duty Vehicles, Aviation e-fuels) Power & Heat Generation (Re-electrification, CHP) Export-Oriented Green Hydrogen/Ammonia Projects |

| By Project Scale (Pilot/Demonstration, Commercial-Scale, Utility-Scale/Complex-Integrated) | Pilot and Demonstration Projects Commercial-Scale Distributed P2G Systems Utility-Scale and Industrial Cluster-Integrated Projects |

| By Ownership & Business Model (Government-Owned, IPPs, PPPs, Industrial Captive) | Government-Owned & State Utility-Led Projects Independent Power Producers (IPPs) & Clean Energy Developers Public–Private Partnerships (PPPs) Captive Industrial & Refinery/Petrochemical-Integrated Projects |

| By Geography | Ad Dawhah (Doha & Ras Laffan Industrial Area) Al Rayyan Al Wakrah (including Mesaieed Industrial City) Other Municipalities (Al Khor, Al Shamal, Dukhan, etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Energy Sector Executives | 120 | CEOs, CTOs, and Senior Management from energy companies |

| Regulatory Bodies | 40 | Policy Makers, Energy Regulators, and Government Officials |

| Technology Providers | 75 | Product Managers, Engineers, and R&D Heads from technology firms |

| Academic Researchers | 40 | Professors, Research Scientists, and Graduate Students in energy studies |

| Industry Consultants | 60 | Consultants specializing in energy transition and sustainability |

The Qatar Power to Gas Market is valued at approximately USD 1.1 billion, reflecting early-stage growth in low-carbon hydrogen and synthetic fuels, driven by increasing demand for sustainable energy solutions and government initiatives under Qatar National Vision 2030.