Region:Middle East

Author(s):Rebecca

Product Code:KRAD4993

Pages:81

Published On:December 2025

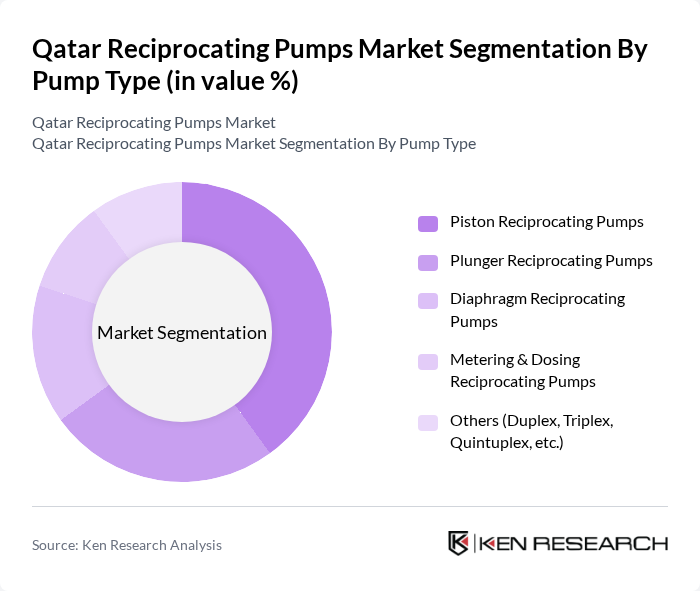

By Pump Type:The market is segmented into various pump types, including Piston Reciprocating Pumps, Plunger Reciprocating Pumps, Diaphragm Reciprocating Pumps, Metering & Dosing Reciprocating Pumps, and Others (Duplex, Triplex, Quintuplex, etc.). This classification is consistent with global reciprocating pump segmentation used in leading industry studies. Among these, Piston Reciprocating Pumps are widely used in Qatar’s industrial base due to their versatility and efficiency in handling a wide range of relatively clean fluids at moderate to high pressures, making them suitable for many utility and process duties. However, for the most demanding high-pressure services in oil and gas (such as well service, injection, and certain chemical dosing applications), plunger and diaphragm reciprocating pumps are also critical, given their superior pressure capabilities and sealing performance; together, these three types form the core of high?pressure and metering applications in the country.

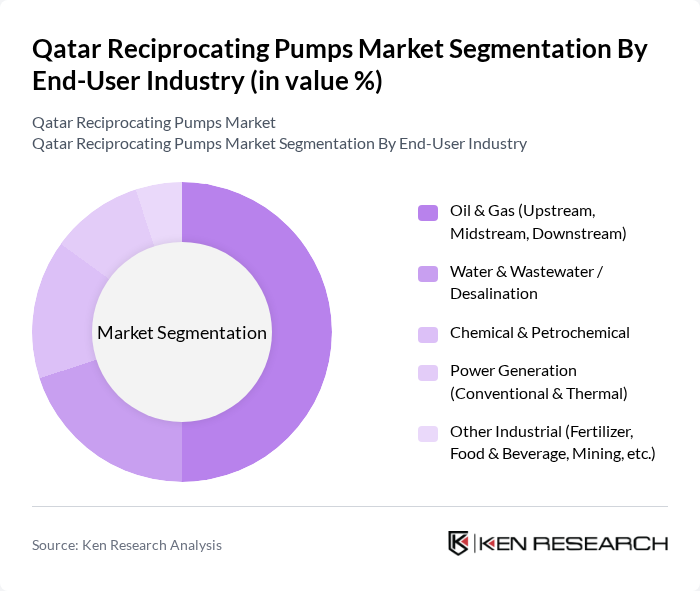

By End-User Industry:The market is segmented by end-user industries, including Oil & Gas (Upstream, Midstream, Downstream), Water & Wastewater / Desalination, Chemical & Petrochemical, Power Generation (Conventional & Thermal), and Other Industrial (Fertilizer, Food & Beverage, Mining, etc.). This segmentation reflects the primary applications of reciprocating pumps observed globally and across the Middle East. The Oil & Gas sector is the leading end-user in Qatar, driven by the need for reliable high-pressure pumping, chemical injection, and process transfer solutions in exploration, production, gas processing, and LNG operations. The increasing focus on water management and treatment, including large-scale desalination and wastewater treatment, also boosts demand in the Water & Wastewater / Desalination sector, where positive displacement and reciprocating pumps are used for dosing, sludge handling, and high-pressure services within broader pump systems.

The Qatar Reciprocating Pumps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Flowserve Corporation, Sulzer Ltd, KSB SE & Co. KGaA, Ebara Corporation, Weir Group PLC, SPX Flow, Inc., ITT Inc., Xylem Inc., Ruhrpumpen Group, National Oilwell Varco, Inc. (NOV), LEWA GmbH, Milton Roy (Ingersoll Rand Inc.), Grundfos Holding A/S, KSB Qatar / KSB Service LLC (Local Entity), Flowserve Qatar (Local Service & Sales Entity) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar reciprocating pumps market appears promising, driven by technological advancements and increasing demand for energy-efficient solutions. As industries prioritize sustainability, the integration of smart technologies and IoT in pump systems is expected to enhance operational efficiency. Furthermore, the government's commitment to infrastructure development will likely create a favorable environment for market growth, encouraging investments in innovative pumping solutions that meet evolving industry needs.

| Segment | Sub-Segments |

|---|---|

| By Pump Type | Piston Reciprocating Pumps Plunger Reciprocating Pumps Diaphragm Reciprocating Pumps Metering & Dosing Reciprocating Pumps Others (Duplex, Triplex, Quintuplex, etc.) |

| By End-User Industry | Oil & Gas (Upstream, Midstream, Downstream) Water & Wastewater / Desalination Chemical & Petrochemical Power Generation (Conventional & Thermal) Other Industrial (Fertilizer, Food & Beverage, Mining, etc.) |

| By Application | High-Pressure Injection (Water / Chemical / Polymer) Process & Transfer Pumping Metering & Dosing Cooling, Boiler Feed & Utility Services Other Specialized Applications (Hydrotesting, Firefighting Skids, etc.) |

| By Material of Construction | Carbon Steel Stainless Steel & Duplex / Super Duplex High-Alloy / Corrosion-Resistant Alloys Non-Metallic & Lined (PTFE, Rubber, etc.) Others |

| By Power Rating | Up to 50 kW –200 kW –500 kW Above 500 kW |

| By Sales Channel | Direct OEM / EPC Sales Local Distributors & Trading Companies Aftermarket / Service & Spares Others |

| By Region | Doha Al Rayyan Al Wakrah Others (Umm Salal, Al Khor, Al Daayen, Al Shamal, etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector | 120 | Operations Managers, Procurement Specialists |

| Water Treatment Facilities | 90 | Plant Managers, Environmental Engineers |

| Power Generation Plants | 80 | Maintenance Supervisors, Technical Directors |

| Manufacturing Industries | 70 | Production Managers, Quality Control Officers |

| Research & Development Departments | 60 | R&D Managers, Product Development Engineers |

The Qatar Reciprocating Pumps Market is valued at approximately USD 140 million, driven by the demand for efficient fluid handling solutions in sectors such as oil and gas, water management, and industrial applications.