Region:Middle East

Author(s):Shubham

Product Code:KRAB4428

Pages:89

Published On:October 2025

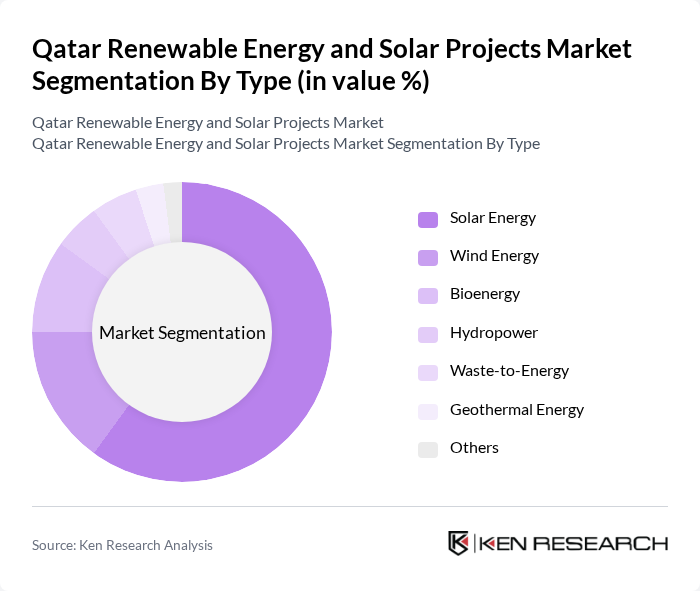

By Type:The market is segmented into various types of renewable energy sources, including solar energy, wind energy, bioenergy, hydropower, waste-to-energy, geothermal energy, and others. Among these, solar energy is the most dominant segment due to Qatar's abundant sunlight and government support for solar initiatives. Wind energy is also gaining traction, but solar remains the primary focus due to its scalability and technological advancements.

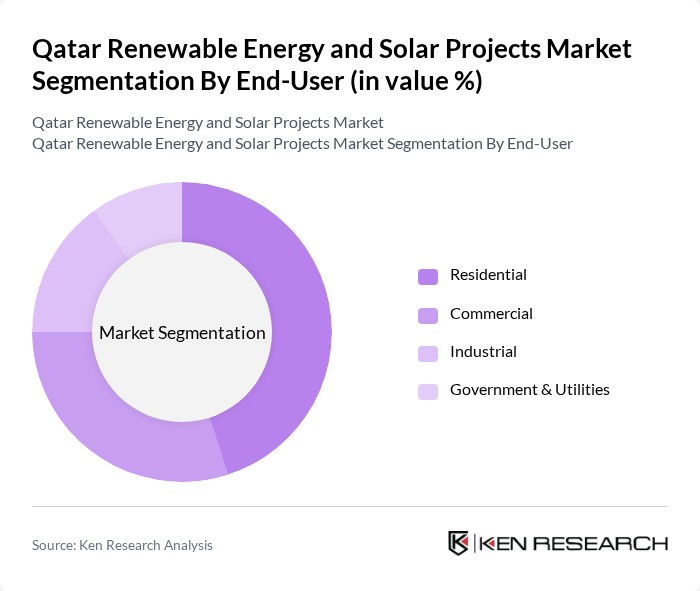

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities sectors. The residential segment is currently leading the market, driven by increasing consumer awareness of renewable energy benefits and government incentives for solar installations. The commercial and industrial sectors are also significant contributors, as businesses seek to reduce energy costs and enhance sustainability.

The Qatar Renewable Energy and Solar Projects Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Solar Technologies, Qatar Electricity and Water Company, Qatar General Electricity and Water Corporation (Kahramaa), First Solar, Inc., Siemens AG, TotalEnergies SE, Enel Green Power, ACWA Power, Masdar, JinkoSolar Holding Co., Ltd., Canadian Solar Inc., Trina Solar Limited, SunPower Corporation, ABB Ltd., Schneider Electric SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of Qatar's renewable energy market appears promising, driven by a combination of government support and technological advancements. In the future, the country is expected to see a significant increase in solar capacity, with projects like the Al Kharsaah Solar PV Plant contributing to the energy mix. Additionally, the growing trend of international partnerships will likely enhance local expertise and investment, fostering a more robust renewable energy ecosystem that aligns with global sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Energy Wind Energy Bioenergy Hydropower Waste-to-Energy Geothermal Energy Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Grid-Connected Systems Off-Grid Systems Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Solar Project Developers | 100 | Project Managers, Technical Directors |

| Government Energy Policy Makers | 80 | Energy Ministers, Regulatory Officials |

| Renewable Energy Equipment Suppliers | 70 | Sales Managers, Product Engineers |

| Energy Consultants and Analysts | 60 | Market Analysts, Sustainability Consultants |

| End-users of Solar Energy | 90 | Facility Managers, Corporate Sustainability Officers |

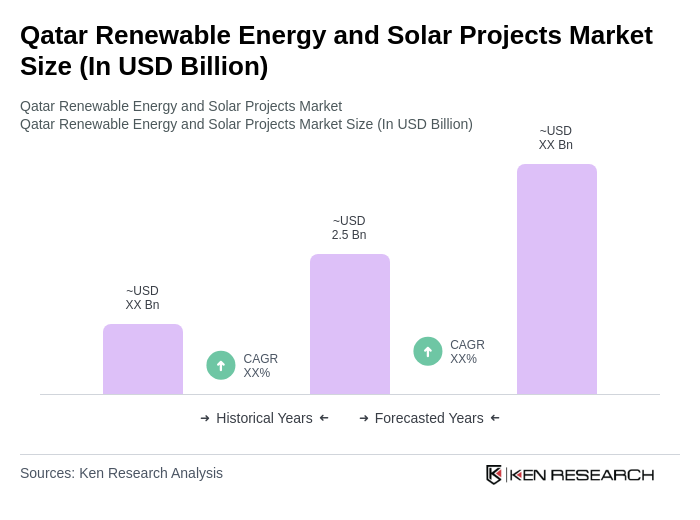

The Qatar Renewable Energy and Solar Projects Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by government initiatives aimed at diversifying energy sources and reducing carbon emissions through investments in renewable technologies.