Region:Middle East

Author(s):Shubham

Product Code:KRAD5370

Pages:99

Published On:December 2025

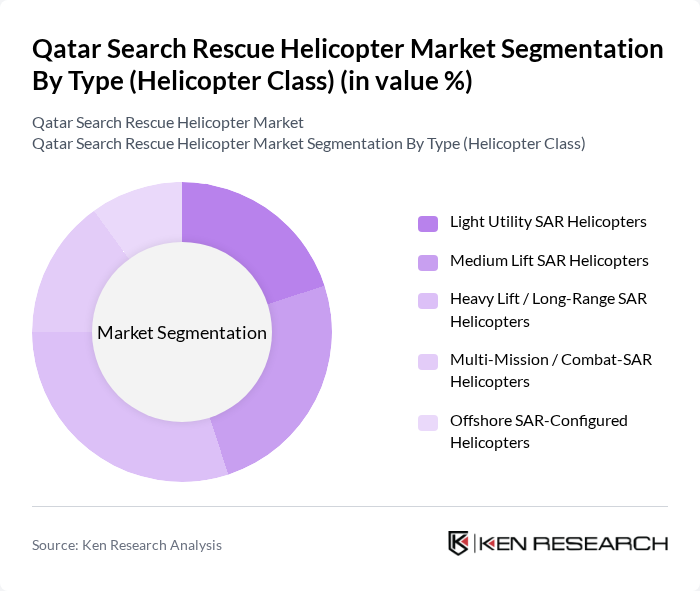

By Type (Helicopter Class):The market is segmented into various helicopter classes, each serving specific operational needs. The Light Utility SAR Helicopters are favored for their versatility in urban environments, while Medium Lift SAR Helicopters are preferred for their balance of capacity and range. Heavy Lift / Long-Range SAR Helicopters dominate in offshore operations due to their ability to cover vast distances and carry larger payloads. Multi-Mission / Combat-SAR Helicopters are increasingly utilized for specialized missions, and Offshore SAR-Configured Helicopters are essential for oil and gas operations.

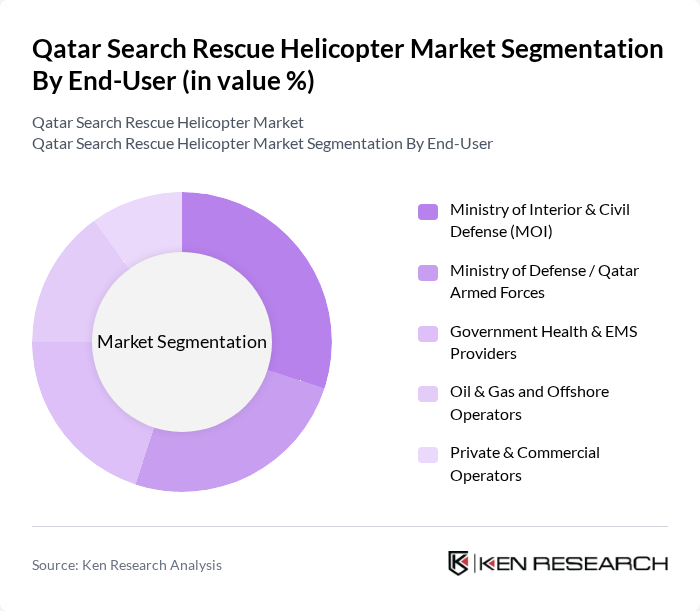

By End-User:The end-user segmentation includes various government and private entities that utilize search and rescue helicopters. The Ministry of Interior & Civil Defense (MOI) is a significant user due to its responsibility for public safety. The Ministry of Defense / Qatar Armed Forces also plays a crucial role, utilizing helicopters for military operations. Government Health & EMS Providers are increasingly relying on air medical services, while Oil & Gas and Offshore Operators require helicopters for emergency response in remote locations. Private & Commercial Operators are also emerging as key players in this market.

The Qatar Search Rescue Helicopter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Helicopters Company (GHC), Barzan Holdings (Military Aviation & ISR Programs), Leonardo S.p.A. (AW139 / AW189 SAR Platforms in Qatar), Airbus Helicopters (H145 / H225 SAR and HEMS Platforms), Qatar Emiri Air Force (QEAF) – Search & Rescue Wing, Ministry of Interior – Air Operations Department, Hamad Medical Corporation – Ambulance Service (Air Ambulance Operations), Qatar Civil Aviation Authority – Aviation Safety & Regulation, Qatar Civil Defence – Search & Rescue and Firefighting Aviation Units, North Oil Company & Offshore Operators (Offshore SAR Contracting), Qatar Red Crescent Society – Air-Supported Humanitarian & Disaster Response, Ministry of Transport – Air Navigation & Rescue Coordination, National Command Center – Joint Search & Rescue Coordination, International Contractors (e.g., Bristow Group, Babcock International) Supporting Gulf SAR Operations, Local and Regional MRO Providers for SAR Helicopter Fleets contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar search and rescue helicopter market appears promising, driven by ongoing government initiatives and technological advancements. As the population grows and urbanization increases, the need for efficient emergency response systems will intensify. Additionally, the integration of advanced communication technologies and hybrid helicopters is expected to enhance operational efficiency. The focus on sustainability will also shape future investments, leading to more eco-friendly practices in rescue operations, ensuring a robust market environment.

| Segment | Sub-Segments |

|---|---|

| By Type (Helicopter Class) | Light Utility SAR Helicopters Medium Lift SAR Helicopters Heavy Lift / Long-Range SAR Helicopters Multi-Mission / Combat-SAR Helicopters Offshore SAR-Configured Helicopters |

| By End-User | Ministry of Interior & Civil Defense (MOI) Ministry of Defense / Qatar Armed Forces Government Health & EMS Providers Oil & Gas and Offshore Operators Private & Commercial Operators |

| By Mission Profile | Air Medical & HEMS (Helicopter Emergency Medical Services) Maritime & Offshore Search and Rescue Combat Search and Rescue (CSAR) Disaster Relief & Humanitarian Support Border Security & Coastal Surveillance Support |

| By Payload / Seating Capacity | Up to 6 Passengers / Light Payload –12 Passengers / Medium Payload Above 12 Passengers / Heavy Payload Dedicated Cargo & Special Equipment Configurations |

| By Operating Base | Land-Based SAR Units (Airfields & Heliports) Offshore Platform & Rig-Based Operations Naval Vessel-Based SAR Detachments Joint Operations & Multi-Agency Coordination Centers |

| By Avionics & Systems Technology | Basic IFR / VFR-Equipped SAR Helicopters Advanced SAR Avionics (NVG, FLIR, Radar, AIS) Satellite-Enabled & Network-Centric SAR Platforms Integration with Unmanned Aerial Systems (Manned-Unmanned Teaming) |

| By Funding & Procurement Model | Direct Government Procurement Public–Private Partnership (PPP) Contracts Outsourced SAR Services / Long-Term Service Contracts Donor, Multilateral & International Support Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Emergency Services | 100 | Emergency Response Coordinators, Policy Makers |

| Private Helicopter Operators | 80 | Operations Managers, Fleet Supervisors |

| Search and Rescue NGOs | 60 | Program Directors, Field Operations Managers |

| Aviation Regulatory Bodies | 50 | Regulatory Officers, Safety Inspectors |

| Training Institutions for Pilots | 40 | Training Coordinators, Curriculum Developers |

The Qatar Search Rescue Helicopter Market is valued at approximately USD 450 million, reflecting a five-year historical analysis. This growth is attributed to increased investments in emergency response capabilities and advancements in helicopter technology.