Region:Middle East

Author(s):Rebecca

Product Code:KRAC4663

Pages:80

Published On:October 2025

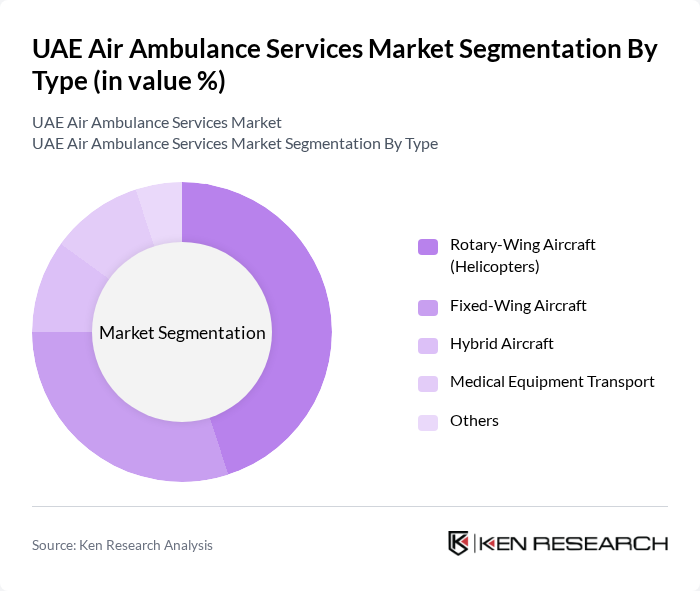

By Type:The market is segmented into various types, including Rotary-Wing Aircraft (Helicopters), Fixed-Wing Aircraft, Hybrid Aircraft, Medical Equipment Transport, and Others. Among these, Rotary-Wing Aircraft (Helicopters) dominate the market due to their ability to access remote locations quickly and provide immediate medical assistance. The flexibility and speed of helicopters make them the preferred choice for emergency medical services, especially in urban areas where traffic congestion can delay ground transport.

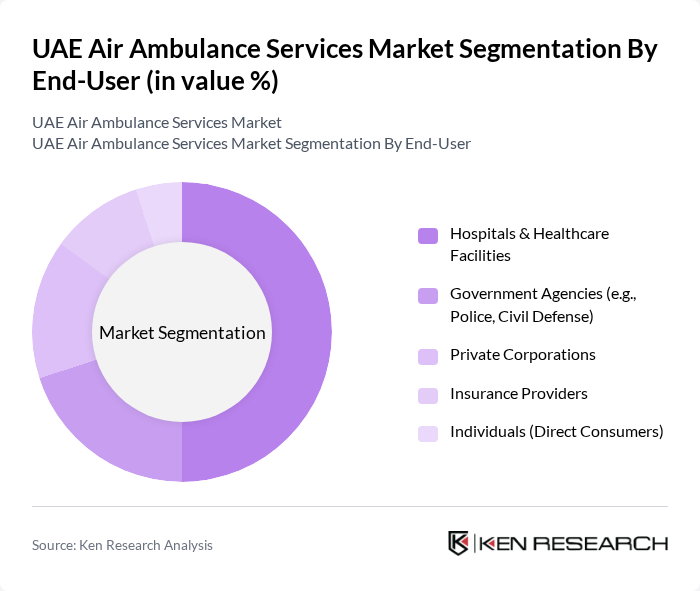

By End-User:The end-user segmentation includes Hospitals & Healthcare Facilities, Government Agencies (e.g., Police, Civil Defense), Private Corporations, Insurance Providers, and Individuals (Direct Consumers). Hospitals & Healthcare Facilities are the leading end-users, as they require air ambulance services for critical patient transfers and emergency medical situations. The increasing number of healthcare facilities and the growing emphasis on patient-centered care contribute to the dominance of this segment.

The UAE Air Ambulance Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Ambulance LLC, Abu Dhabi Aviation, Emirates Flight Ambulance (Emirates Airlines Medical Services), Dubai Corporation for Ambulance Services, AirMed International, Global Air Rescue, Air Ambulance Worldwide, Lifeline Air Ambulance, Royal Jet, Falcon Aviation Services, Medavia, IAS Medical, REVA Air Ambulance, Air Charter Service, Gulf Helicopters contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE air ambulance services market appears promising, driven by technological advancements and increasing healthcare investments. As the government continues to enhance healthcare infrastructure, air ambulance services are likely to expand their reach and capabilities. The integration of telemedicine and advanced medical equipment will further improve patient care during transport. Additionally, the growing expatriate population and tourism will create a higher demand for emergency medical services, ensuring sustained growth in this sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Rotary-Wing Aircraft (Helicopters) Fixed-Wing Aircraft Hybrid Aircraft Medical Equipment Transport Others |

| By End-User | Hospitals & Healthcare Facilities Government Agencies (e.g., Police, Civil Defense) Private Corporations Insurance Providers Individuals (Direct Consumers) |

| By Service Type | Emergency Medical Services (EMS) Inter-facility Patient Transfers Medical Repatriation Organ Transport Event Medical Services Others |

| By Region | Abu Dhabi Dubai Sharjah Northern Emirates Others |

| By Aircraft Size | Light Aircraft Medium Aircraft Large Aircraft |

| By Response Time | Under 30 Minutes 60 Minutes Over 60 Minutes |

| By Pricing Model | Pay-Per-Use Subscription-Based Contractual Agreements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Air Ambulance Service Providers | 50 | CEOs, Operations Managers |

| Healthcare Professionals | 60 | Emergency Physicians, Paramedics |

| Insurance Companies | 40 | Claims Adjusters, Underwriters |

| Patients and Families | 40 | Recent Users of Air Ambulance Services |

| Regulatory Bodies | 40 | Policy Makers, Health Administrators |

The UAE Air Ambulance Services Market is valued at approximately USD 120 million, reflecting significant growth driven by the increasing demand for rapid medical response services and advancements in aviation technology.