Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4045

Pages:85

Published On:December 2025

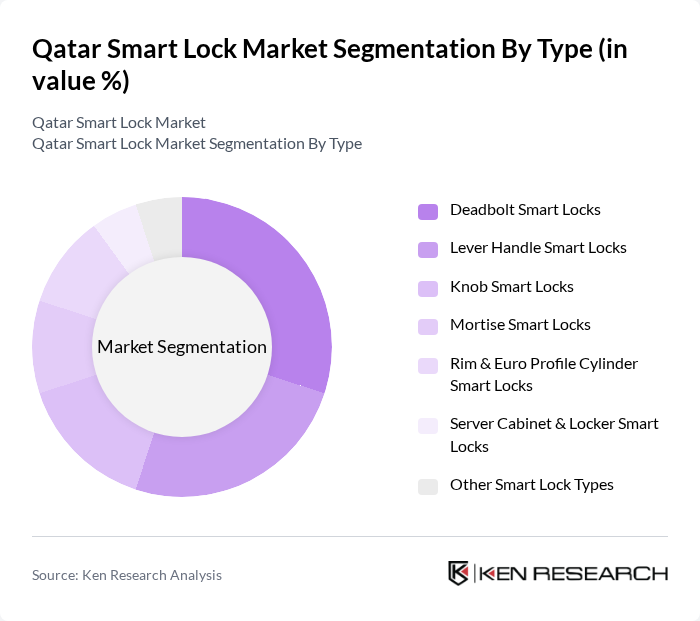

By Type:The market is segmented into various types of smart locks, including Deadbolt Smart Locks, Lever Handle Smart Locks, Knob Smart Locks, Mortise Smart Locks, Rim & Euro Profile Cylinder Smart Locks, Server Cabinet & Locker Smart Locks, and Other Smart Lock Types. Each type caters to different consumer preferences and security needs, with deadbolt and lever?handle formats favored in villas and apartments, while mortise and server?cabinet locks see higher uptake in commercial, hospitality, and data?center applications.

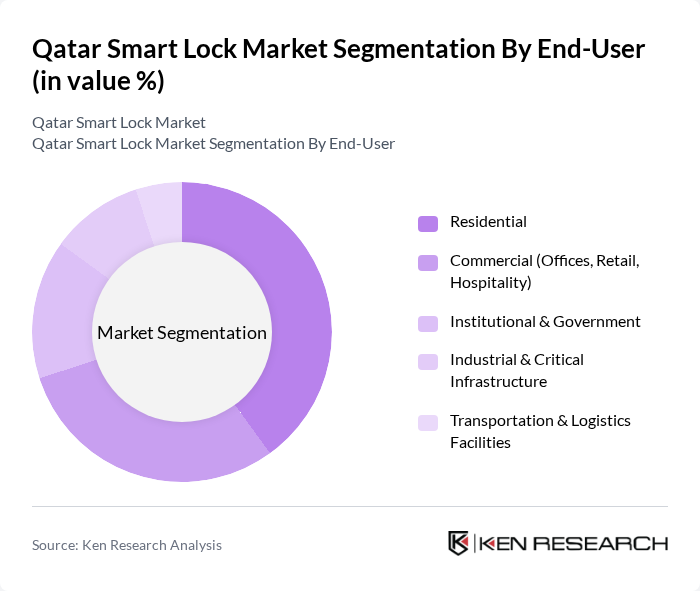

By End-User:The smart lock market is segmented by end-user into Residential, Commercial (Offices, Retail, Hospitality), Institutional & Government, Industrial & Critical Infrastructure, and Transportation & Logistics Facilities. Each segment has unique requirements and preferences for smart lock solutions, with residential demand driven by smart home ecosystems and mobile?app control, while commercial, institutional, and infrastructure users prioritize integration with access control, time?attendance, and centralized security monitoring platforms.

The Qatar Smart Lock Market is characterized by a dynamic mix of regional and international players. Leading participants such as ASSA ABLOY AB (Yale, HID, etc.), Allegion plc (Schlage), Dormakaba Holding AG, Honeywell International Inc., Samsung Electronics Co., Ltd. (Samsung Smart Door Lock), Bosch Security Systems GmbH, Salto Systems S.L., Dahua Technology Co., Ltd., Zhejiang Hikvision Digital Technology Co., Ltd., Yale Middle East (ASSA ABLOY Middle East FZE), Dormakaba Qatar LLC, Qatar Security Systems Co. (Electra Group), Alaraby Security & Safety Systems, Gulf Security Technology (GST Qatar), Mannai Trading Co. W.L.L. (Technology Division) contribute to innovation, geographic expansion, and service delivery in this space, with many focusing on cloud?based access platforms, mobile credentials, and integration with broader smart building and surveillance systems.

The future of the smart lock market in Qatar appears promising, driven by increasing urbanization and a growing emphasis on home security. As more consumers embrace smart home technologies, the demand for integrated security solutions is expected to rise. Additionally, advancements in artificial intelligence and machine learning will likely enhance the functionality of smart locks, making them more appealing. Collaborations with real estate developers will further facilitate market penetration, ensuring that smart locks become standard features in new housing projects.

| Segment | Sub-Segments |

|---|---|

| By Type | Deadbolt Smart Locks Lever Handle Smart Locks Knob Smart Locks Mortise Smart Locks Rim & Euro Profile Cylinder Smart Locks Server Cabinet & Locker Smart Locks Other Smart Lock Types |

| By End-User | Residential Commercial (Offices, Retail, Hospitality) Institutional & Government Industrial & Critical Infrastructure Transportation & Logistics Facilities |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Al Khor & Al Shamal |

| By Connectivity Technology | Bluetooth Smart Locks Wi?Fi Smart Locks Z?Wave Smart Locks Zigbee Smart Locks NFC and RFID Smart Locks Other Connectivity Technologies |

| By Application | Access Control & Authentication Asset & Equipment Control Smart Home & Building Automation Short?Stay & Rental Properties Other Applications |

| By Distribution Channel | Offline (Security Dealers, System Integrators, Retail) Online (E?commerce & Marketplaces) Direct Sales to Projects Other Channels |

| By Unlocking Mechanism | Keypad / PIN Code Biometric (Fingerprint, Face) RFID / Key Card / Fob Smartphone & Mobile App Hybrid & Multi?Factor Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Smart Lock Users | 150 | Homeowners, Renters |

| Commercial Property Managers | 100 | Facility Managers, Security Directors |

| Retail Sector Decision Makers | 80 | Store Managers, Security Consultants |

| Smart Home Technology Enthusiasts | 70 | Tech Savvy Consumers, Early Adopters |

| Construction and Real Estate Developers | 60 | Project Managers, Architects |

The Qatar Smart Lock Market is valued at approximately USD 8 million, driven by urbanization, security concerns, and the adoption of smart home technologies, particularly in high-end residential and commercial developments.