Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7334

Pages:89

Published On:October 2025

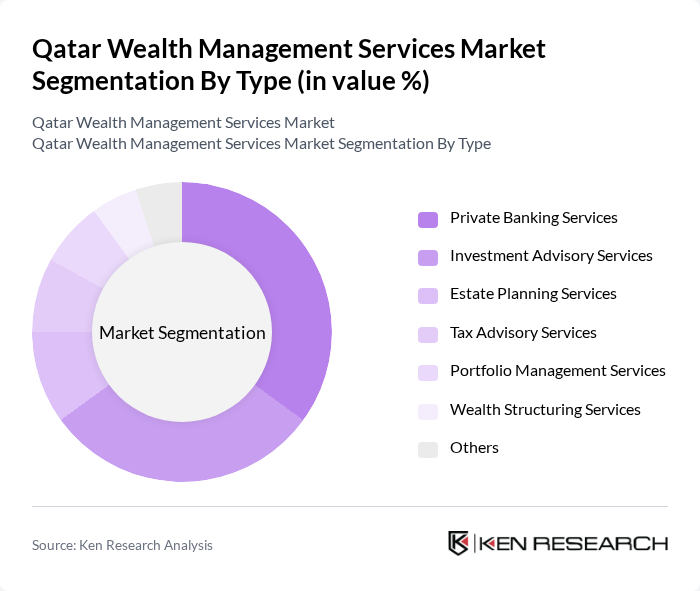

By Type:The wealth management services market is segmented into various types, including Private Banking Services, Investment Advisory Services, Estate Planning Services, Tax Advisory Services, Portfolio Management Services, Wealth Structuring Services, and Others. Among these, Private Banking Services and Investment Advisory Services are particularly prominent due to the increasing demand for personalized financial solutions and investment strategies tailored to individual client needs.

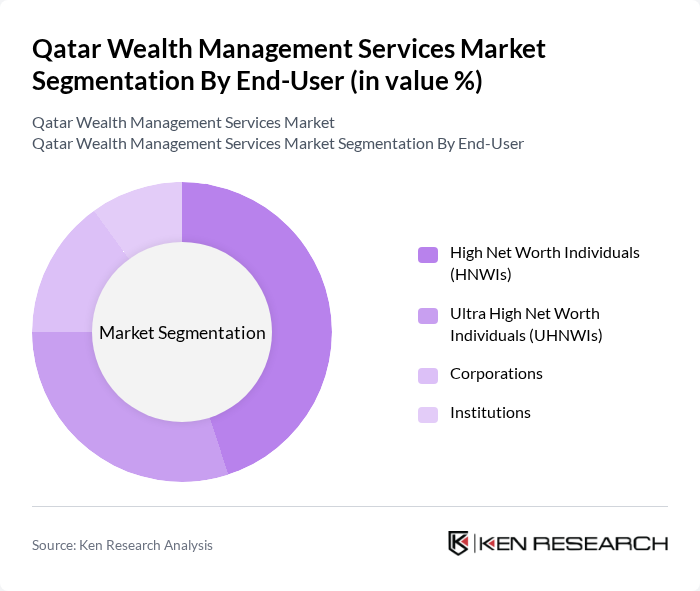

By End-User:The end-user segmentation of the wealth management services market includes High Net Worth Individuals (HNWIs), Ultra High Net Worth Individuals (UHNWIs), Corporations, and Institutions. The HNWIs and UHNWIs segments dominate the market, driven by their increasing wealth and the need for specialized financial services to manage their assets effectively.

The Qatar Wealth Management Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar National Bank, Doha Bank, Qatar Islamic Bank, Commercial Bank of Qatar, Masraf Al Rayan, Al Khaliji Commercial Bank, QInvest, Amwal Qatar, Barwa Bank, Qatar Financial Centre, Qatar Investment Authority, Doha Insurance Company, Qatar Development Bank, Al Jazeera Finance, Qatar Wealth Management Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of Qatar's wealth management services market appears promising, driven by technological advancements and evolving client expectations. The integration of digital platforms and AI-driven solutions is expected to enhance service delivery and client engagement. Additionally, as sustainability becomes a priority, wealth management firms are likely to focus on ESG investments, aligning with global trends. This shift will not only attract new clients but also foster long-term relationships, positioning firms for sustained growth in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Private Banking Services Investment Advisory Services Estate Planning Services Tax Advisory Services Portfolio Management Services Wealth Structuring Services Others |

| By End-User | High Net Worth Individuals (HNWIs) Ultra High Net Worth Individuals (UHNWIs) Corporations Institutions |

| By Service Model | Fee-Only Model Commission-Based Model Hybrid Model |

| By Investment Strategy | Active Management Passive Management Tactical Asset Allocation |

| By Client Demographics | Age Group (Millennials, Gen X, Baby Boomers) Gender Income Level |

| By Geographic Focus | Domestic Investments International Investments |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| High-Net-Worth Individuals | 150 | Individuals with investable assets over QAR 1 million |

| Wealth Management Advisors | 100 | Financial advisors and wealth managers from leading firms |

| Family Offices | 80 | Executives and decision-makers from family-owned investment entities |

| Private Banking Clients | 70 | Clients of private banks with tailored wealth management services |

| Investment Analysts | 60 | Analysts specializing in wealth management and investment strategies |

The Qatar Wealth Management Services Market is valued at approximately USD 30 billion, driven by the increasing wealth of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) in the region, along with a growing demand for personalized financial services.