Region:Middle East

Author(s):Rebecca

Product Code:KRAB7364

Pages:100

Published On:October 2025

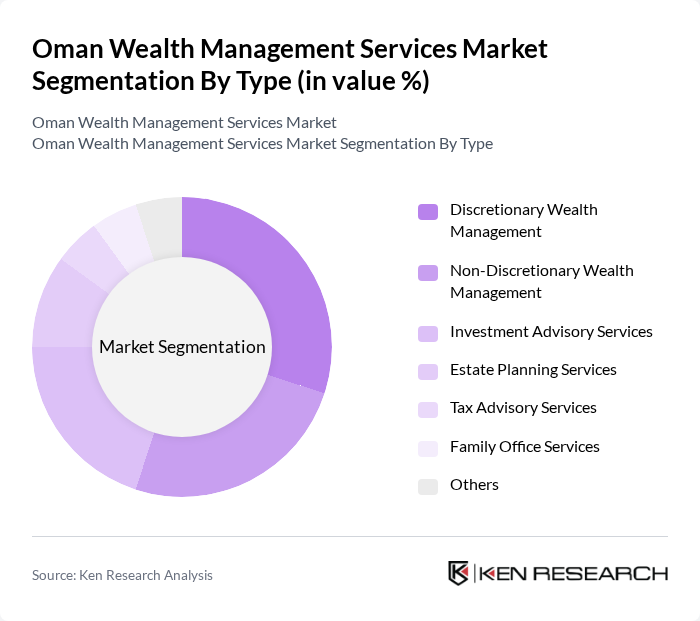

By Type:The wealth management services market can be segmented into various types, including discretionary wealth management, non-discretionary wealth management, investment advisory services, estate planning services, tax advisory services, family office services, and others. Each of these segments caters to different client needs and preferences, with discretionary wealth management being particularly popular among affluent clients seeking personalized investment strategies.

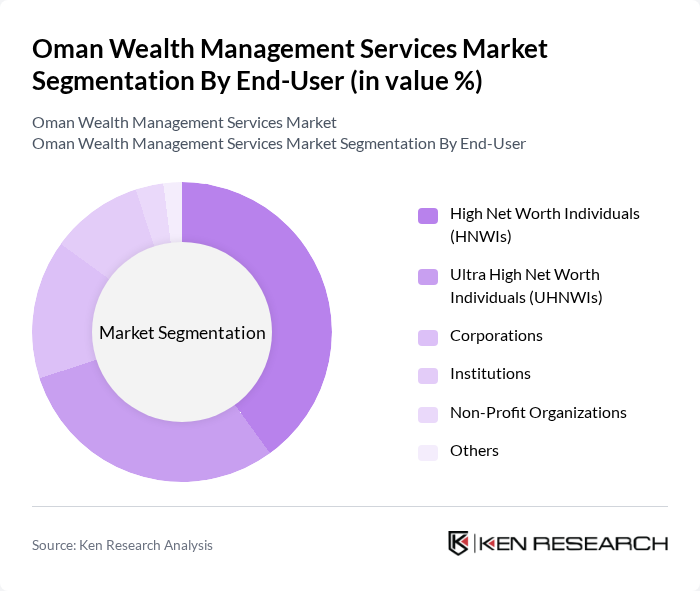

By End-User:The end-user segmentation includes high net worth individuals (HNWIs), ultra high net worth individuals (UHNWIs), corporations, institutions, non-profit organizations, and others. HNWIs and UHNWIs represent the largest segments, driven by their need for comprehensive wealth management solutions that address their complex financial situations.

The Oman Wealth Management Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Muscat, Oman Arab Bank, National Bank of Oman, Dhofar Bank, Alizz Islamic Bank, Oman Investment Authority, Muscat Capital, Oman International Development and Investment Company, Al Habib Investment Company, Al Ahlia Insurance Company, Oman Insurance Company, Bank Dhofar, Oman National Investment Corporation Holding, Muscat Securities Market, Oman Investment Fund contribute to innovation, geographic expansion, and service delivery in this space.

The Oman wealth management services market is poised for significant transformation, driven by technological advancements and evolving client preferences. As firms increasingly adopt digital solutions, the integration of AI and data analytics will enhance service personalization and operational efficiency. Additionally, the growing focus on sustainable investments will reshape portfolio strategies, aligning with global trends. These developments will create a dynamic environment, fostering innovation and competition among wealth management providers in Oman.

| Segment | Sub-Segments |

|---|---|

| By Type | Discretionary Wealth Management Non-Discretionary Wealth Management Investment Advisory Services Estate Planning Services Tax Advisory Services Family Office Services Others |

| By End-User | High Net Worth Individuals (HNWIs) Ultra High Net Worth Individuals (UHNWIs) Corporations Institutions Non-Profit Organizations Others |

| By Service Channel | Direct Sales Online Platforms Financial Advisors Partnerships with Banks Others |

| By Investment Strategy | Active Management Passive Management Tactical Asset Allocation Strategic Asset Allocation Others |

| By Asset Class | Equities Fixed Income Real Estate Commodities Alternatives Others |

| By Client Demographics | Age Group (Millennials, Gen X, Baby Boomers) Income Level (Low, Middle, High) Geographic Location (Urban, Rural) Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| High-Net-Worth Individuals | 150 | Wealth Managers, Financial Advisors |

| Investment Firms | 100 | Portfolio Managers, Investment Analysts |

| Private Banking Services | 80 | Relationship Managers, Client Service Executives |

| Regulatory Bodies | 50 | Compliance Officers, Regulatory Analysts |

| Financial Planning Consultants | 70 | Financial Planners, Tax Advisors |

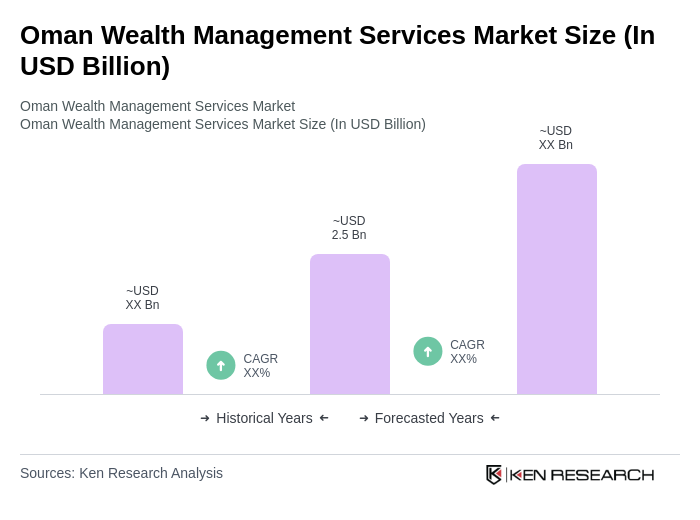

The Oman Wealth Management Services Market is valued at approximately USD 2.5 billion, reflecting a significant growth trend driven by an increasing number of high-net-worth individuals (HNWIs) and a rising demand for personalized financial services.